Investors in Russian stocks have almost given up on seeing any of the cash the country’s leading companies generate. The valuation of what should be some of the world’s richest companies is in the basement, as would-be minority investors don't believe the management will share the billions of dollars in revenue these companies make every year. Russia’s stock market boomed in the noughties, adding about 50 percent to stock valuations every year, but since about 2014 the leading RTS index has got stuck at between 900 and 1,300 depending on the sanctions newsflow or the price of oil.

That’s why when the state-owned gas behemoth Gazprom hiked its dividend payments twice in a week in the middle of May to 16 rubles per share it came as a shock to the market. Gazprom’s shares, which have been trading sideways for years, soared by 30 percent in a matter of days. The management had doubled the dividend payout from the 8 rubles per share it has been paying come rain or shine to 16.6 rubles without warning. Now everyone is wondering if something has changed.

Russia’s leading RTS index is for once doing very well this year, up by 20 percent year-to-date as of May 20, having shaken off a big sell-off across all emerging markets in the last week, as investors are spooked by the escalating trade war between the U.S. and China. Russia currently has one of the best performing markets in the world.

But no one has made much money from investing in Russia shares for years. Apart from the short-term swings — and those can be dramatic — the stock market valuation is not growing. There are some companies that are world class, and should be very valuable listed on the Moscow Exchange (MOEX), but investors remain reluctant to invest in them. Russia’s price-to-earnings ratio — a standard measure of how attractive a company is to investors — makes it one of the cheapest in the world, at half the level of other emerging markets.

What makes the low valuation doubly perplexing is the fact that Russian companies are currently paying the most generous dividends in the world. Russian dividend yields are over 7 percent — more than twice the benchmark MSCI EM index dividend yield of 3.2 percent, and on a par with the typical long-term return an investor would make on an equity investment. In other words, you can make a decent return from just your share of the profits paid out as dividends in many Russian names without the stock price moving at all.

So why are investors so uninterested in Russian stocks? Gazprom was supposed to be the world’s most valuable company by now. Gazprom’s CEO Alexi Miller famously boasted in 2008 that the “state within the state,” as it was once known, would become the world’s first trillion dollar company. The company was worth $350 billion at the time after its share price rocketed once the so-called “ring-fence” — special rules that prevented foreign portfolio investors from buying the locally traded shares — was pulled down in 2006.

It hasn't worked out like that. U.S. technology company Apple became the world’s first trillion dollar company last August, while Gazprom’s market cap has shrunk seven-fold to a mere $56 billion. Gazprom throws off a lot of cash, but its management refuses to share the company’s profits with investors, said fund managers interviewed by bne IntelliNews.

“It's like investing in a bond,” says Kirill Tachennikov, the oil and gas analyst with BCS Global Markets. “The company makes a lot of money, but every year it paid out that same 8 rubles per share regardless of how well or badly the company had performed. That was true until now.”

Gazprom management has argued it needs its cash to pay for a slew of mega-infrastructure projects, but Russia’s Finance Ministry has been on the hunt for fresh sources of revenue to foot President Vladimir Putin’s 27 trillion ruble spending bonanza that was announced last year during his state of the nation speech.

Gazprom is spending nearly all the money it makes on building infrastructure that, in theory, adds to the value of the company but in practice simply eats up its cash. Last year Gazprom launched a record capital expenditure (capex) programme, investing over 2.1 trillion rubles ($32 billion) in a series of pipelines.

“The money that Gazprom is making is literally being buried – in one large capex project after another; in the pipeline in the Baltic Sea, in Turkish Stream, in the connection with China, in a pipeline on the moon...” said one fund manager who declined to be named. “The book value of all these assets is over $300 billion, but Gazprom makes very little cash from these projects. And what profit there is always goes back into the ground.”

Gazprom’s revenue last year was a massive $131 billion, and its income a tidy $23 billion, but analysts complain that its free cash flow (FCF), from which dividends are usually paid, was practically zero. There is a joke among traders that Gazprom’s capex programme equals the cash the company earns minus dividends it has to pay.

In theory Gazprom’s enormous spending spree should be coming to an end, as all three of the major pipelines under construction are due to be completed in the next 12 months or so. But last summer Gazprom floated a new idea; it now wants to get into liquified natural gas (LNG) and build a plant, which typically cost at least $10 billion each.

“If Gazprom is going to get into LNG, the point of which is to make gas easier to transport, then why has it just spent all that money on building pipelines?” asked one exasperated investor. “Gazprom is not just a company. It is responsible for developing Russia’s energy infrastructure. It will never stop building.”

Russia’s Finance Ministry is also exasperated by the same problem. It has insisted that all state-owned enterprises (SOEs) pay out 50 percent of their income as dividends, which should benefit the investors as much as the state. But management of the SOEs have been resisting as hard as they can, and all claim they have essential investments that are good for the country as well as their companies.

