At the end of one of the most turbulent weeks on the Russian stock markets since 2014, almost the entire page of stock prices reported by Alfa Bank in its weekly wrap was red.

That means shares were down over the last 24 hours, last month, since the beginning of the year, and over the last 12 months. The only exception was Acron, a Russian fertiliser company.

The market staged a partial recovery Friday since Alfa’s calculations were published, jumping 9%. But is still down significantly over the last few days, highlighting the exceptional volatility in the Russian markets.

“Markets plunged lower [on March 12] as investors moved from uncertainty to panic: Stocks spiralled lower in a bear market Thursday as the coronavirus-driven selloff accelerated,” Alfa Bank said in a note to clients.

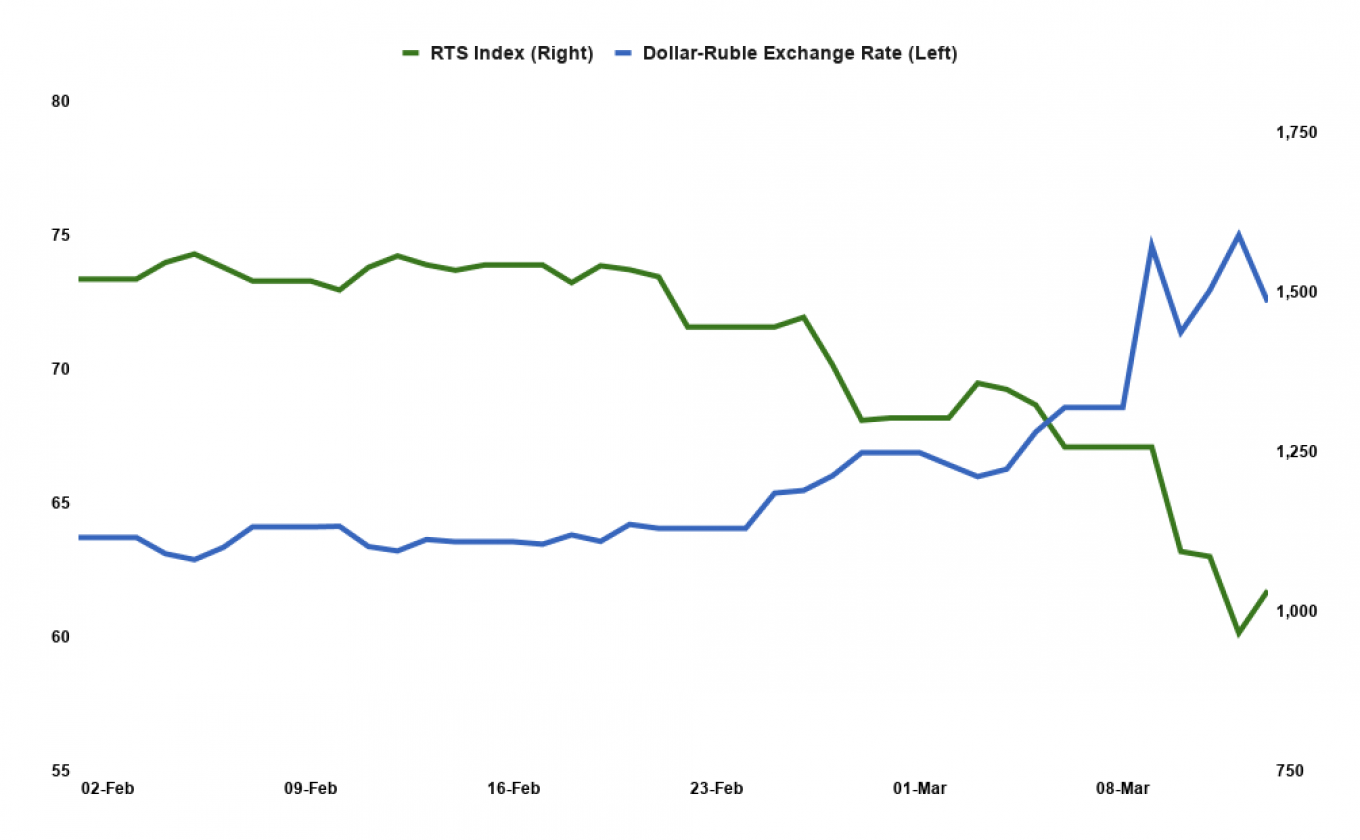

“The Russian market was heavily sold with the RTS index back at the lows of November 2016 in a broad selloff with liquid names hardest hit.”

