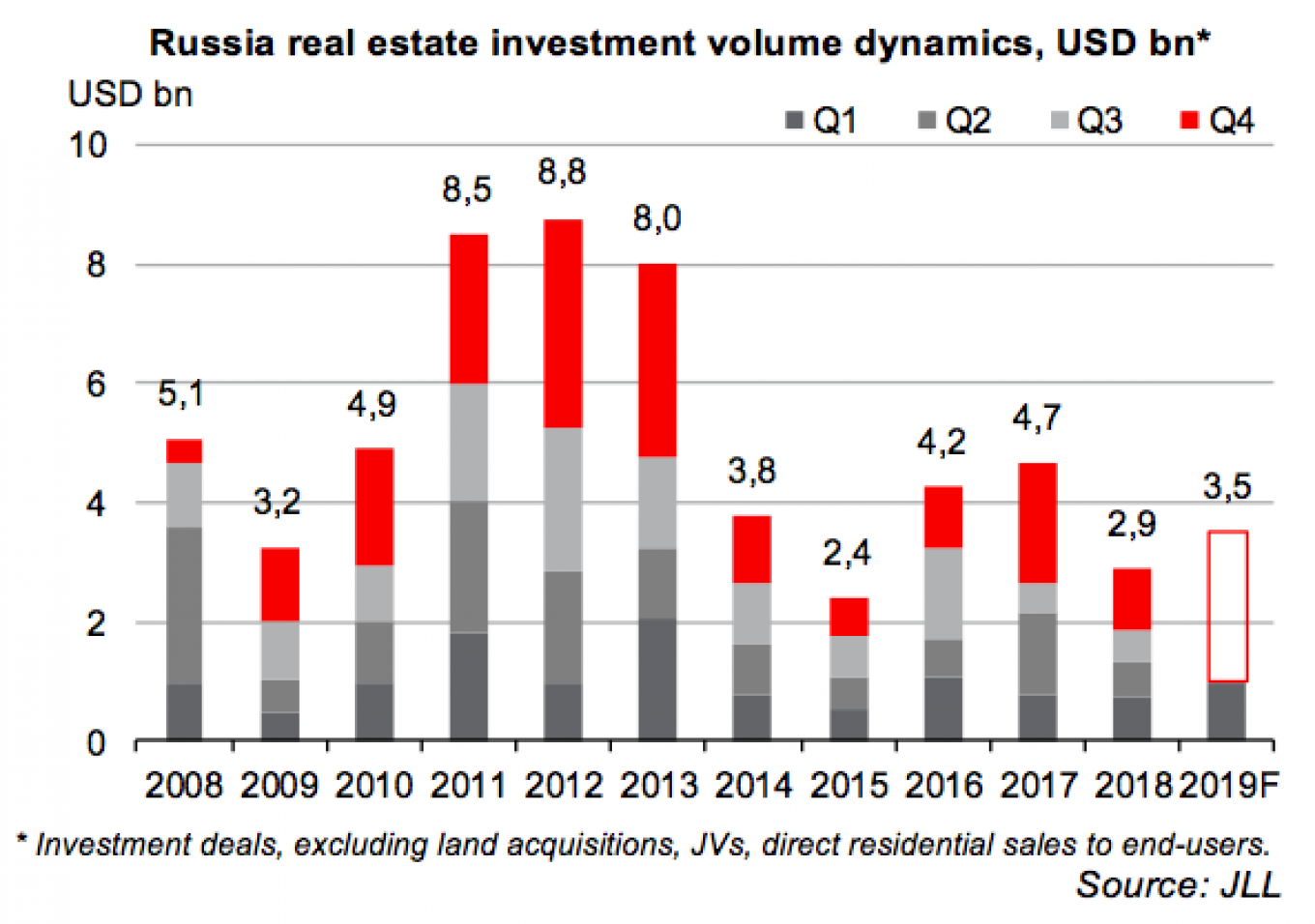

Russia’s real estate market is back in play after investment rose by 30 percent year-on-year in the first quarter of this year, according to consultants JLL — the best result in the last three years.

Russia’s real estate investment volumes reached $967 million in the first quarter of 2019, up from the $742 million invested in the same period a year earlier.

