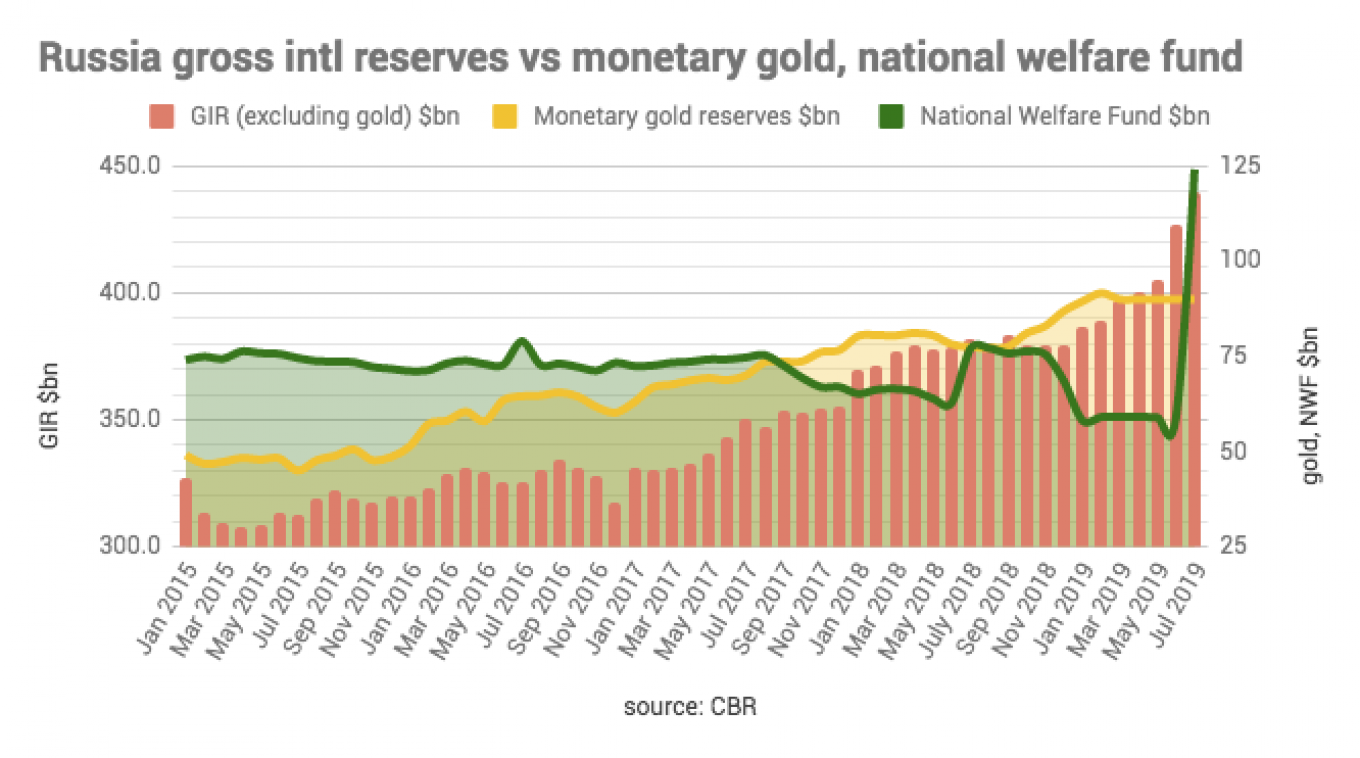

Russia's National Welfare Fund (NWF) doubled in July, increasing by 4.1 trillion rubles ($64.5 billion), to 7.9 trillion rubles ($124.1 billion), the Ministry of Finance of Russia reported.

As of Jul. 1, 2019, the amount of the fund was 3.8 trillion rubles ($59.7 billion).

The sudden rise was caused by the Ministry of Finance adding cash to the NWF it siphons off from oil revenues as part of its sterilizing process into temporary accounts.

Notably, the liquid part of the NWF reached 5.7% of GDP, approaching the threshold of 7%. The rules governing the fund say that above the threshold the government can spend any surplus as it likes. The Finance Ministry estimated that the NWF will break 7% of GDP by the end of 2019, with funds available to spend estimated at 1.8 trillion rubles ($27.7 billion) in 2020 and 4.2 trillion rubles ($64.6 billion) in 2021. Recently there has been a vigorous debate on what to do with this extra money.

Proposals for spending the extra funding from NWF vary from supporting exports and investing in facilitating selling Russian produce abroad by the Ministry of Economic Development, to investing in infrastructure projects proposed by the Finance Ministry, whereas the Central Bank of Russia (CBR) worries that this will stoke inflation and wants to hike the bar further.

Unconfirmed reports suggested that the NWF is also eyed for supporting the troubled downstream oil industry and construction of liquefied natural gas (LNG) tankers for the Novatek gas major.

The ministry reported that in July, additional oil and gas revenues from the budget for 2018 were transferred to the fund in foreign currencies of the amounts of $30.2 billion, €25.7 billion and £5.1 billion.

As of Aug. 1, 2019, in separate accounts for funds of the NWF were $45.5 billion, €39.2 billion, £7.7 billion and 98.8 million rubles, according to the CBR.

Another $3 billion was invested in Ukraine's sovereign bonds, which the country defaulted on. 585.4 billion rubles was deposited with Vnesheconombank. More was invested to cover Russian issuers related to the implementation of infrastructure projects to the tune of 169.1 billion rubles ($2.6 billion) and $4.1 billion. Another 138.4 billion rubles ($2.1 billion) was placed on deposits with VTB and Gazprombank in order to finance infrastructure projects. 279 billion rubles ($4.3 billion) was invested in preferred shares of banks.

This article first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.