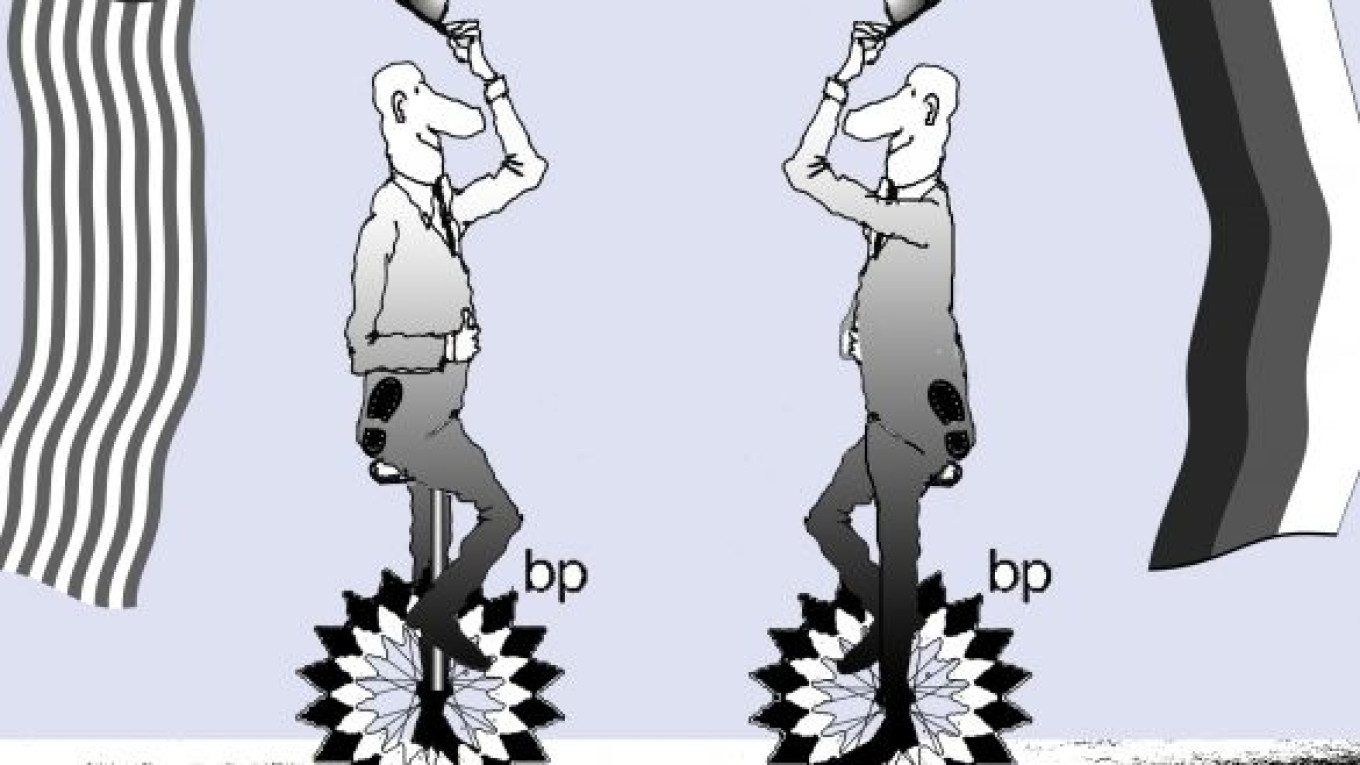

As BP CEO Tony Hayward clears his desk from St. James’s Square in London, Robert Dudley is getting ready to take his place, effective Oct. 1. The rationale is clear: BP wants an American to take care of its U.S. assets. But in the end, this could prove to be misguided. BP is a global player, not just a Gulf of Mexico upstart.

The U.S. House of Representatives’ National Resource Committee is currently wasting its time pushing an amendment to effectively bar BP from obtaining future drilling permits. You don’t need a law to do this. BP will never obtain new permits in the United States. It would be like trying to sell Bermuda shorts to an Eskimo.

Alas, London has made it quite clear that it has no interest in allowing a BP fire sale to U.S. majors at the behest of Congress. It wants to weather the storm, spin off $30 billion of noncore assets and raise easy money as it goes along.

But if BP is to survive, it must surely look beyond the United States, where it will struggle to maintain concessions, let alone secure new contracts. It must look toward the markets of tomorrow. This, of course, raises a thorny question: Is Dudley, who was raised in Mississippi, the right man to navigate global markets in jurisdictions such as Libya, Colombia, Angola and Algeria, or merely the guy who knows how to sweet-talk the White House into taking its foot off BP’s neck?

Russia might well provide an answer here. Before being shipped back to the United States, Dudley had been walking a tightrope to ensure that BP remained part of the TNK-BP equation. Many in Moscow thought that Gazprom would be a better partner than TNK-BP to develop Kovykta, one of the country’s largest undeveloped natural gas fields in East Siberia.

Hayward understood this, which explains why his first plane out from his congressional grilling was not back to London but to a far more important meeting with Deputy Prime Minister Igor Sechin to affirm BP’s Russia position. It is precisely these markets where BP’s future fortunes rest. In addition, BP has important interests in Azerbaijan and Georgia, where BP operates the Baku-Tbilisi-Ceyhan pipeline.

To put it bluntly, Dudley is not liked in Russia. He had to flee the country to avoid alleged labor law violations and visa problems in 2008 when TNK was piling on pressure to take more of the 50-50 cut from BP. Moscow’s choice was stark: Either Dudley goes or BP can pack up and leave.

Being honest, no doubt many of these claims had about as much credence as the environmental charges laid against Royal Dutch Shell when they were cut off the Shtokman development in 2006, but that is the whole point in Russia. Political risk is high. Cordial political relations are therefore crucial to success.

No doubt Dudley thinks that if he takes over BP, his main risk is that the leaking well in the Gulf of Mexico will continue to leak. But his real problem is whether some of the low-

hanging fruit in Russia, Central Asia or in the United States decide to turn the contractual tables on BP. The market has already priced in BP’s U.S. write-off, but it has not thought about the potential of BP’s global empire crumbling before Dudley’s U.S.-centric eyes.

The temptation for Russia to bite into the contract renegotiation apples is no doubt immense. A gas dispute with Belarus and a shaky Collective Security Treaty Organization following the recent regime change in Kyrgyzstan have left the Kremlin bruised. Hanging BP out to dry could well be seen as a quick and easy political ointment for Moscow to apply. But this is a bad time to be playing fast and loose with upstream hydrocarbon provision. Oil markets remain very lax, with a slack of more than 6 million barrels per day from OPEC supply alone. International oil companies such as BP have also been given a second life in the form of shale gas discoveries in the United States, Europe and Asia. Access to reserves is no longer the sacrosanct prize that states had previously sought. Consistent investment to bring resources online is, however.

If Russia helps put pressure on BP, the company could well be subject to an outright takeover bid. ExxonMobil would no doubt be the front-runner. But Moscow surely understands two key factors also in play: The first is that in a globalized market, China has the deepest pockets of all to launch a credible BP bid. The second is that money is the only thing that matters in London. BP assets might not go to the “vulture of choice.”

Unless Russia really wants Washington or Beijing to start playing in its backyard, it should probably give Dudley some slack. This might be made all the easier should Hayward turn up for his new prospective job as a director at TNK-BP. What plays well globally obviously does not play well in Washington. This is where the contrasting fates of Dudley and Hayward will be determined. Whether this proves to be in BP’s long-term interests remains to be seen.

Matthew Hulbert is a senior fellow at the Center for Security Studies in Zurich.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.