“A significant investment volume increase at the beginning of the year can be explained by a few large transactions which were postponed from 2018 to 2019. Nevertheless, investors are still cautious and are adopting a ‘wait and see’ approach,” Natalia Tischendorf, head of capital markets, JLL, Russia & CIS, said in a report.

“The market faces a shortage of real estate products available for purchase and, despite the fact that the economy and debt markets are recovering, and senior debt financing is available at relatively low interest rates, the volume of deals under negotiations has not increased.”

Of all the subsectors in the real estate business, the one that has been doing best is warehousing, driven by the vibrant growth of Russia’s e-commerce business.

Online shopping already accounted for 4.5 percent of Russia's total retail turnover in 2018 and with compound average growth rate (CAGR) of 16 percent — about ten-times faster than the real economy — the size of the business will double to 8 percent of retail turnover, or 3.4 trillion rubles, in the next five years, according to VTB Capital.

The vacancy rate in the Moscow region warehouse market declined by 0.3 percentage points in the first three months of 2019, to 4.2 percent. The take-up volume in the first quarter of 2019 was 348,000 square meters (sqm), of which 60 percent of the deals were done on the secondary market. And warehouse completions reached 132,000 sqm — almost double the level of the first quarter a year earlier.

“On the one hand, the positive quarterly dynamics of the main indicators is a signal of warehouse market recovery. On the other hand, there are a number of economic indicators, such as retail turnover, Purchasing Managers Index (PMI) and economic growth forecast which restrain optimism about the future market prospects,” said Evgeniy Bumagin, head of JLL’s industrial & warehouse department.

Only 60 percent of total first quarter 2019 completions, or 75,000 sqm, was available on the open market in the first quarter and an additional 1.1 million sqm of new warehouse premises are scheduled for delivery by the end of the year, according to JLL. If the announced projects are delivered on time, the annual warehouse completions will be 1.4 times higher than in 2018.

The total modern warehouse stock on the Moscow region warehouse market amounted to 17.9 million sqm, of which 755,000sqm is vacant space.