Russian equities have faced a perfect storm that has destroyed all the value gains from a strong start to the year. The golden rule of investing in Russia is simply to ask: “is this a crisis year?” If the answer is “no” then the market usually returns at least 20%.

Clearly the answer to that question this year is “yes” — and things get really nasty in crises. In 1998 the market fell 85% year-on-year, in 2008 it was down 72% and in 2014 it dropped 45%. This year’s crisis is already looking like it will be a vintage of disaster: the RTS closed under the important 1,000-mark Thursday, down 38% — making it Russia’s third biggest selloff since the market was established in 1996.

Digging into the sectors, the picture is even more grim. Oil and gas companies have obviously taken the brunt of the selling following the collapse of the oil prices and the sector as a whole was down 44% as of March 12, according to BCS Global Markets.

Financials and consumers were also down 38% and 33% respectively, despite both classes having performed well at the start of the year on hopes that the helicopter money Russian President Vladimir Putin promised to spend on the social sphere this year would boost these sectors.

Maybe the biggest casualty has been the utilities sector which was down 32% since the start of the year as of Thursday. The sector has been outperforming for the last nine months and was the only one to show any sort of resilience to the mounting nerves following the market’s peak on January 20. But all that resolve has gone now and portfolio investors have clearly decided that this crisis is a big one and fled the market to lick their wounds. Bonuses for traders are going to be thin on the ground this year.

Oddly, the metal and mining sector has been the best performer, down only 22%. But that may be because previously it was the worst performer and investors had already sold out of the section.

The ruble has also suffered from high volatility, hitting almost 75 rubles to the U.S. dollar Thursday before recovering back towards 72.

The panic was stoked as countries across Europe took even more drastic action, putting their populations on lockdown. Italy ordered all its stores and public places like schools closed. The rest of Europe is maybe a week behind and similar measures are almost certain to be widely implemented across the region.

Oil prices also seemed in free fall as Brent lost 7.8% on Thursday to hit $33 a barrel, “due to a combination of the oil price war, further demand concerns due to travels restrictions in Europe and beyond, as fallout from the virus intensifies,” Alfa Bank said.

Tens of billions of dollars have been wiped off the market capitalization of Russia’s top stocks in the volatility.

Gazprom has been particularly hard hit with its market cap almost halving in value from $97 billion at the market peak in January to $52 billion on Thursday — a loss of a whopping $44 billion. In other words, Gazprom’s valuation has been falling by $6 million per minute over the last two months.

By the end of Thursday, all of Russia’s blue chip names had seen their prices fall by more than 45% — is worse than the market’s overall decline of 40% over the same period.

The big question is when will the market hit bottom?

Some bottom fishers appeared on the market on March 3 as Russian stocks appeared extremely cheap again. The buying was concentrated in the utilities names, where the investment story remains attractive.

However, the market has stepped down again in the last two days before recovering Friday to end the week strongly — a sign of how volatile and complicated trading conditions have become.

Alfa Bank was upbeat and said it sees some signs of relief at the market’s current levels. There has also been a wave of top Russian managers and owners buying stocks in their own companies in the last few days, and some companies are announcing they will launch new buyback programmes to support their share prices.

“Friday the 13th provides a fitting end to a terrible week for financial markets,” Alfa Bank said in its morning monitor.

“Volatility remains at record highs and investors are jittery because of a belief that fiscal plans and the U.S. Federal Reserve's ramped-up funding actions won’t be sufficient to offset the economic impact from the coronavirus. But the trouble with sudden economic stops is that it is not easy to restart an economy. In our view the selloff is not yet over, with recession a possibility and the coronavirus continuing to spread through Europe and North America causing severe economic disruptions.”

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.