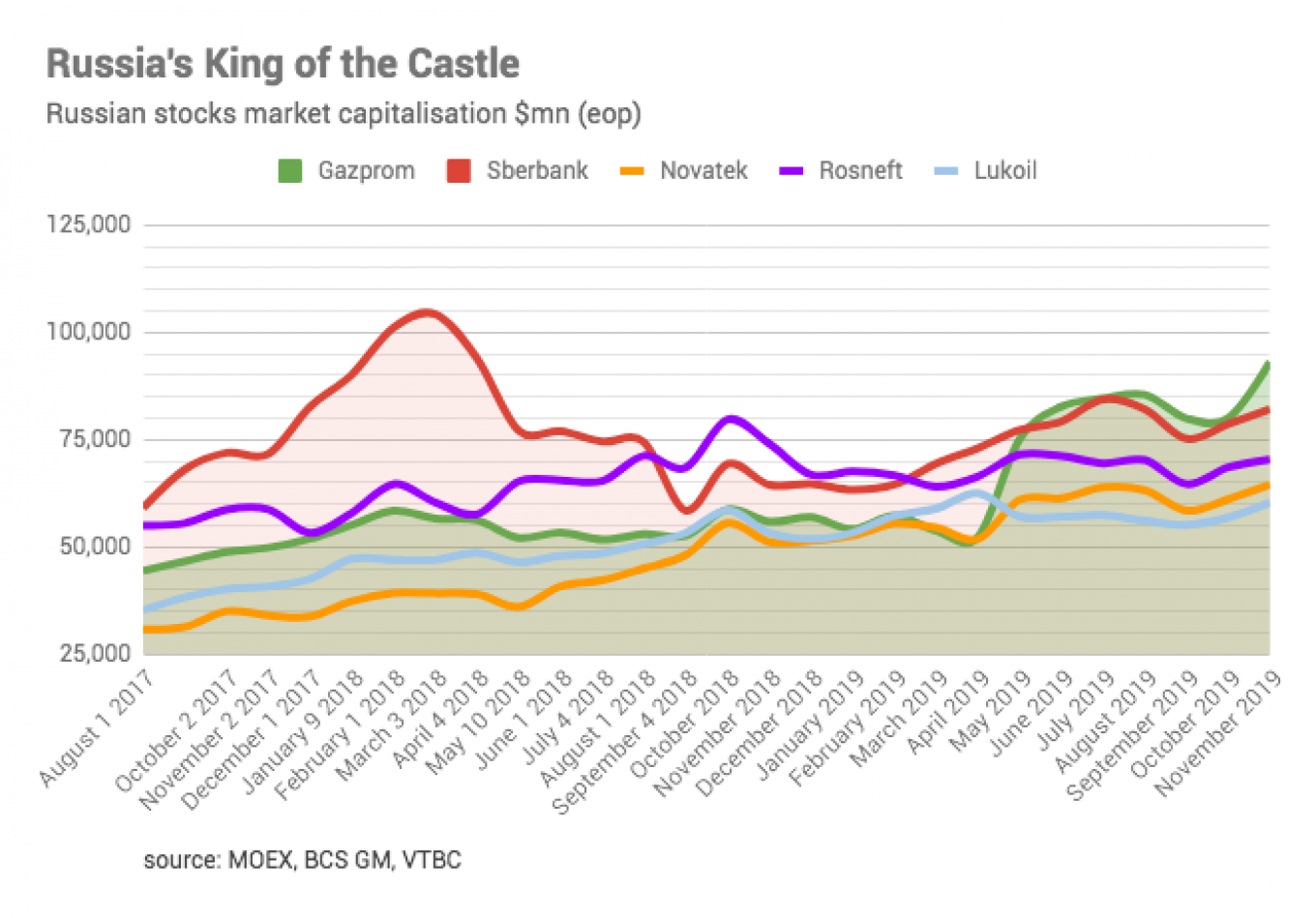

State-owned gas company Gazprom extended its lead over rival state-owned banking giant Sberbank in the stakes to be Russia’s most valuable company.