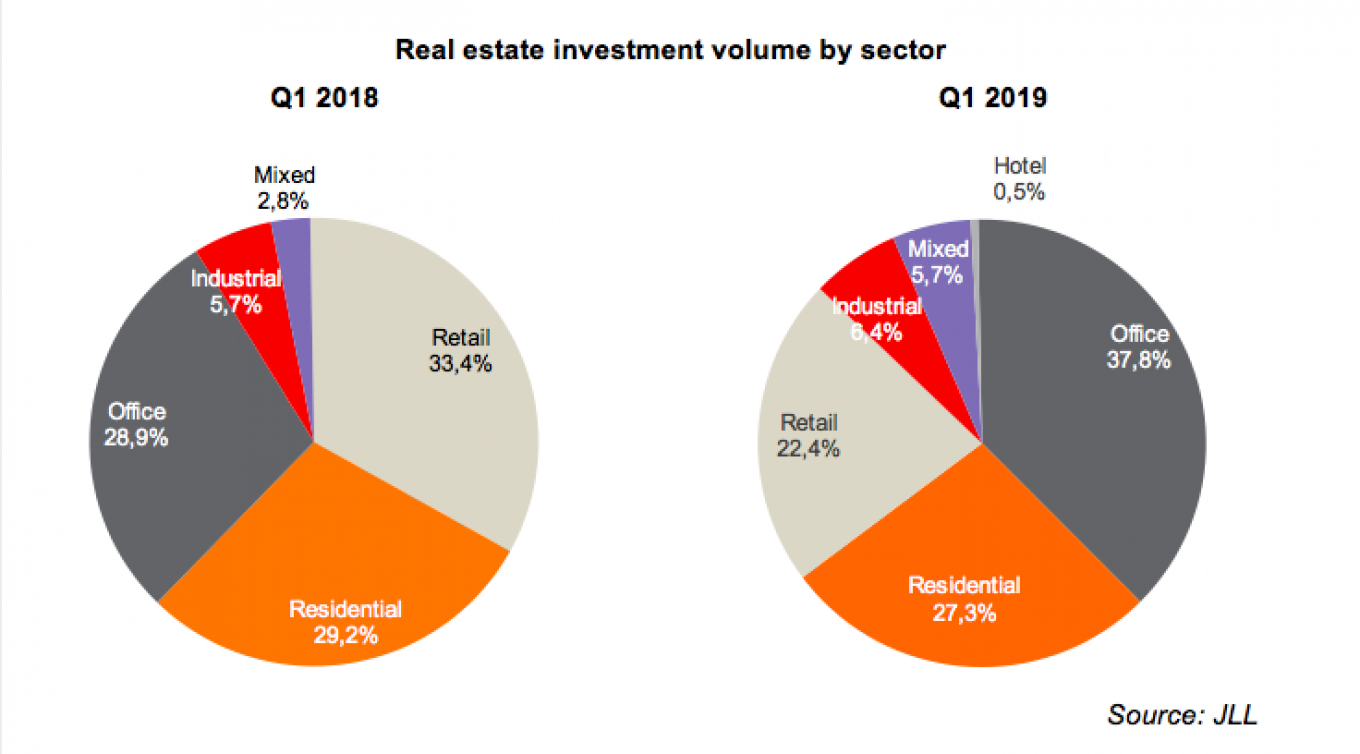

The most activity has been in the office sector, which received well over a third, 38 percent, of all the investments. There have been a number of large deals as investors speculate the market has bottomed out and are taking advantage of low prices.

The largest office deal was the sale of B and C class office premises by Alexander Svetakov, the chairman of Absolute Investment Group.

However, the number of new projects coming online is lagging behind demand and that has driven down vacancy rates. Moscow office completions declined 26 percent year-on-year in the first quarter. Despite the slight reduction in take-up volume, the vacancy rate continues to fall toward new lows, according to JLL.

In Moscow’s two key business districts vacancy rates fell further in the first quarter: in the Central business district (CBD) vacancy rates fell from 7.8 percent to 7.3 percent over the first quarter and in Moscow City from 7.3 percent to 7.0 percent, according to Olesya Dzuba, JLL’s head of research.

That will change this year as 400,000 sqm of new projects are slated to be completed — more than three times as much as the year before, which marked a decade long low of 125,000 sqm of completions.

Still, this year is off to a slow start after only 25,000 sqm of new space was delivered in the first quarter, down by 25 percent compared with the same period a year earlier, and most of those were Class B.

The residential sector is also active, although development has been subdued to an extent by the imminent change in regulations that bans pre-selling of apartments to consumers that comes into effect in June.

The residential sector took a quarter, 27 percent, of the total investment and here too there have been a number of big deals. The residential complex Prime Park was bought by A1, the investment arm of Russian oligarch Mikhail Fridman’s Alfa-Group.

Retail took another fifth, 22 percent, of the total investment, where the largest retail deal was the purchase of Nevsky Centre shopping mall in St. Petersburg by PPF Real Estate Russia, owned by Petr Kellner, the richest man in the Czech Republic, who is an active investor in Russian business.

Retail vacancy rates fell to 4.3 percent in the first quarter, the lowest level in five years, driven down partly by the lack of new projects being completed and the slow growth of the economy.

After a flurry of projects coming onto the market in 2014, just before the crisis years started, there has been little new investment. Between 2017 and 2018, there were only eight new retail projects completed, according to JLL, totalling 278,000 sqm, which was half the level of new shopping centres coming on the market in the two years before that.

A lack of new supply and a high occupancy rate of new shopping centres have led to the decline in the vacancy rate by 1.7 percentage points year-on-year and 0.8 percentage points quarter-on-quarter, JLL said in a report.

“The amount of vacant space has decreased in more than a third of shopping centres over the past year,” says Polina Zhilkina, the head of JLL’s retail advisory. “However, there are projects on the market with considerably higher levels of vacancy — about 20-50 percent, which is caused by drawbacks in location and accessibility, inefficient concepts, or the structure of key tenants.”

However, now the market is picking up again and there has been a total of 320,000 sqm of projects announced for 2019 by developers.

