For Russian businesses, Cyprus just isn’t what it used to be.

New Cypriot anti-money laundering rules are compounding the effects of U.S. sanctions against Russia and its high-profile citizens, driving money away from the one-time haven.

“Russians are downsizing in Cyprus,” said Kyriakos Iordanou, general manager of the Institute of Certified Public Accountants of Cyprus, whose members have clients from the country.

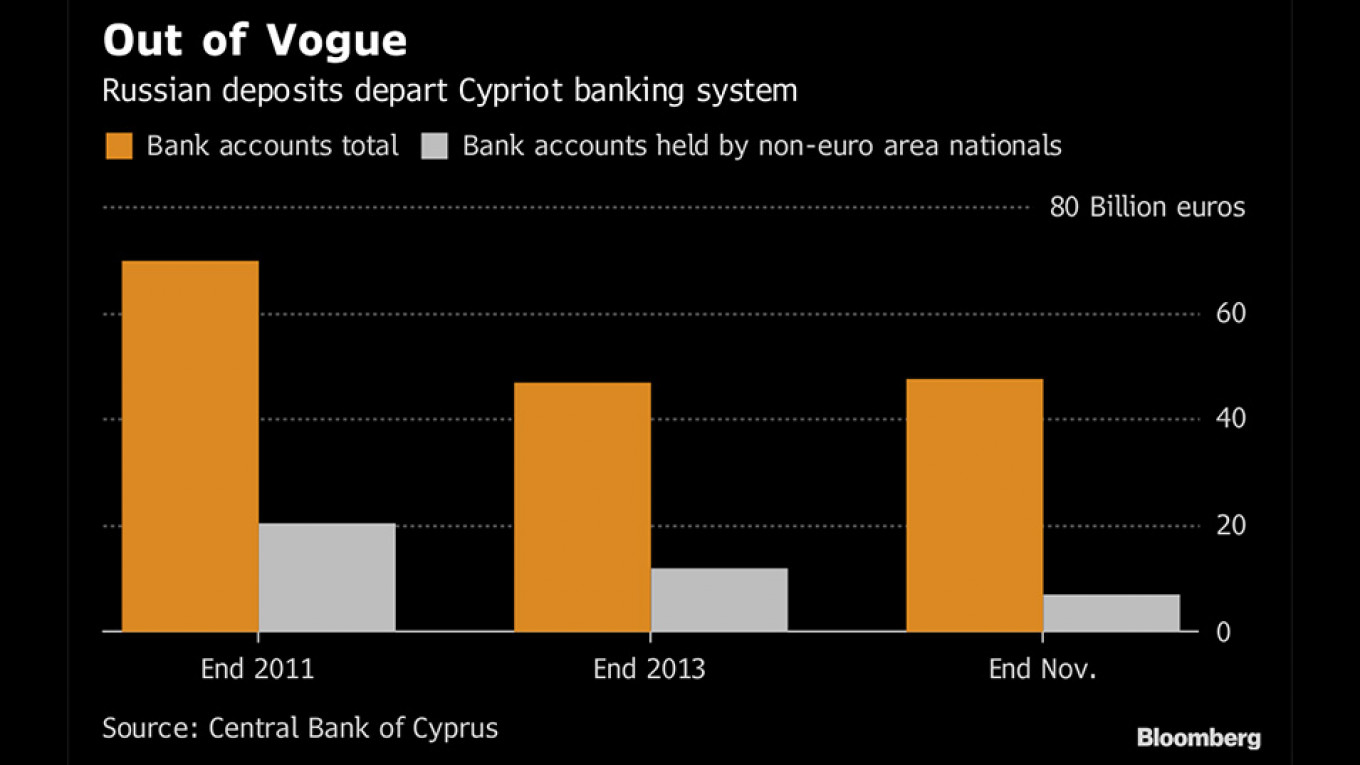

The value of bank accounts at Cypriot lenders held by foreign nationals from outside the euro-area — mostly Russian — fell to 7.1 billion euros ($8.1 billion) at the end of November, according to the Central Bank of Cyprus. That’s down from a peak of 21.5 billion euros at the end of 2012.

