Is Russia’s banking sector in danger of another crisis due to the double whammy of the oil price collapse and coronavirus (COVID-19) shocks?

The Central Bank of Russia has been busy cleaning up the banking sector ever since governor Elvira Nabiullina took over in 2013, but is it healthy enough to weather the storm of oil prices falling to $25 per barrel — a level Russia has not seen for two decades — and a ruble that has collapsed to 80 to the dollar or less?

The best way to get an early warning on the health of the banking sector is to look at the repo market, where banks can use their assets such as bonds to borrow short term from the Central Bank when they are in need of a bit more cash.

Normally the repo market is simply used to manage a bank’s liquidity, but in times of crisis it is also the easiest place for banks to borrow (at high interest rates, as it is meant to be a short-term tool) if they are in trouble.

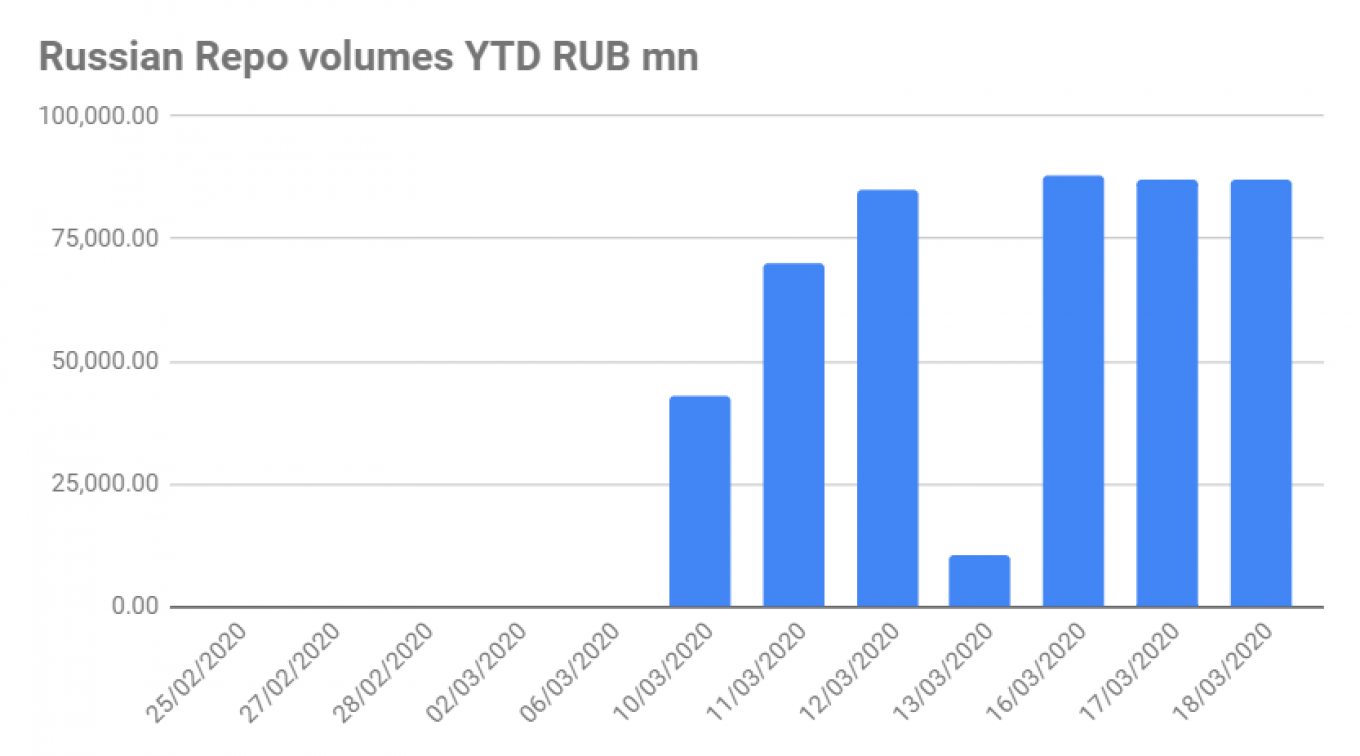

And the volumes on the repo market did jump on March 10, the first day of trading after the long weekend following the collapse of the OPEC+ production cut deal on March 6. Oil prices immediately fell from around $55 per barrel to around $32, which represents a major shock to the system.