Among new schemes for 2019 are Salaris MFC with 110,000 sqm, Ostrov Mechty SC with 65,000 sqm, Novaya Riga Outlet Village with 38,000 sqm and several neighbourhood shopping centres being built by the ADG Group. Taking into account completions in 2019, the vacancy rate is projected to rise to 5.1 percent by the end of 2019, according to JLL.

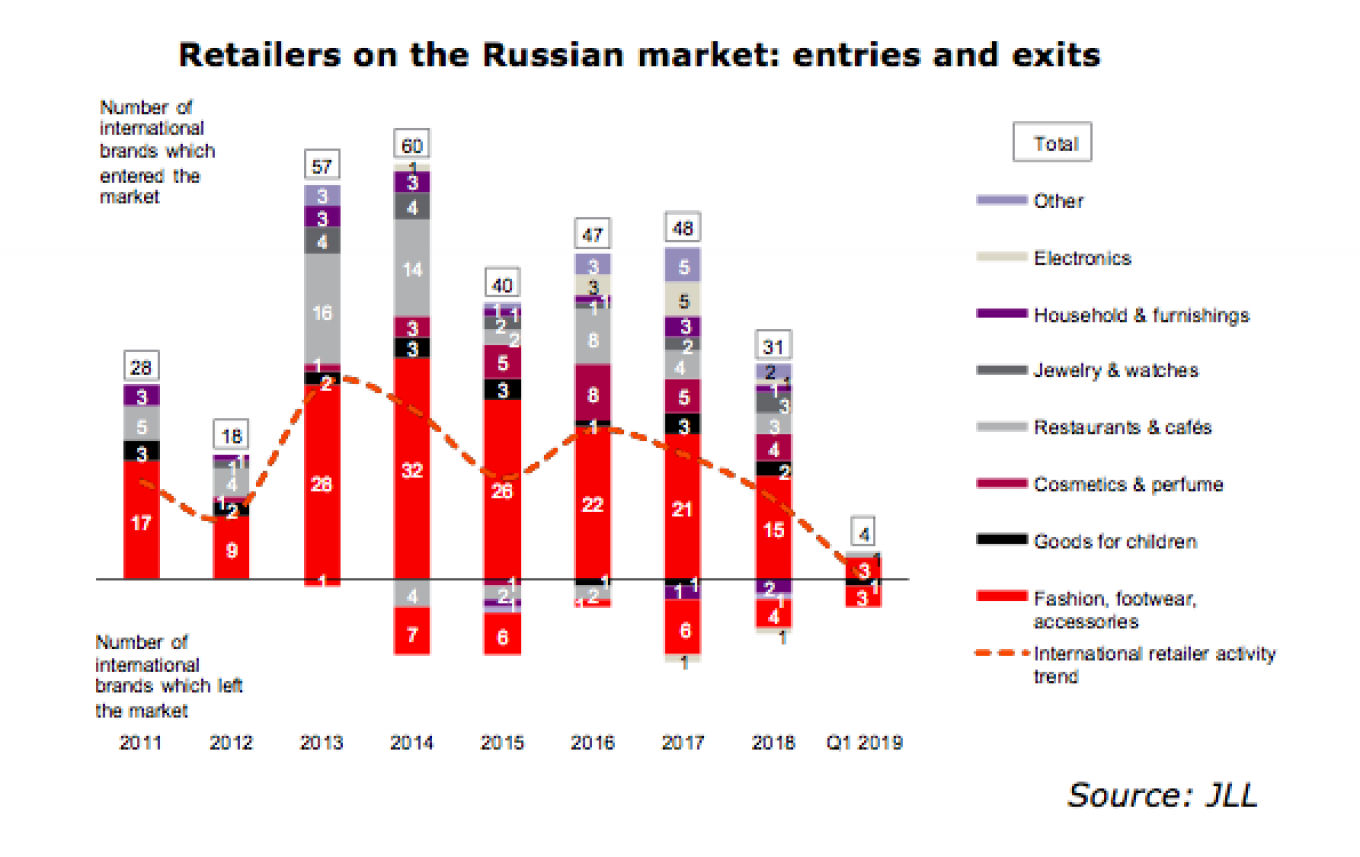

Part of the slowdown has been driven by the changing make-up of companies renting retail space. The retail business is becoming progressively more local as many international players have withdrawn from the market.

