Gazprom stocks soared 30 percent in a matter of days in May after the management doubled its dividend payout from 8 rubles per share to 16.6 rubles under pressure from the Finance Ministry.

It seems that the ministry has the upper hand (and presumably the personal backing of President Vladimir Putin) as one state-owned enterprise (SOE) after another has announced plans to pay out the mandatory 50 percent of profits as dividends. Most of the SOEs have already achieved this benchmark, but the laggards — Sberbank, VTB, Gazprom and Rosneft — have all increased their payout ratio and say they will pay out 50 percent by next season.

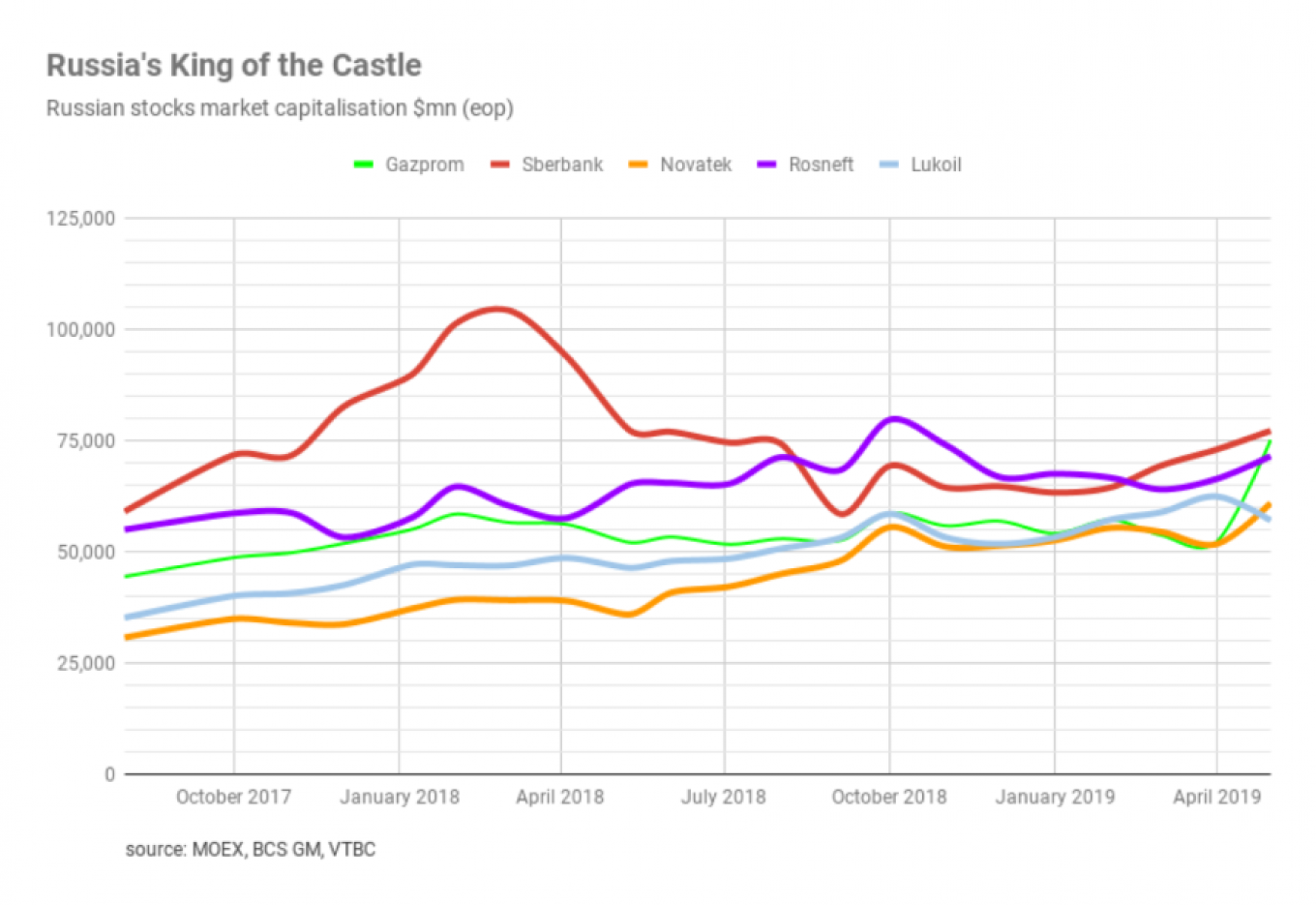

The spike in Gazprom’s share price lifted its valuation by an astonishing $20 billion overnight from $57.1 billion on May 14 to $71.4 billion a week later. The company’s market capitalisation rose another $4 billion through to the end of the month and was $75.1 billion as of May 31, breaking through the $75 billion mark for the first time in years.

That spike allowed Gazprom to close a lot of the gap with state-owned retail banking behemoth Sberbank, which is currently Russia’s most valuable company, worth $77.2 billion as of May 31, but only just ahead of Gazprom.

Gazprom is clearly one to keep an eye on now. The company has been through a management shake up recently, and it increasingly looks like the Kremlin has lit a fire under the old guard to try and improve profits and efficiency.

Moreover, the Kremlin recently threatened to take direct control of the gas giant’s investment programme. Clearly the powers that be are not happy with the way the programmes are being run and these represent a huge part of Russia’s overall fixed investment. Last year Russia’s capital investment was 20 percent of GDP, of which Gazprom’s pipe-building activity accounts for the lion’s share. However, despite the massive investment programmes GDP growth in the first quarter was only 0.8 percent, well below even the most pessimistic forecasts.

The changes at Gazprom have apparently already borne fruit as the company just reported a 44 percent jump in its first quarter profits year-on-year to 535.9 billion rubles ($8.2 billion) compared with 371.6 billion rubles in the same period a year earlier.

That was "mainly due to an increase in sales of gas to Europe and other countries and sales of crude oil and gas condensate and refined products," the company said in a statement last week.