En+ Group plc said Nov. 2 it plans to move to Russia from Jersey rather than to Cyprus as previously planned. En+ is the main shareholder of aluminum giant United Co. Rusal, a company of billionaire Oleg Deripaska, who is on the U.S.’s sanctions list. Accounts belonging to Viktor Vekselberg, who’s also on the U.S. list and whose Lamesa Investments Ltd, an affiliate of Renova Group, is the largest shareholder in Bank of Cyprus, have been frozen, according to the bank.

The outflow of Russian funds from the island marks the reversal of a trend that began after the fall of the Soviet Union and accelerated as Cyprus joined the European Union in 2004 and adopted the euro in 2008. Russian investors were attracted to Cyprus by its status as a low-tax regime within the EU and was seen as safe and stable.

“Cyprus’s economic model has already changed and has shifted to one that relies a lot less on shell companies and foreign deposits,” Finance Minister Harris Georgiades said in an interview at Bloomberg’s European headquarters in London in September. The island “has been focusing on bringing new business with substance, physical presence and real activity and employment,” he said.

Looking elsewhere

Russian-related business in Cyprus generated gross income of around 2.2 billion euros in 2017, about 11 percent of economic output, down from an estimated peak of about 14 percent in 2012, according to Fiona Mullen, director of Nicosia-based Sapienta Economic Ltd.

“Tourism is now bigger than banking, so what you see is a slightly different mix of Russians,” she said. “There is still the old money, but you also see a lot of regular middle-class Russians just coming for a holiday.”

New banking business from Russia is “limited,” Iordanou said. His public accountants’ organization’s members are looking for opportunities from elsewhere, like China, India, the Middle East and Africa.

While some of the drop in numbers over the years stems from Russians — like Deripaska — acquiring Cypriot nationality, affecting the way such funds are classified, tightened local rules are also beginning to bite.

Not bankable

In November, a directive from the Central Bank of Cyprus kicked in, giving lenders less leeway to work with shell companies. That’s making many Russian companies “non-bankable,” said Iordanou.

Two Russian businessmen with accounts in Cyprus for over a decade said they were contacted by their banks over the past few months asking for documents from many years ago on the source of the money in their accounts. Unable to provide them, they were forced to close the accounts, they said, declining to be named.

“Cyprus banks require a lot of papers now,” said Alexander Ryazanov, Gazprom’s former deputy CEO, who has a real-estate business in Cyprus and has worked for many years with Cypriot banks. “It is very difficult to open a new account now.”

The central bank directive on money laundering involves avoiding dealings with entities deemed to be shell companies, which hits at the heart of Russian investments.

Moneyval, the council of Europe’s money-laundering watchdog, is conducting another evaluation of Cypriot measures to combat money-laundering and financing of terrorism. The results are expected in May.

‘Becoming toxic’

Meanwhile, for Bank of Cyprus, the country’s largest lender, Russian clients now account for only 1.5 percent of the total and 5.7 percent of total deposits compared with 2.4 percent and 9.9 percent in 2014, according to the lender.

Although the central bank’s measures didn’t specifically target Russians, “one can argue that this group is affected to a larger degree than others,” said Demetris Taxitaris, general manager of Cyprus-based MAP S.Platis, a consultancy firm for financial services companies.

That said, a number of Russian businesses continue to keep a foothold in Cyprus, among them Victor Rashnikov, owner of Magnitogorsk Iron & Steel Works PJSC; Vladimir Lisin, who controls his stake in Novolipetsk Steel PJSC through a Cyprus-based holding company; and Vladimir Potanin, president of MMC Norilsk Nickel PJSC, a producer of refined nickel.

For their part, Cypriot entities are cutting their Russian exposure. RCB Bank Ltd, whose second-largest shareholder is Russia’s state-owned VTB Bank PJSC with a 46.3 percent stake, plans to strengthen and further develop domestic business operations, a spokesperson for the Limassol-based lender said.

“Amid sanctions and tightening compliance, Cyprus banks prefer not to deal with Russian money and Russian clients, even those who’ve had accounts in Cyprus banks many years,” said Evgeny Kogan, former director of the Center for Protection of Shareholders and Investor Rights of Cypriot Banks set up in 2014. “Russian clients are becoming toxic.”

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.