The oil giant’s market capitalization stepped up by over $10 billion in recent weeks to make the company worth $93.1 billion as of the start of November. Sberbank’s market capitalization rose on the month by $4 billion to a total of $82.1 billion, putting it in second place.

Russian stocks are having a banner year as investors return to the Russian equity market and are currently overweight. The Russian stock market is currently the best performing in the world, with the MSCI Russia Index up 44% year to date, the dollar-denominated Russia Trading System (RTS) index up 34% and the ruble-denominated MOEX Russia Index up 23% as of Nov. 14.

A variety of factors have gone into lifting the index, apart from a so-called “santa rally” that happens every year in the last quarter. Chief amongst the positive factors is receding fears of new and harsh U.S. sanctions, growing corporate earnings, sustained high dividend payouts and a mild economic recovery.

However, Gazprom’s stock has had an even better year, storming past Sberbank to become the king of the castle in June when its share price jumped some 30% in a single day after the management unexpectedly doubled the company's dividend payout.

So far this year Gazprom’s shares have earned investors a 72% return against Sberbank’s 39%. Both higher than the 33% gain in the financial sector as a whole, and better than the RTS general index.

The rise has been driven by a limited rerating of the market as a whole. While Russia remains in conflict with the West over issues such as the war in Ukraine and the annexation of the Crimea in 2014, Russia’s numerous recent foreign policy successes, such as the stabilisation of the situation in Syria, the “honest broker” status President Vladimir Putin has gained in the Middle East, especially between Iran and Saudi Arabia, and rapprochement with Turkey, have led to European leaders such as French President Emmanuel Macron reaching out to Russia and calling for a reset.

At the same time, at a corporate level Russian companies have been doing very well and with high dividend payouts and rising earnings per share investors have been cherry-picking amongst the shares. The utilities sector stands out in particular. Utility stocks have performed particularly well and are up 29%, as the sector is in the midst of a major reform that should lift valuations further. Last year it was metals, mining, oil and gas stocks that did well on the back of rising commodity prices.

However, despite the gains, Gazprom’s market cap is still well off the circa $300 billion it was worth in 2008, when CEO Alexey Miller boasted the company would become the world’s first ever trillion dollar stock. During the subsequent crisis, Gazprom’s market cap fell to a low of $56 billion.

Not only has Gazprom recovered some of the ground lost, but its stock has outperformed the other leading bluechips with more recent gains. In addition to promising to hike dividends to 50% of income next year, several of the company’s big investment projects are winding down.

The Power of Siberia gas pipeline to China is almost completed. The TurkStream gas pipeline to southeast Europe is also almost done. And the controversial Nord Stream 2 pipeline has cleared its final hurdle and will be completed some time in May. In theory, the end of these mega projects will leave Gazprom with more cash available to distribute to shareholders.

Since Gazprom’s fall, Sberbank has been the only other company to break through the $100 billion mark. It did so in 2017, but its share price has underperformed since. However, next year the bank has also promised to increase its dividend payouts to 50% of its income, which might lift its valuations again.

Finally, the two privately owned companies at the top of Russia’s market — oil company Lukoil and gas company Novatek — continue to grow steadily, but are now being outpaced by their state-owned peers.

Much liked by investors, Lukoil and Novatek have closed the gap on their peers in the last few years. Lukoil’s stock was up 32% year-to-day and Novatek up 21%, giving them market capitalizations of $62.2 billion and $62.4 billion respectively.

While the rapid gains of the state-owned companies can be attributed to the rerating that has following a change in political risk, the gains made by Novatek and Lukoil are probably much more to do with normal gains made by expanding business.

Some analysts believe the current rally will run out of steam in 2020. “We are overweight Russia now, but you should sell up before the holidays, as Russia is due a duff year,” said Julian Rimmer, a trader at Investec in a recent research note.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.