Over the past decade, tech billionaire Elon Musk has been fond of telling people that he wants to die on Mars.

But with the recent successes of his company SpaceX, the Silicon Valley entrepreneur-turned-rocket man has taken to qualifying his remarks. "My family fears Russia will assassinate me [first]," he told a Bloomberg reporter last year.

Musk can perhaps be forgiven for feeling this way. On April 9, just days before Russians celebrated the 55th anniversary of Yury Gagarin's historic flight into space, SpaceX successfully landed one of its rockets on a barge in the Atlantic Ocean. It was a clear demonstration that Musk is on the verge of radically transforming the business of space exploration, an industry traditionally dominated by Russia.

SpaceX hopes to begin reusing its rockets 10 to 20 times, and Musk has on various occasions claimed that reusability can reduce costs for launching things into space by a factor of 100.

That is likely to be an overambitious estimate, suggests Russian space journalist Igor Lissov. But even in a more realistic scenario — say, for example, SpaceX manages to halve its advertised $60 million launch cost — the challenger will be a problem for Russia, which leans on foreign cash flows in times of economic crisis.

In November, President Vladimir Putin ordered Roscosmos to take measures to protect its market position. The following month, Roscosmos carried through a planned reorganization, turning the organization into a state-corporation supposedly better placed to compete with tech upstarts like SpaceX .

Roscosmos did not respond to a request to elaborate on those plans, but the company's chief, Igor Komarov, told RIA Novosti on April 12 that it is "actively working to reduce costs" and develop a reusable rocket of its own — one that won't fly until after 2030. Komarov had told RT that Russia is still the undisputed industry leader, responsible for 40 percent of all launches.

Roscosmos counts on this market position to supplement its government funding. Over the next ten years, it has predicted some 230 billion rubles ($3.5 billion) income from foreign customers, which compares to state funding of 1.4 trillion ruble ($21 billion).

With SpaceX already eroding Russia's standing in the global space industry, it is not currently clear that Roscosmos can meet that goal.

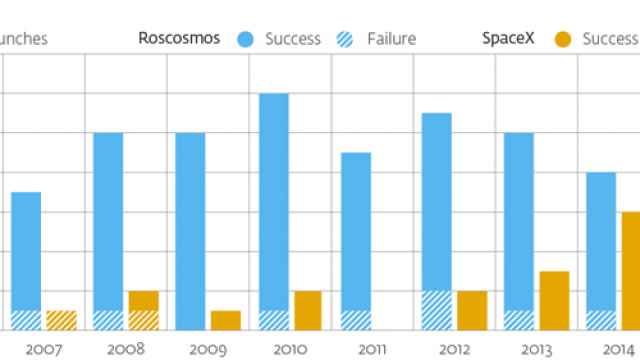

10-year track record of Roscosmos and SpaceX

In an attempt to fend off Musk's encroachment, Roscosmos has begun offering potential customers discounts for launches on its Proton rockets — the commercial competitor to SpaceX's Falcon 9 — if bought in bulk. Industry publication Space News has suggested bulk discount prices may be as low as $65 million per rocket, as opposed to the list price of $90 million

Cost-cutting is a tactic Roscosmos might not be able to rely on for long. Most assume Musk will be able to significantly reduce launch costs down in the near future, and no one quite knows how much Proton's eventual cost would be. It may well be that the market price settles at a level that Roscosmos will find too difficult to manage.

There are several other factors working against Roscosmos as it maneuvers to compete with SpaceX — primarily brand image and reputation. Russia is struggling to overcome serious quality control issues that have caused a series of spectacular launch failures since 2010. SpaceX is meanwhile becoming "increasingly reliable," says Phil Smith, a senior analyst with the Tauri Group, a U.S.-based aerospace consulting firm.

There are two other means by which SpaceX poses an imminent threat to Roscosmos.

The first is the impact it is having on United Launch Alliance (ULA), the immediate U.S. competitor to SpaceX. ULA currently buys Russian-made engines for its Atlas V rocket, but SpaceX's success may cause it to rethink. Without sales to ULA, Roscosmos' engine-making subsidiary, Energomash, will lose its main customer.

An even greater impact is expected when SpaceX begins flying NASA astronauts to the International Space Station in the next two to three years. Since the U.S. space shuttles were retired in 2011, Roscosmos? charged NASA $70 million for each seat. Musk promises to undercut that significantly, charging around $20 million on his "Dragon" spacecraft. Considering that Roscosmos is expecting an annual budget of $2 billion over the next decade, the loss of an $500 million annual subsidy is significant.

Even if Roscosmos is able to weather these storms, the long term future of the company does not look too promising. The space behemoth remains largely dependent on state budget injections, and that makes it inflexible.

"A slow, state-owned, ineffective and mostly non-market oriented company is, simply speaking, incapable of competing with SpaceX and other agile private space companies," says Pavel Luzin, a space industry expert at Perm State University.

Contact the author at m.bodner@imedia.ru. Follow the author on Twitter at @mattb0401

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.