Acron, the country's third-largest nitrogen-fertilizer maker, has asked Prime Minister Vladimir Putin to override anti-monopoly regulators' approval of price increases of more than a third for potash used in the company's goods.

"We ask you to take measures to re-establish state regulation of the monopolistic market for potash," Acron wrote in a Nov. 9 letter to Putin, copied to Bloomberg. Dmitry Peskov, a spokesman for the prime minister, did not answer calls to his mobile phone Wednesday seeking comment.

Uralkali, the country's second-largest potash producer, will raise prices for local makers of complex fertilizers by about a third next year after gaining approval from regulators, it said Wednesday in a statement. Fertilizer makers will pay 5,700 rubles ($182) a metric ton in the first quarter, up from 4,300 rubles this year, and the price will then be revised each quarter, Uralkali said.

While PhosAgro, the country's largest phosphate fertilizer producer, and EuroChem signed long-term contracts with Uralkali on those terms, Novgorod-based Acron has said it opposes the decision to allow the price increases.

"As a result of a totally non-transparent operation, new rules have emerged that we have no intention of respecting," Vyacheslav Kantor, the billionaire owner of Acron, said in an interview in Moscow last week.

Kantor told Putin at a meeting in July that Acron's profits were being hurt by "monopolists."

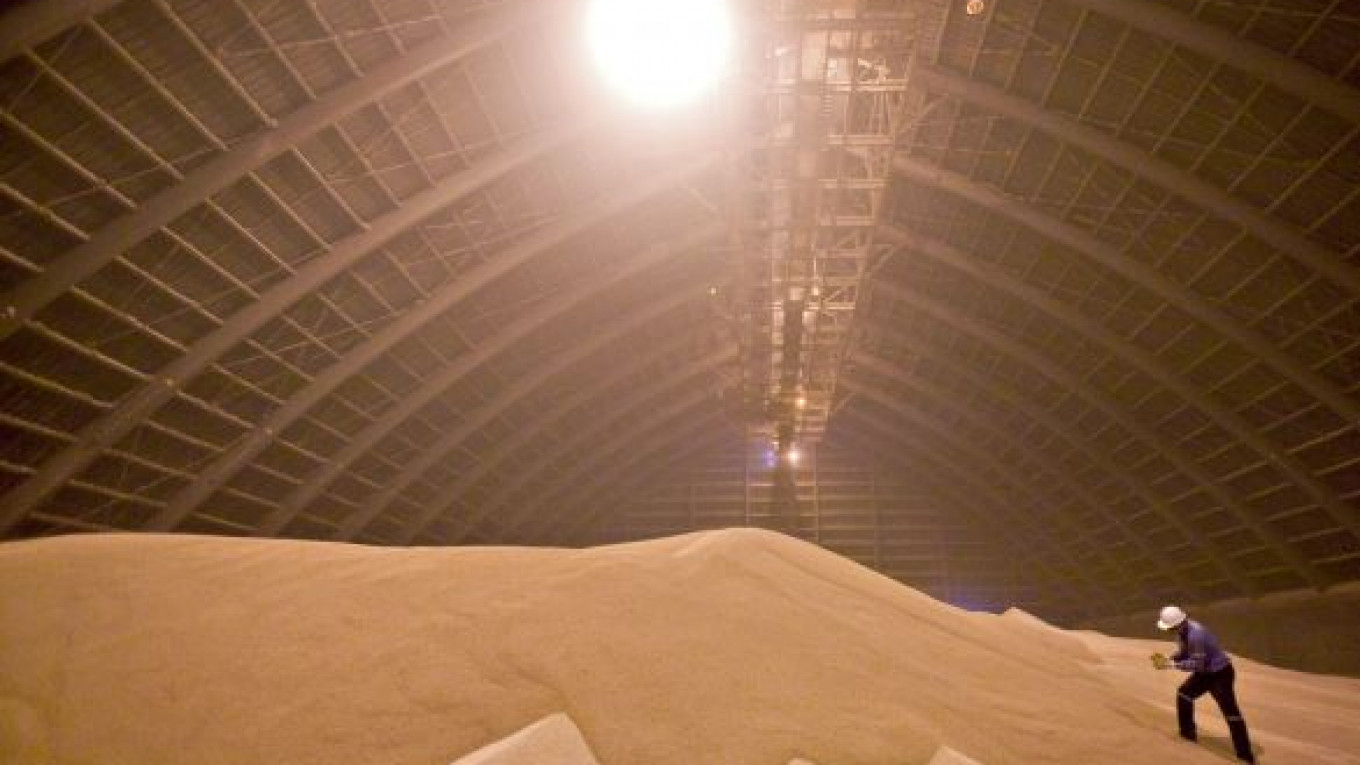

With the world population adding 75 million people a year, food demand is increasing the need for fertilizer. A fivefold surge in potash prices over 2007 and 2008 led to at least eight class-action claims in the United States over alleged collusion, a charge the producers denied. Consolidation among producers of potash has caused concern that prices will increase in countries from Russia and India, the biggest importer last year, to Canada.

Acron, which has benefited from price caps on potash prices imposed by the Russian government to guarantee its farmers cheap fertilizer supplies, exported 83 percent of its complex fertilizer output last year.

Silvinit, the country's largest potash maker, and Uralkali, its sole domestic rival, are controlled by billionaire Suleiman Kerimov and his partners, who acquired stakes in the companies this year and plan to merge them.

Kerimov is ranked by Finans magazine as the country's fourth-richest man with $14.5 billion.

Uralkali and Silvinit have said domestic makers of complex fertilizers compete with them on exports after buying potash from miners as a raw material. Anton Subbotin, a spokesman for Silvinit, declined to comment immediately, saying the company planned to release a statement.

Uralkali referred Bloomberg to Wednesday's news release and a statement Monday that said the company would keep prices for local farmers at 4,280 rubles. Acron owns about 8 percent of Silvinit.