Russia posted a 500 billion ruble ($5.4 billion) federal budget surplus in March 2025 amid falling oil revenues, according to preliminary data from the Finance Ministry.

The deficit was equivalent to 1% of GDP, well ahead of the 0.5% deficit target for this year in the budget. However, the Finance Ministry said this week that average oil prices are expected to come in at less than the $70 in the budget and the deficit was likely to be higher than anticipated.

The Finance Ministry missed its target last year as well with a deficit of 1.7% of GDP (minus 3.3 trillion rubles), which was still modest compared to the previous year’s 1.9% end-of-year result.

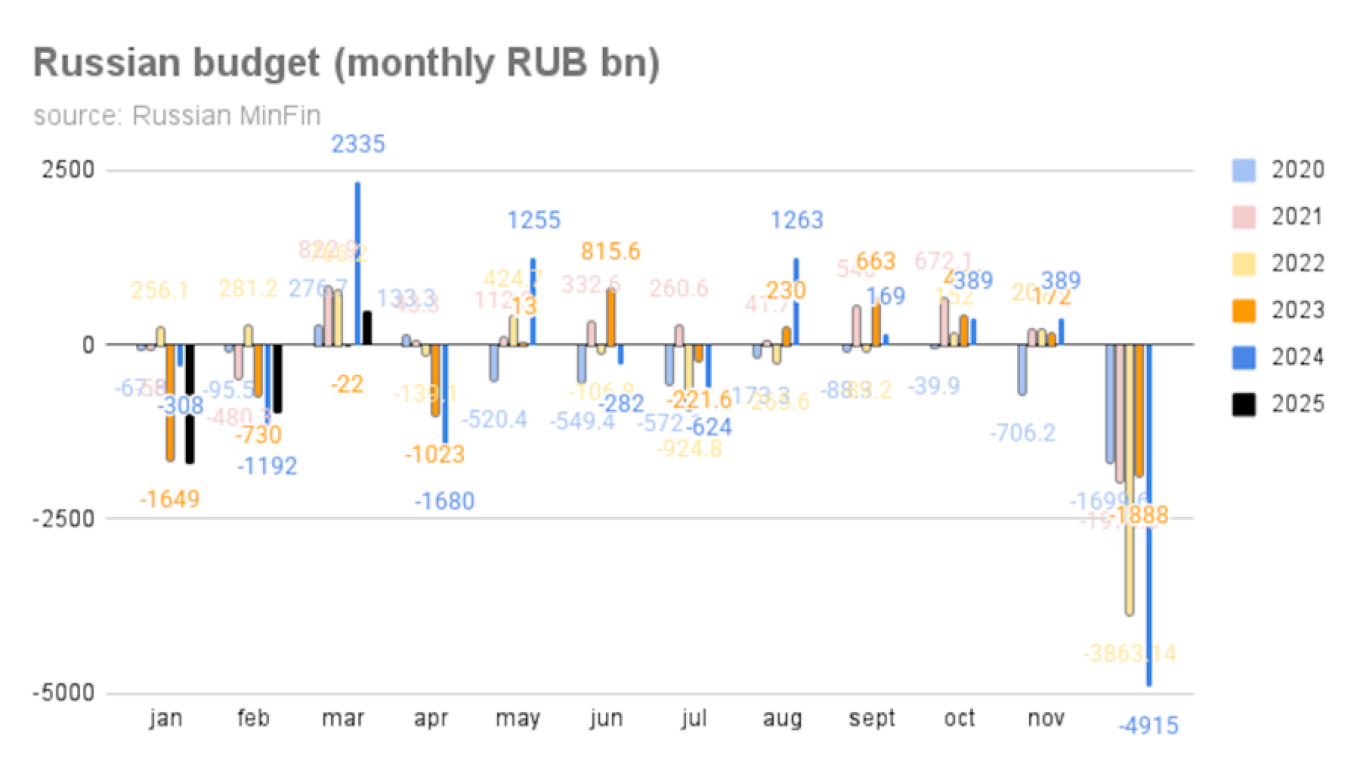

Previously, the federal budget posted an unusual spike in spending and high deficits in January and February, which the ministry attributed to front-loaded expenses.

Despite a surplus recorded in March, the cumulative 1Q25 deficit stood at 2.2 trillion rubles ($23.7 billion), equivalent to 1% of GDP. The full-year budget anticipates a 1.2 trillion rubles ($12.9 billion) deficit, or 0.5% of GDP.

Federal budget revenues in March totaled 3.7 trillion rubles ($39.9 billion), flat year-on-year, contributing to a 4% year-on-year (y/y) increase in total revenues for 1Q25.

Oil and gas revenues declined by 17% y/y in March, while non-oil and gas revenues grew by 10% y/y. For 1Q25 overall, these revenue groups saw respective changes of -10% and +11% y/y.

Federal budget spending rose by 11% y/y to 3.2 trillion rubles ($34.5 billion) in March, returning to seasonal norms and driving a monthly surplus of 500 billion rubles ($5.4 billion).

Renaissance Capital analysts caution that the rising likelihood of a global recession increases the chances of a “hard landing” for the Russian economy due to falling oil prices. In such a scenario, an expanding budget deficit would signal continued fiscal stimulus.

They argue, however, that the inflationary impact of such a stimulus would be milder than in 2022–2024.

Using National Wealth Fund (NWF) reserves to offset lost oil revenues and increasing borrowing to cover non-oil income shortfalls is seen as less inflationary than deploying these funds to ramp up spending by analysts.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.