The strange, convoluted saga of the privatization of one of Russia’s largest oil companies appears to be drawing to a close — and the end result isn’t looking so private.

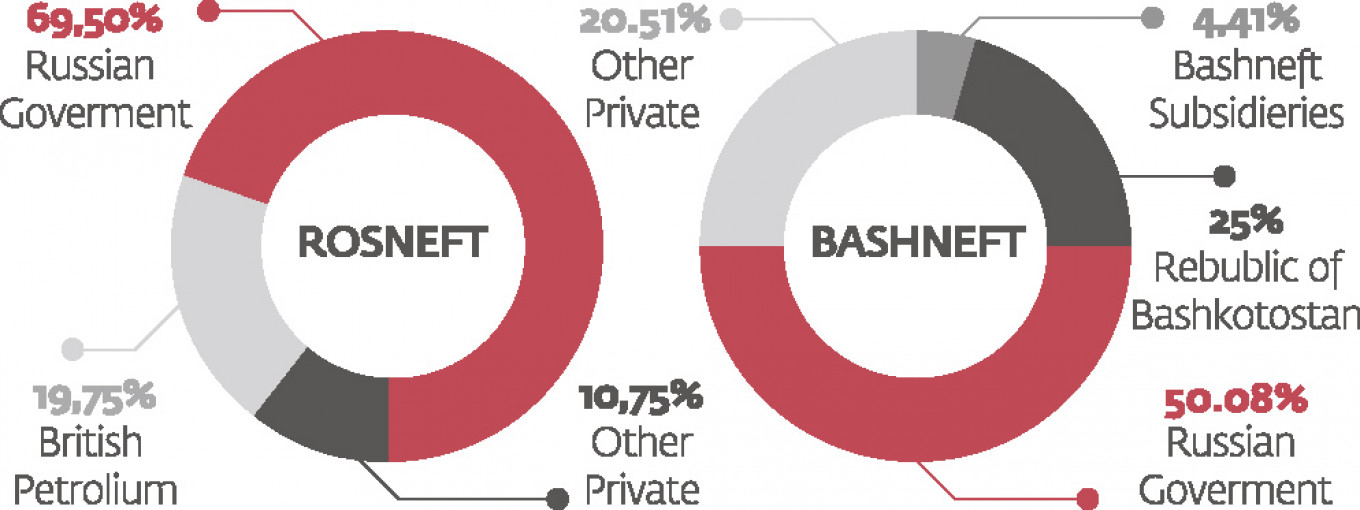

On Oct. 2, Russian media reported that the Cabinet of Ministers was considering two privatization plans for Bashneft, an energy firm based in Ufa, Bashkortostan. The first plan would involve an auction. The second — which experts consider more likely — would simplify the process: the state-controlled oil conglomerate Rosneft would purchase the 50.8 percent controlling stake in the company for 316 billion rubles ($5.2 billion) without auction.

The sale of Bashneft is part of the government’s plan to buttress its rapidly depleting foreign exchange reserves by selling shares in state companies. Besides Bashneft, shares in several major state firms — including Rosneft, the bank Vneshtorgbank, and the shipping company Sovkomflot — are potentially up for grabs. In July, Russia sold a 10.9 percent stake in the Alrosa diamond miner for 52.2 billion rubles ($835 million).

But Rosneft’s purchase of Bashneft looks less like privatization than the consolidation of state assets.

“One of the biggest goals of privatization is to make the energy company more efficient through market competition,” says Sergei Romanchuk, head of money markets at Metallinvestbank. According to him, that isn’t happening here.

Initially, it appeared the authorities wanted to avoid this problem. In August, Bloomberg News reported that Putin had banned Rosneft from taking part in its privatization, even personally rejecting appeals from Igor Sechin, Rosneft’s CEO and a close ally. Putin’s objection made logical sense: how could a state corporation “privatize” another state corporation?

Shortly thereafter, the government postponed the privatization, reportedly due to conflict between the two biggest potential buyers, Rosneft and the private oil company LUKoil.

But then Sechin made the Kremlin an offer it couldn't refuse: Rosneft would purchase a controlling stake in Bashneft for $5 billion dollars, a higher price than any other prospective buyer. Following the government’s established privatization plan, a 19.5 percent stake in the enlarged Rosneft would then be privatized for $11 billion. The maneuver would net the Kremlin a total of $16 billion dollars, allowing it to plug major budget holes.

There was indeed tension among the elite over Bashneft, says Konstantin Gaaze, a journalist who has extensively covered privatization. However, in the end, the supporters of selling to a private company lost out.

The reasons were both practical and political. Bashneft has the right to develop the largest oil deposits in Western Siberia, making it an extremely attractive asset for Rosneft. Gaining access to this deposit allows Rosneft to increase its capitalization and become the only large energy company in Russia.

But selling to Rosneft also had clear advantages for the government. No other company could outbid Rosneft’s offer of $5 billion dollars. Additionally, the oil company has an open credit line with VTB bank and has recently paid off many of its debts to Western banks, Gaaze says. It is in a good position to take out loans to pay for Bashneft.

“Sechin was preparing for the purchase for a full year, judging by [Rosneft’s] accounting reports,” Gaaze told The Moscow Times.

But analysts remain skeptical of the end result of the sale.

“In the ideal situation, privatization should both fill the budget and allow Rosneft to make a greater contribution to the Russian economy,” says Romanchuk. “It remains unclear how effective this will be.”

Additionally, he adds, Rosneft may subsequently face the same problem Bashneft encountered: finding a buyer for the enlarged company’s enormous 19.5 percent stake.

But the solution may also be similar — state-led privatization. On Oct. 5, the Vedomosti newspaper reported that Rosneft would purchase its own 19.5 percent share from its majority shareholder, state energy company Rosneftegaz.

The scheme would benefit all parties involved: the state budget would immediately receive 700 billion rubles ($11.2 billion) from the sale and Rosneft could later resell the shares to other buyers.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.