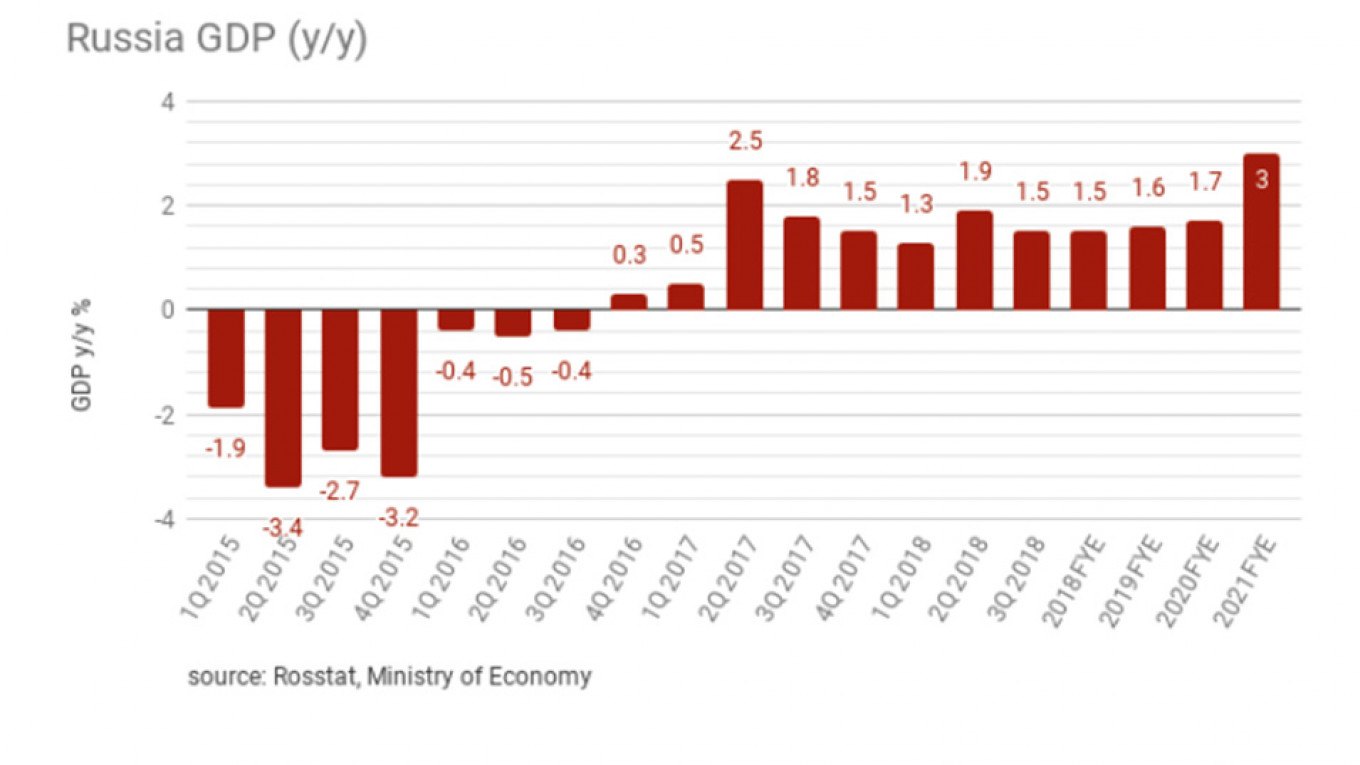

Russia’s banks and companies are back in profit, but the population are miserable and feel poor. Last year Russia earned a record current account surplus of $114.9 billion, but real incomes in 2018 fell for the fifth year in a row. There was a federal budget surplus of 2.2 percent -- the first surplus in years – but growth for the full year came in at three quarters of what the government was predicting at the start of 2018 at 1.5 percent.

What is going on? Is Russia recovering or not?

The short answer is although at the macroeconomic level Russia is back on an even keel, because of sanctions the government is running an austerity budget and that is hurting.

There is an enormous amount of cash in the system ($467 billion in reserves, or over 23 months of import cover), the sovereign external debt is ridiculously low, 15 percent of GDP, trade is booming and Russia Inc. is currently a more profitable concern than it was in the boom years during the noughties.

All these numbers are far in excess of what is needed to ensure the stability of the economy or the national currency. Yet instead of leveraging these rock solid fundamentals CBR governor Elvira Nabiullina chose to hike interest rates at the last Central Bank of Russia (CBR) meeting of last year. She was not looking to promote growth, but to anticipate volatility on the currency markets in case the US imposed fresh “crushing” sanctions on Russia in the first quarter. That’s no even austerity. That is a war mentality.