What shocked the market this month was Gazprom caving into Finance Ministry pressure and reluctantly agreeing to increase dividends to 10 rubles per share. And surprisingly, it seems the ministry had enough clout to force a further hike to 16.6 rubles a week later — a potential total payout of 393 billion rubles ($6 billion) to be approved by the board and the shareholder meeting on June 28. The proposed payout under international accounting standards would increase from 17.5 percent of net profit to 27 percent, which is still well shy of the 50 percent of profits the finance ministry is demanding.

Investors are now asking themselves if the new higher dividends are a permanent feature and if the government will force the company to increase dividends even further. Almost all the SOEs have increased their dividend payouts to 50 percent already. Even Sberbank, which increased its dividend payout from 36 percent of profits to 42 percent this year, says it will pay 50 percent next year.

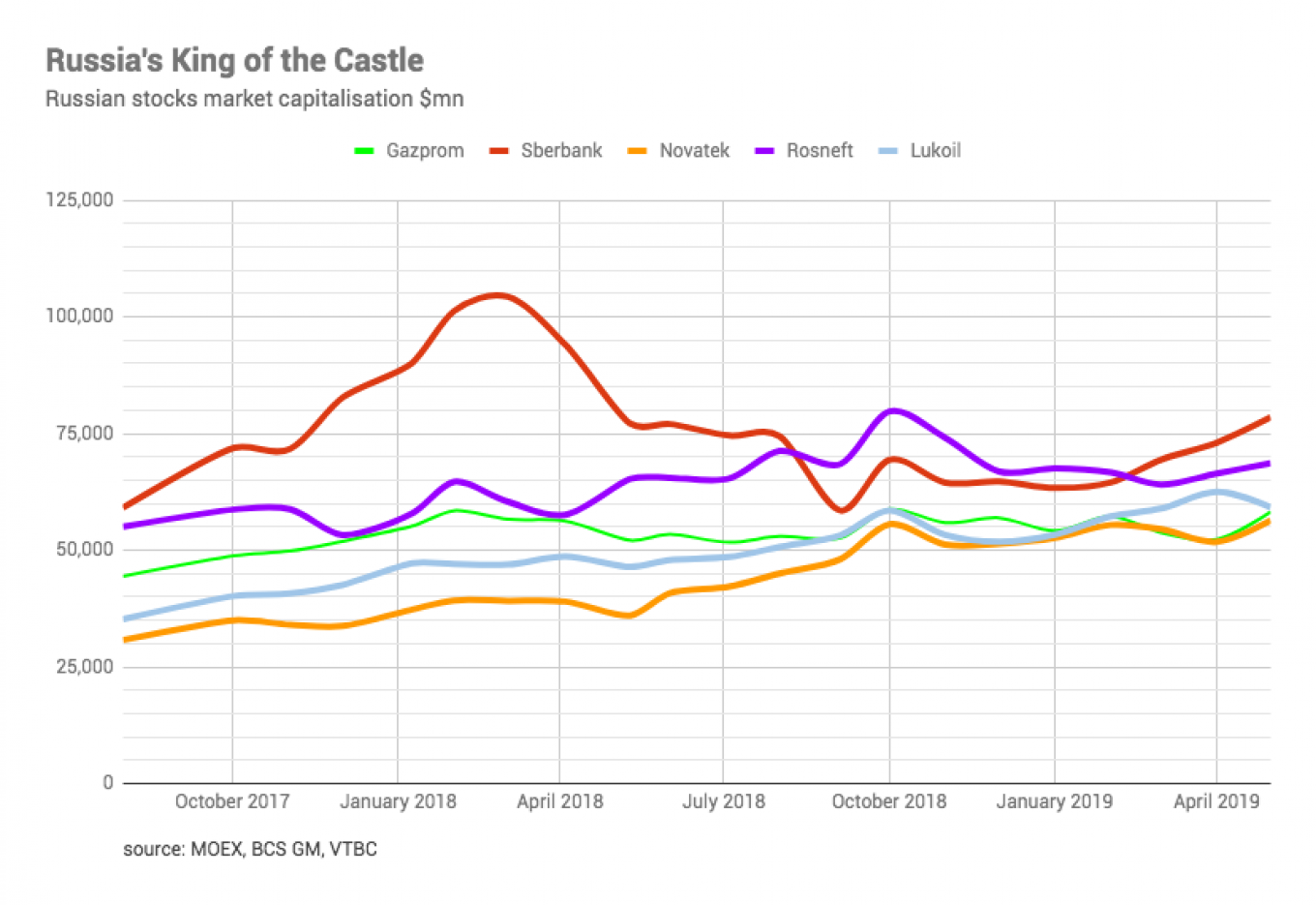

Gazprom’s valuation got a bump this month from the new dividends policy, but none of Russia’s biggest stocks are worth more than $75 billion when several of them should be worth hundreds of billions.