The volume of gas sold in the first quarter actually fell by 13 percent year-on-year, but a rise in prices — by 30 percent when calculated in rubles and 12 percent in dollar terms — more than made up for the decline, analysts said.

While most of the attention has been focused on Putin’s 12 national projects as the source of growth in the next few years, clearly the Kremlin is hedging its bets and wants to make sure the more traditional growth drivers — the huge SOEs — are doing their part as well. Market conditions may favour Gazprom’s bottom line at the moment but the Kremlin is keen to squeeze more out of the company by improving the way it is run.

Novatek overtakes Lukoil

The other big equity market story in May was that the market capitalisation of privately owned gas company Novatek overtook that of Lukoil for the first time to become Russia’s most valuable privately owned company, also breaking through the $60 billion mark for the first time.

While the SOEs have seen their valuations more or less stagnate, despite the short-term wiggles, the two biggest privately owned hydrocarbon producers have seen their market cap double in the last year and have been running neck-and-neck until this month.

Novatek’s value also jumped after it announced it had closed a string of deals for its third liquified natural gas (LNG) project in the Arctic. Novatek has been on a tear and has become de facto the official agent to carry out Russia’s move into LNG. Russia was producing a mere 10 million metric tons of LNG a year until recently, making it a minor player in the business, but with two new LNG plants Russia’s output is rapidly increasing and the country hopes to be producing 80 million tonnes a year in the future, which will make it a major player.

Lukoil hasn't done anything wrong. It has been supporting its share price with a share buyback programme which it recently extended and said it would cancel the shares it bought, thus increasing the value of the remaining shares. But the company’s share price fell sharply in May, allowing Novatek to overtake it. Lukoil’s market capitalisation was $57 billion as of May 31 against Novatek’s $61 billion.

This article is from bne IntelliNews Russia monthly country report.

See a sample here.

Sign up for a one-month trial here.

Contact us here.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.