Russia could leverage its rock solid macro foundation and produce more growth, but it doesn't feel it is safe to do so. That is what is behind the contradictory results Russia is putting in at the moment. And this is the issue that the liberal macroeconomic team in the Kremlin are grappling with at the annual Gaidar forum: how can they sanction-proof the economy but at the same time promote some real growth?

After a very nasty, but not particularly destructive, crisis in 2014-2016 Russia’s economy has been stabilised and now the government are looking ahead at the next six years.

Russian companies had their most profitable October in three years, earning cumulative profits for the year worth $174 billion – about a third more than they earned over the same period a year earlier. Banks too are also black in profit after two years of losses, earning twice last October what they earned in the same month a year earlier. Indeed state-owned oil company Rosneft earned more in the first quarter of 2018 than in all of 2017 and the retail banking giant Sberbank earned more in just October than the entire sector earned in 2016.

Yet none of this is feeding through to the street. The Watcom shopping index that measures foot traffic in Moscow’s biggest malls in real time, just had its worst year since the index was founded in 2014 – and all of the previous years were crisis years, whereas 2018 was not.

Likewise while 70 percent of Russians took a summer holiday last year, only 32 percent of them actually went away, according to a survey by MTS. The rest went to the dacha to save money and bought a nice new phone instead. More seriously, despite being back in profit the investment numbers are extremely low and the only real investment being made, that would bring more growth, is being made by the government into things like the Power of Siberia and Nord Stream 2 gas pipelines.

The good news is also not feeding through to the top level either. The Ministry of Economy downgraded Russia’s economic outlook for 2018 three times last year and IMF says growth this year will be the same at 1.5 percent. In the emerging world 1.5 percent is the same as stagnation.

The government is starting to pay the price for its austerity. Only last week the state owned pollster, the Russian Public Opinion Research Centre (VTsIOM), released a survey that shows that trust in Putin’s ability to run the country has fallen to a 13-year low – less than in December 2011 when over 100,000 people took the streets to protest against the rigged Duma election that year. Something is going to give unless the Kremlin makes some changes.

The Gaidar Forum is supposed to find a solution to all these problems and this year’s event is very different to last year’s.

Named in honor of liberal economist Yegor Gaidar, who implemented Russia’s IMF sponsored “shock therapy” in 1992, the forum is more of a workshop of the liberal fraction that actually runs Russia’s economic policy than the usual Kremlin platforms designed to make president Vladimir Putin look good.

The “strategic” sectors (ie those that have all the money like oil, gas and metals) are directly under Putin’s control, but the rest of the economy (high volume, low margin businesses like real estate, retail and food) are left to market forces. The decisions that the liberal team make have a real impact on the bulk of Russians lives.

The key panel in 2018 featured CBR governor Elvira Nabiullina, Russian First Deputy Prime Minister and Finance Minister Anton Siluanov and Minister of Economy Maxim Oreshkin. The talk was of the unexpected recovery in price of oil over the last 12 months coupled with a revolution in the tax service amongst other reforms that already suggested last January Russia was going to end 2018 with its first budget surplus in years. (The year eventually closed with a 2.2 percent headline surplus).

By April of that year the bones of plan were worked out that Putin presented in his annual state of the nation speech and has been dubbed the May Decrees, an ambitious set of investment programmes that are supposed to “transform” the economy and more concretely bring about 3 percent growth by 2021.

This is a major change of mentality. Starting in 2012, Putin sacrificed Russia’s prosperity by ploughing every spare kopek into the modernization of the army in anticipation of a serious clash with the west – manifest in the annexation of the Crimea in 2014. However, with the military modernization drive nearly complete the Kremlin is finally turning its attention back to its people.

President Putin’s April speech unveiled a very ambitious plan. There are 12 national programmes with sweeping Key Performance Indicators, but little of the detail has been worked out. This year’s Gaidar forum was all about what exactly is to be done, to paraphrase Lenin’s famous maxim.

Nuggets of detail was being cast off by the forum, like a “regulatory guillotine” that will simple cancel unnecessary regulations of $900 billion to be invested into the Northern Route that allows shipping to travel from Europe to Asia by sailing round the top of Russia, rather than via Cape Horn of the Suez canal. More will follow as the year wears on but there is still almost everything to do.

Ben Aris is the founder and editor of Business New Europe. The views expressed in opinion pieces do not necessarily reflect the position of The Moscow Times.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.