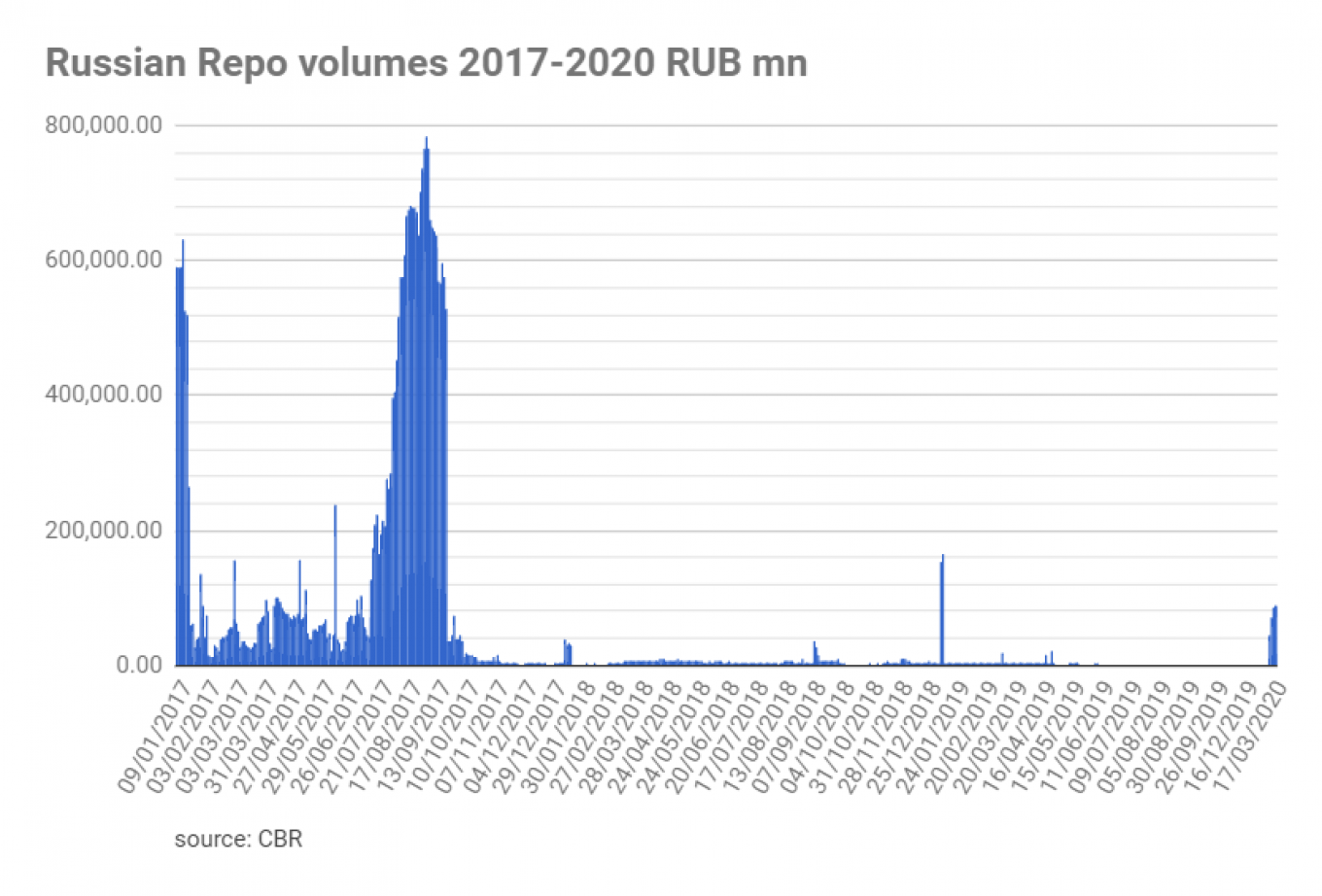

Repo volumes were close to zero for almost all of 2019 as the banking sector returned to healthy profits after a mini-crisis in the autumn of 2017, when the so-called Garden Ring banks went bust and had to be rescued by the Central Bank. At the same time, the Central Bank has continued its clean-up of the sector and has made a great deal of progress since the programme was launched in 2013.

Repo volumes took off on March 10, the first day of trading after the collapse of the OPEC+ deal, and reached 43 billion rubles ($539 million) before doubling over the next two days to reach a daily volume of 85 billion rubles. After a brief respite at the end of last week, the daily volume of repo deals have stayed at the level of 88 billion rubles for the last three days.

Should we be worried? While a daily volume of around $1 billion on the repo market is unusual in the last two years during the banking sector’s recovery, it is not that high either. There was a brief spike in volumes over two days in January 2019 when volumes hit 163 billion rubles — double the current level — which went largely unnoticed and unreported.

However, step back and compare the current repo volumes with those during the mini-banking crisis in 2017 and there is no comparison. Russia’s financial system nearly went into systemic meltdown in the third quarter of that year as one big commercial bank after another got into trouble. Eventually the Central Bank stepped in and took them all over in September.

At the peak of the crisis that year the daily volume on the repo markets reached 785 billion rubles on the last day of August in 2017 — ten times the current repo volumes — before dropping back to around 35 billion rubles in the middle of September as the Central Bank started pumping money into the sector and it was all over fairly fast.

Indeed, even before the mini-bank crisis in August of 2017 repo volumes were elevated as banks struggled to cope with more than two years of recession that followed the last oil price shock at the end of 2014. During that period repo volumes fluctuated between 30 billion and 90 billion rubles, occasionally rising as high as 200 billion rubles and even spiking above 500 billion on a handful of occasions.