The number of new international retailers declined significantly in the first quarter, according to JLL, with only four brands entering the Russian market versus ten in the same period a year earlier — the second worst result since 2015 when there were only two new entrants. And as many international brands left the Russian market in the first quarter as entered it. Five years of stagnant real incomes means that Russia’s retail is holding its own but not developing.

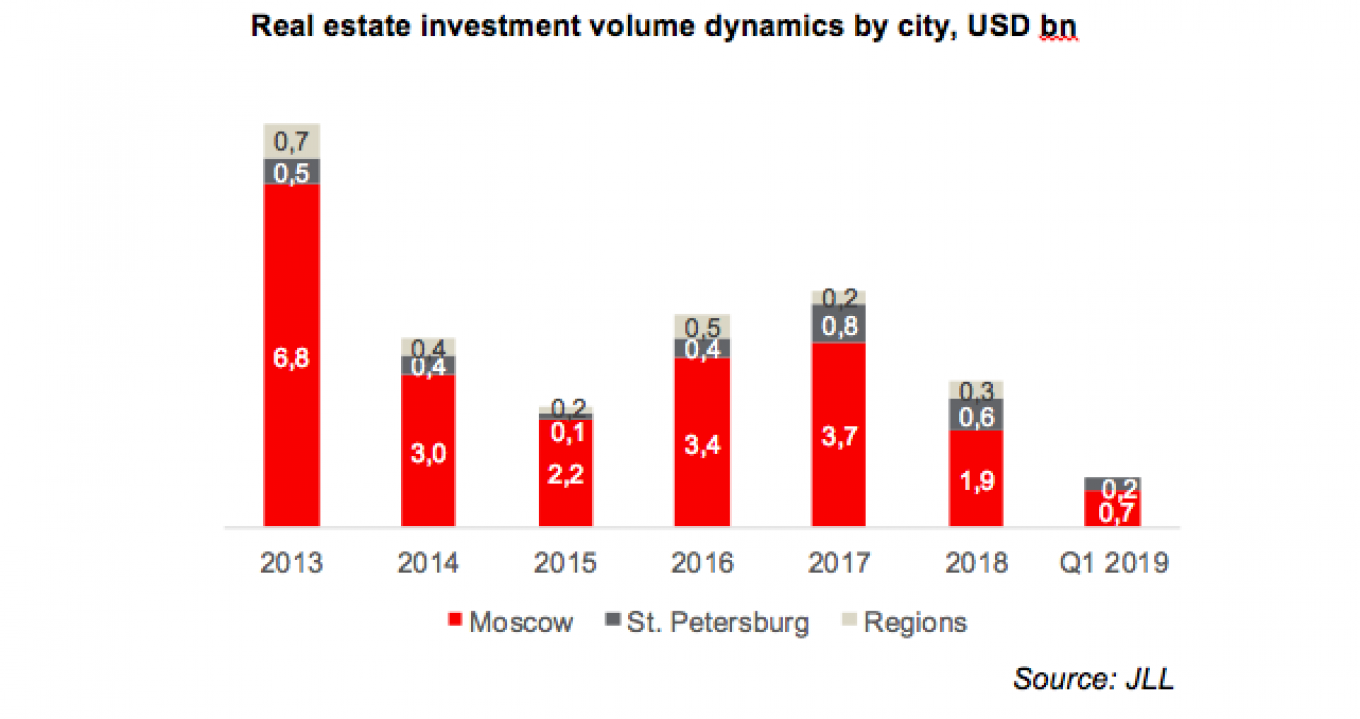

Moscow remains by far the most important real estate market in Russia, accounting for 77 kopeks out of every ruble invested, and even increased its share in the first quarter of this year from the 68 percent of the market it held in the same period a year earlier.

St Petersburg is the second most important market and accounted for 23 percent of Russia’s total investment in the first quarter of this year, up one percentage point from a year earlier. The rest of Russia’s 81 regions barely register in the total investment volumes, collectively accounting for less than 1 percent.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.