Russia’s plans to launch a crypto-based “Digital Ruble” are not going to help it avoid Western sanctions in the foreseeable future, experts say, despite Russian officials’ claims that the new currency could deal a fatal blow to the U.S.-led global financial system.

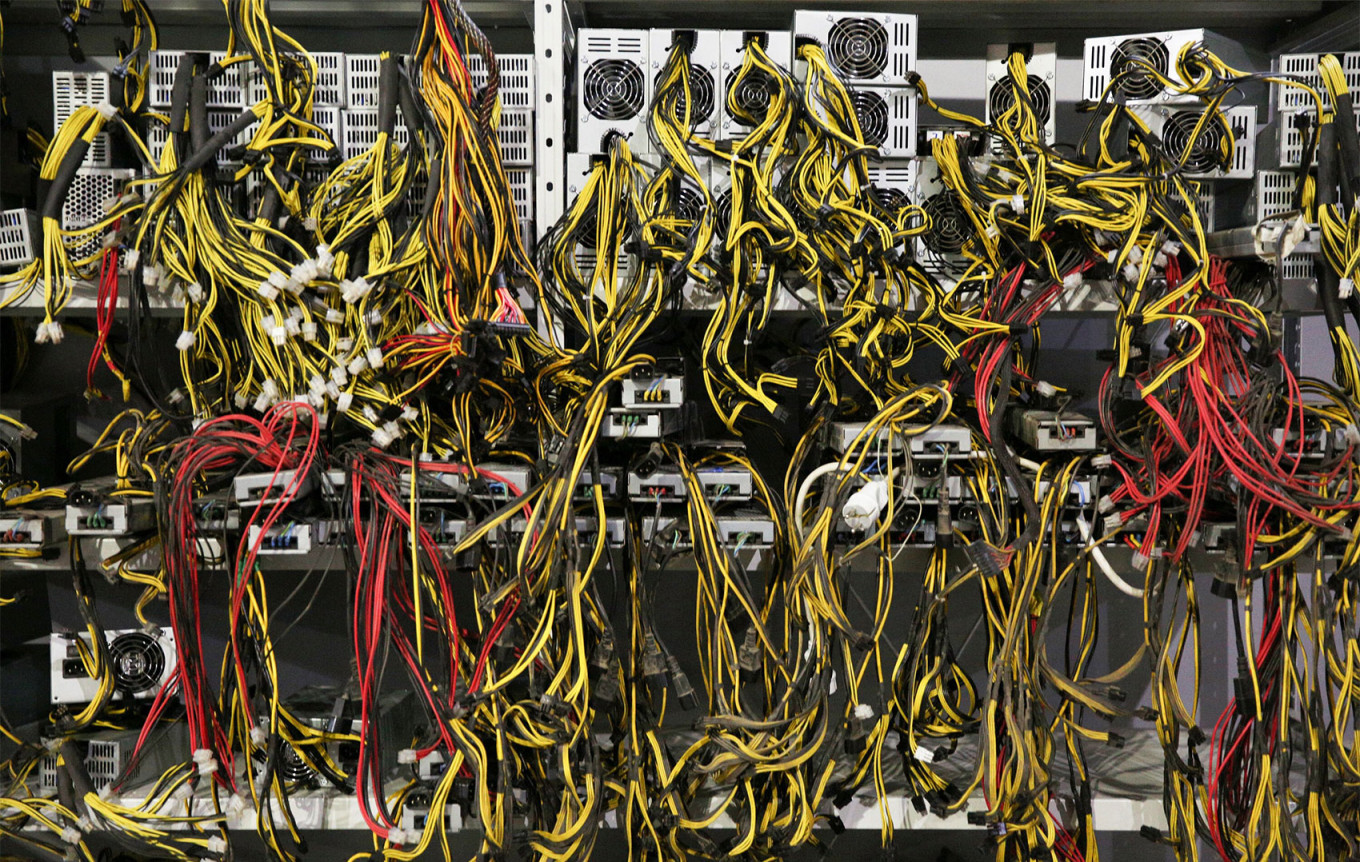

A new law paving the way for the roll-out of the Digital Ruble comes into force on Tuesday, establishing the blockchain-based currency as a new form of legal tender inside Russia.

Although designed as a new domestic payments system, since Russia invaded Ukraine in February 2022, Russian lawmakers, analysts, think tanks and state media outlets have touted the Digital Ruble as a game-changer in helping Russia skirt Western restrictions.

“We will be able to use this technology ... to carry out settlements with foreign countries and foreign companies. Thus, it will be very difficult for our enemies, including the United States, to influence our financial activities. It’s a big step forward, both in terms of payments and as an opportunity to protect ourselves from sanctions,” said Russian lawmaker Anatoly Aksakov, a co-author of the Digital Ruble laws.

Independent experts tend to disagree.

“I cannot see how the Digital Ruble can help with sanctions avoidance,” said Alexandra Prokopenko, a former Central Bank staffer and now a visiting fellow at the German Council on Foreign Relations.

