The upheaval set off by the threat of American sanctions is roiling the Kremlin’s economic plans even before the U.S. announces a new round of penalties.

The speculation alone was enough to put Russian assets under such pressure that the authorities had to look for policy compromises. With the turmoil gripping other emerging nations, President Vladimir Putin’s government is already adjusting down its outlook for the economy, bracing for growing outflows of capital and a weaker currency.

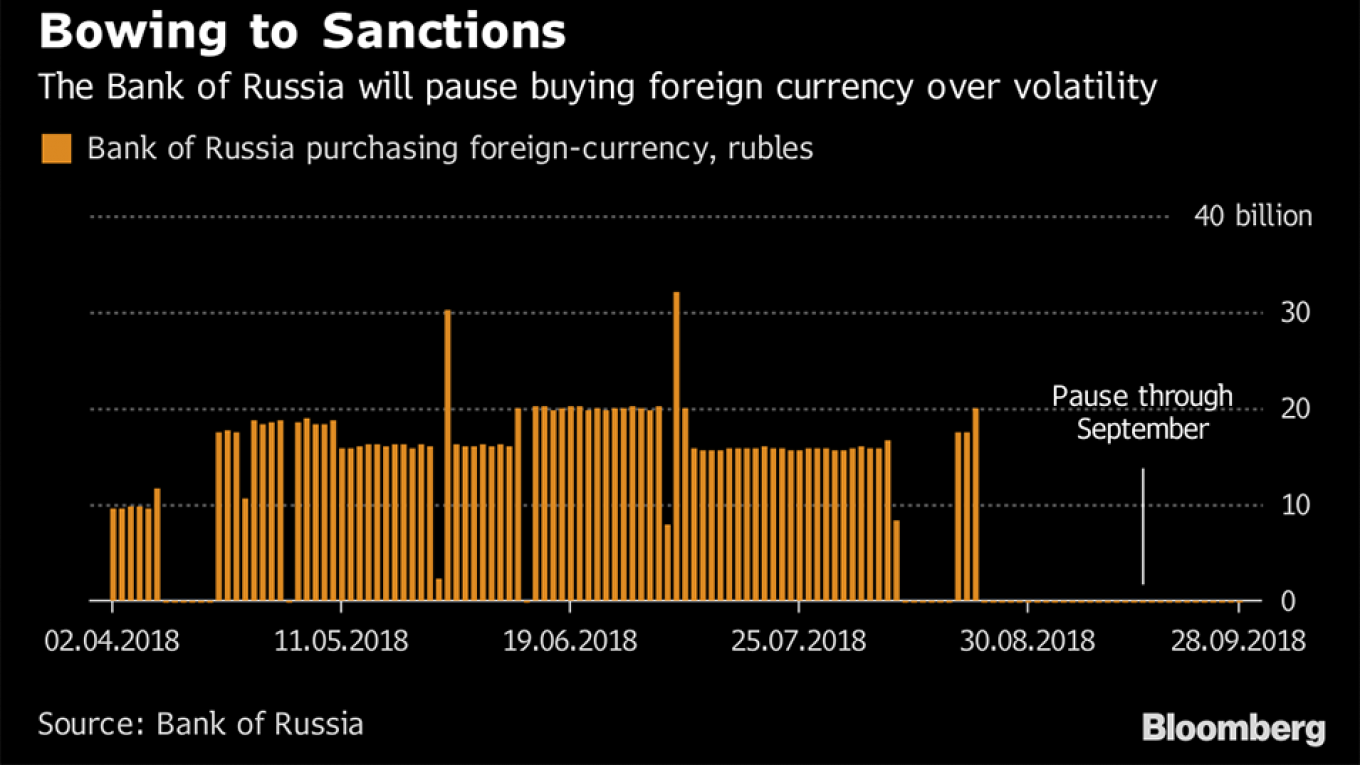

In the most dramatic official step yet to stem the ruble’s declines, the central bank said Thursday it will suspend sales of rubles to purchase foreign exchange for the sovereign wealth fund through the end of September. A day earlier, the Finance Ministry canceled a bond auction for the first time since April as the the ruble traded close to its lowest level since 2016.

Meanwhile, the country’s largest lender is penciling in a surprise U-turn by the central bank. Sberbank PJSC now believes a pause in monetary easing will give way to an increase in interest rates by year-end. In a survey conducted only a month ago, not a single economist was predicting a hike in the months or years ahead.

“Based on what’s happening in the market, I wouldn’t rule out a rate increase at the next meeting” in September, Alexander Morozov, Sberbank’s chief financial officer, said in an interview Thursday. “The whole logic of how the situation is developing indicates that such a hike is possible.”

In the four years after the first major sanctions were imposed over the crisis in Ukraine, Russia has committed to fiscal restraint and focused on rebuilding its international reserves, which took on strategic importance during Putin’s intensifying standoff with the West. The policies helped the government win its first upgrade in over a decade from S&P Global Ratings, returning the world’s biggest energy exporter to investment grade after three years at junk.

Under a mechanism aimed at insulating the economy from volatility in oil prices, the central bank has been buying foreign currency for the Finance Ministry since early 2017. But it’s changing tack after the ruble’s declines picked up in recent days. As U.S. midterm elections approach, American lawmakers are pondering curbs on Russian sovereign debt sales and tougher limits on some of the country’s biggest banks as punishment for election meddling.

“They don’t like the market thinking the ruble is a one-way street,” said Paul McNamara, a London-based fund manager at GAM UK Ltd. “They’ll redefine the budget rule if they think they need to.”

The central bank explained its decision Thursday as an effort “to increase the predictability of monetary authorities’ actions and to reduce volatility on financial markets.” The Finance Ministry later said the pause wouldn’t affect its accumulation of reserves under the budget rule.

The Bank of Russia had already called off its purchases for six days earlier this month when the ruble was depreciating, only to resume them Aug. 17 in larger volumes. Renaissance Capital estimates the suspension means the central bank will miss out on buying about $8.4 billion in August-September.

The back-and-forth was “messy but justifiable with this kind of high volatility,” said Vladimir Miklashevsky, a strategist at Danske Bank A/S in Helsinki.

The effect was short-lived on Thursday, with the ruble depreciating for a fifth straight day after an initial rebound. But the Russian currency recouped some losses on Friday and traded 0.5 percent stronger at 67.86 against the dollar at 1 p.m. in Moscow, the second-best performer in emerging markets.

“The spillover effect of this pause in interventions is negative sentiment-wise,” said Daria Isakova, an analyst at Sova Capital in Moscow. “It degrades the credibility of the budget rule and increases the ruble’s volatility as the mechanism of the budget rule becomes less transparent.”

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.