In short, the Russian banking sector was very sick and unstable for most of 2014-2017. It was only after the Central Bank cleaned out the deadwood of dodgy commercial banks that the sector became truly healthy from the third quarter of 2017 until now.

Banks back in the black

bne IntelliNews tracks the health and reforms to the banking sector in its Russian monthly country report (see a sample here) and the sector returned to strong profits in the middle of 2018, with the state-owned retail giant Sberbank leading the way.

Sberbank, Russia's largest bank, reported net profit of $13 billion in 2019 and added another 156 billion rubles under Russian Accounting Standards (RAS) in January-February 2020, up by 9% year-on-year and a 21% return on equity (ROE).

All in all, Russian banks made a profit of 1.7 trillion rubles in 2019 according to IFRS accounts, an increase of 72% year-on-year according to the Central Bank numbers. At the same time, the losses of the banks bailed out by the Central Bank in 2017 declined to 200 billion rubles in 2019 from 500 billion rubles in 2018.

The Central Bank has done an extremely good job of cleaning up the banks. Nabiullina has been closing an average of three banks a week over most of the last seven years and the total number of banks has fallen from a peak of over 4,000 during the “wild cat” banking days of the '90s to just 444 as of January this year — close to the 300 banks Russian President Vladimir Putin said he thinks are needed to service the Russian economy.

The latest of many reforms was the introduction of IFRS9 accounting standards last year, a new, more reliable method of calculating accounts that has been adopted around the world during the last year. The smaller number of banks means the regulator can more closely monitor what is going on in the sector and it has used this improved scrutiny to shutter all the scam banks that were nothing more than money-laundering fronts of “glorified treasury departments” for big companies.

The infamous “bank-like institutions” of the '90s have almost entirely disappeared, as respected analyst Kim Iskyan of Renaissance Capital dubbed them.

Central Bank to the ruble’s rescue

The Central Bank stepped into the forex markets on March 19 to buy rubles in order to pay for the stake in Sberbank that is to be sold.

The move is a de facto injection of dollars into the foreign exchange markets to support the ruble. Investors have become very nervous in the last few days after oil prices fell to $25 and the ruble tanked falling below the psychologically important 80 to the dollar rate.

The Central Bank is trying to be prudent with its $570 billion of reserves as of the start of March, and has resisted the urge to rush into the market to prop up the sinking ruble, which could lead to it burning through its stockpile of dollars to little effect.

Last time round when oil prices collapsed at the end of 2014 the ruble also followed oil down to around 80 to the dollar. Traders began to scream for a rescue by the Central Bank and cursed Nabiullina’s name, calling her “incompetent” and “irresponsible” for not intervening. Similar comments started appearing on social media on March 18 as the ruble’s value collapsed, albeit more muted than six years ago.

However, the staff at the Central Bank are battle-scarred veterans of multiple crises and have shown themselves to be extremely competent. Nabiullina herself has been dubbed “the most conservative central banker in the world” and is widely respected as a safe pair of hands. During the last sell-off in 2014 after the dust had settled, commentators said one of the most encouraging takeaways is that Putin did not interfere and left the Central Bank to manage the crisis on its own, with the overriding goal of preserving Russia’s hard currency reserves.

That goal has been made a lot easier since the Central Bank allowed the ruble to float freely in 2014 and the rapid devaluation of the currency provides a shock absorber for the economy few other countries in the Commonwealth of Independent States (CIS) or even the Middle East enjoy.

The mistake of acting too early was highlighted after the US Federal Reserve bank cut rates to near zero last week, which had no noticeable effect on the market. Likewise in Ukraine, last week was marred by dollar panic buying and the National Bank of Ukraine (NBU) spent $1.5 billion of its $26.6 billion in reserves in just the last 10 days. If it keeps that up Ukraine could run out of money in the next three weeks and face a full-blown currency crisis.

Nabiullina’s cautious intervention on March 19 is designed to put a floor under the fall of the ruble and start managing expectations to allow for a recovery in the value.

And the ruble is likely to recover its value as the value of a currency is predicated on both the amount of hard currency reserves a country has and the productive capacity of the economy. Russia’s $570 billion reserves are the fourth-highest in the world and currently cover its entire external and public debt dollar-for-dollar in cash, and would still leave $100 billion over as cash if all the debts were paid off tomorrow.

On top of its huge reserves, Russia’s economy is likely to weather the current storm with relatively little damage. bne IntelliNews crunched the numbers recently and found the Russian economy is in robust health as far as its macroeconomic fundamentals are concerned.

Finance Minister Anton Siluanov recently announced that he believed the oil price shock would cut 2 trillion rubles ($25 billion) from budget revenues this year and put Russia into a mild recession, but as the government has a total of 10 trillion rubles of reserves in its National Welfare Fund (NWF), it can cover a shortfall of this size for at least five years.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.