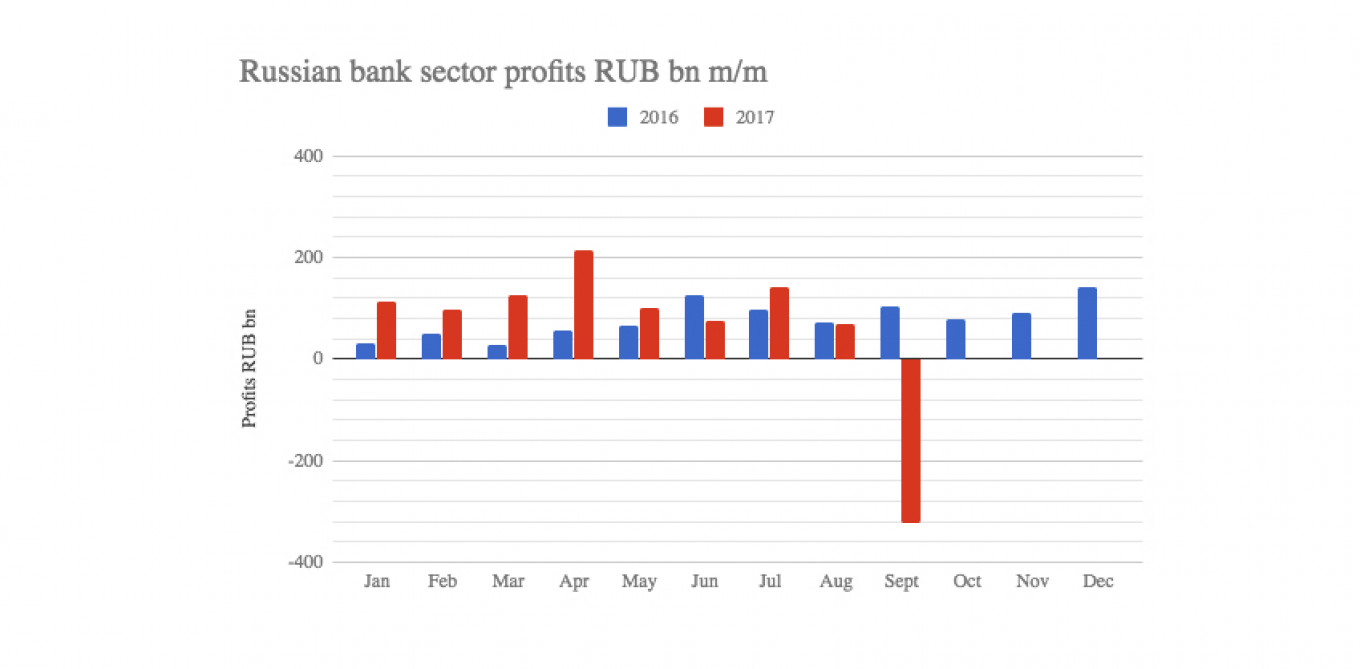

The cost of bailing out a string of failed banks in the last quarter means Russia’s aggregate banking sector profits fell heavily in September, going negative for the first time in years.

The total net profit of the Russian banking sector from January to September declined to 675 billion rubles ($11.7 billion) from 997 billion rubles seen from January to August, the Central Bank of Russia (CBR) said on Oct. 11. That is a fall of minus 322 billion rubles month-on-month, a big aberration from a two-year run of steadily improving month-on-month profits.

The drop in banking profit was attributed to a one-off recognition of "negative financial results of banking groups" that are undergoing a bailout with the help of the newly established Fund for Consolidation of Banking Sector (FKBS), the regulator commented.

In August and September, the CBR had to take over Financial Corporation Otkrytiye and Binbank (aka B&N Bank), the largest private banks in the ongoing sector clean-up yet, since the problems with Vnesheconombank (VEB) in 2016 and Bank of Moscow in 2011 that needed $16 billion and $14 billion bailouts respectively.

If this summer's losses had not been booked then the net profit of the banking sector in nine months of 2017 would have been 1.1 trillion rubles. The reserves for possible losses went up by 6.5 percent in September and 13.6 percent year-to-date to 6.2 trillion rubles.

In the recent outlook upgrade on Russia's sovereign rating Fitch dismissed the idea of banking risks, but days later issued a report cautiously critical of the Central Bank of Russia managing and spending on the sector clean-up.

Fitch estimates that the state has invested over 2 trillion rubles in the biggest state banks, or about 1.5 percent of GDP, through various refinancing and support mechanisms, which de facto represent indirect bail-outs. This spending came in addition to 2.7 trillion rubles cost of compensating depositors of failed privately owned lenders.

Part of the blame for the situation lies on the CBR, Fitch believes, as asset problems "are typically the result of aggressive growth through mergers" that included bank rescues under the old bail-out mechanism approved by the CBR.

Out of the 30 bail-outs, 10 ended up with the banks entrusted by the CBR to take over failed peers got in trouble themselves, including the controversial cases of Financial Corporation Otrkitye, B&N Bank, Probiznes Bank, and Tatfondbank.

However, the new bail-out regime, by which the CBR consolidation fund FKBS acquires and recapitalizes failed banks so that they immediately meet all regulatory requirements, is welcomed by Fitch as it should deter weaker buyers and attract stronger ones.

Previously in the old bail-out regime, the rescued banks did not have to comply with regulatory ratios while they rebuilt capital from income supported by cheap CBR funding, which attracted weak buyers to acquire rescued banks and transfer toxic assets into them.

Read more at bne.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.