“Sanctions limited the ability of Russian businesses and the state to use the dollar and euros. The Digital Ruble in this case isn’t helpful at all. I can’t imagine how it will work.”

What is the Digital Ruble?

The Digital Ruble is a new form of currency in Russia, which will be issued by the Central Bank. It is Russia’s version of a central bank digital currency (CBDC) and will be based on blockchain technology. It will sit alongside cash and existing forms of electronic money as a means of payment. The Central Bank says the Digital Ruble will reduce transaction costs for businesses, add an extra layer of security for consumers and help combat corruption. It is currently being tested by the regulator and commercial banks.

Once launched, businesses will be able to accept payments in Digital Rubles in shops, potentially including through offline methods like NFC payments. Digital Rubles will be stored directly in accounts with the Central Bank, but accessible through wallets with commercial banks. Digital Rubles will be fully convertible into both cash and other electronic payment forms. The Central Bank will not pay interest on holdings of Digital Rubles and will not allow borrowing in Digital Rubles.

Russia claims that the Digital Ruble, if used for international transactions, will enable payments without the involvement of foreign commercial banks or Western financial infrastructure, like the SWIFT financial messaging system.

Commercial banks are on the frontline of enforcing Western sanctions, with the power and responsibility to block transactions involving sanctioned entities. Given the high importance of carrying out transactions in U.S. dollars, even financial institutions in countries on friendly terms with Moscow — such as China, Turkey and the United Arab Emirates — have been cautious in their transactions with Russia, wary of being hit with secondary sanctions.

But because CBDCs, in theory, do not need the involvement of a commercial bank, Russian analysts say the Digital Ruble will let foreign companies trade directly with their Russian counterparts, away from the prying eyes of Western financial regulators.

“The main advantage of the Digital Ruble for cross-border payments is that such payments will be made without using the banking system of other countries, only through the Digital Ruble platform, operated by the Bank of Russia,” said Nikolay Zhuravlev, general director of TFA.RF, a consultancy on digital financial assets.

“We know that there are many companies in the world that are interested in doing business with Russia, but today their capabilities are limited by … sanctions against Russian banks. Thanks to the Digital Ruble, banks are removed from the equation, and all companies ready to trade with Russia will be able to do it directly,” he added.

In practice, the system is unlikely to play out that way, analysts say.

In its first stage, the Digital Ruble will be a purely domestic payments system. The Central Bank has mentioned the possibility of using it for cross-border payments sometime in the future, but has not given any indication that it has started any serious effort in developing the required financial architecture.

That would require detailed bilateral agreements and technology sharing with other central banks, or some kind of unified clearing system for CBDCs. Both would take years to set up.

“The worries about the use of CBDCs to circumvent sanctions are currently exaggerated … It requires technical compatibility with other CBDCs. The cross-border central bank-to-central bank infrastructure isn't there yet,” said Maria Shagina, a senior research fellow for economic sanctions at the International Institute for Strategic Studies (IISS).

“In theory, if cross-border CBDC infrastructure is created with enough partners, it could be potentially used to circumvent the U.S. nexus and hence sanctions. But we are not there yet,” she added.

Even if the infrastructure were in place, two large barriers to widespread uptake remain: the toxicity of the Russian ruble as a currency, and sanctions fears in other countries about dealing with Russia.

“If people want to work around sanctions, they can already do that with rubles. The Digital Ruble doesn’t add anything. The problem is that nobody wants rubles,” said David Gerard, a blockchain researcher and author.

Russia has spent years trying to convince its trading partners — particularly in Asia — to switch to settling payments in rubles, but only recently has it had success in transferring some of its imports and exports payments into Chinese yuan.

Shagina says this switch to non-Western currencies, and the use of non-Western traditional payments systems — like Russia’s and China’s domestic alternatives to SWIFT — are much more realistic as a potential means to avoid sanctions than an untrusted blockchain-based Digital Ruble.

Moreover, using the Digital Ruble for Russia’s international trade doesn’t address the issue of companies outside Russia being targeted with sanctions — a factor even Russian analysts admit is a serious barrier.

“It’s impossible to rule out secondary sanctions against the central banks of Russia-friendly countries that carry out settlements with Russia in Digital Rubles. It could be interpreted by unfriendly countries as assisting Russia in circumventing sanctions,” the Stolypin Institute, a Moscow-based research center, wrote in a recent report.

For its part, the Central Bank has been cautious in pushing the Digital Ruble as a sanctions-avoidance tool, focusing mainly on its domestic functions. But that hasn’t stopped Russian lawmakers and analysts from talking up its potential — and that’s due to both domestic political reasons, and a lack of understanding about what the Digital Ruble actually is, Gerard says.

“People don’t understand that it doesn’t do anything that they can’t already do,” he told The Moscow Times.

“The sanctions nonsense is essentially this: They need something, the Digital Ruble is something, so they’re seizing upon it — whether or not it makes sense.”

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.