The only one that comes close is state-owned retail banking giant Sberbank, which remains Russia’s most valuable company and saw its market cap top $76 billion in the last month. But its valuation is still down from the $100 billion-plus it was worth at the start of last year. The value of the Russian market as a whole has been more than halved from its heyday in 2008, just before the international financial crisis hit.

Pennies on the dollar

The state-owned companies are particularly good at ignoring the interests of their shareholders, but the private companies have additional problems.

Another stock that is massively undervalued is aluminium producer Rusal, which belongs to sanctioned oligarch Oleg Deripaska. The company floated a few years ago on the Hong Kong stock exchange at a price of 11 Hong Kong dollars per share, but when it was hit by the U.S.'s April 6 round of sanctions the price collapsed to 2 Hong Kong dollars, and currently the company is worth $5.7 billion — a fifth of its previous valuation.

It should be worth more. Amongst its assets the company owns a 27.8 percent stake in Norilsk Nickel, the world’s largest producer of nickel and platinum group metals. Norilsk Nickel’s market cap is currently $33.2 billion, which makes Rusal’s stake worth $9.2 billion.

In other words, just the value of Rusal’s stake in Norilsk Nickel is worth over $3 billion more than the entire company, ignoring its highly profitable aluminium business entirely, which is effectively priced as less than worthless. Last year, despite the sanctions, Rusal’s aluminium business generated $10.3 billion of revenues and an income of $1.7 billion. Clearly the company is ridiculously undervalued by the market.

The threat of sanctions has affected the valuations of all Russian stocks and even some of the best run companies, like Sberbank, are also badly undervalued.

Surgutneftegaz

But maybe the most extreme example is leading privately owned oil company Surgutneftegaz. One of the most popular stocks on the market, Surgut currently has a market valuation of $17.9 billion. But what makes this company so strange is that it also famously has a cash pile of $46 billion.

If one could take the company over then an investor could literally buy the cash the company holds for 40 cents on the dollar. But that’s the point. No one can take the company over. Indeed, it is not even clear who owns it as the company is extremely opaque and has a legendarily complicated holding company structure that controls the shares. And the management has not and will not share that cash pile with investors. Indeed, bankers say no one is even sure where this money is.

So why is the stock so popular with investors? Don't get confused. An investment into Surgut is not an investment into an oil company. It's a hedge against the weakening of the ruble.

Surgut has two kinds of share – the ordinary shares and its preferential shares (known simply as “prefs”).

The ordinary shares pay a meagre 2 percent dividend yield based on what the oil company earns from producing oil and attract almost no attention from investors. But the prefs are more interesting.

Cash pile

The company reports its results in rubles, but the cash pile is in dollars. Company rules mean that each year Surgut has to revalue its cash pile to account for its change in value in ruble terms, depending on what happened to the exchange rate. If the ruble weakens then Surgut makes profits simply on the revaluation. The company rules say it has to pay out about 8 percent of these profits as dividends to the holders of the pref shares.

“Surgut prefs are unique on the market and investors use it as a hedge against investments into ruble denominated assets. If the ruble falls against the dollar, as it did last year, then you make a huge profit just on the FX effect,” says Tachennikov.

Surgut’s board has just recommended dividends of 0.65 rubles per share for ordinary shares and 7.62 rubles per share for preferred shares for 2018 that will be approved at the annual shareholders meeting on June 28.

What these numbers imply is dividend yields of a paltry 2.7 percent for the ordinary shares but a massive 19.3 percent for the prefs — by far the highest on the Russian market. An investor buying the prefs can make a 20 percent return, without the share price moving.

“Investors see the ordinary shares and the prefs as two entirely different assets,” says Tachennikov.

However, as the 60 percent discount on the cash pile Surgut’s valuation implies, no one is investing into the company’s shares for their own sake. All the normal arguments for buying a stock, like growing revenues or falling costs, simply don't apply to a company like Surgut.

Surgut’s ordinary shares have actually lost about 5 percent this year to date, despite the fact that the cost of a barrel of oil was up by 34 percent from the start of the year on May 17. The prefs are up by about 10 percent but lagging well behind the RTS, which is up by nearly 20 percent.

Lukoil

Of course not all Russian companies are following the same strategy. In the oil and gas space Lukoil stands out, and has seen its share price almost double in the last year. It pays good dividends and has spent $2.6 billion on buying shares, and so supports its own share price. More recently it extended the buyback and said it will cancel the shares it buys, which makes the remaining ones more valuable. Gazprom is a long way from doing anything like that.

And a few other stocks, especially in the retail sector have price-to-earnings values on a par with, or better than, their emerging market peers. There are some good stories for portfolio investors in the Russian market, but collectively they are not enough to drive the index up or cause any sort of excitement amongst emerging market investors.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.