Russia's Central Bank announced Wednesday that it plans to step up support for the ruble, which has gradually weakened over the past 18 months due to Western sanctions over Moscow's invasion of Ukraine.

The Bank of Russia said that between Sept. 14 and 22 it would sell 21.4 billion rubles ($218.5 million) worth of foreign currency each day, around 10 times the current volume it sells on a daily basis.

The regulator said the move was connected to an upcoming payment of foreign currency bonds — known as Eurobonds — issued by the Russian government.

"Holders of Eurobonds will be paid by the Finance Ministry in rubles in accordance with the established procedure, and therefore a portion of these bondholders may create additional demand for foreign currency," the Central Bank said.

Russian authorities instituted the payment of these bonds in rubles instead of the foreign currency they are formally denominated in following a cascade of Western sanctions.

The additional volume by Russia's Central Bank "will help respond to possible additional demand for foreign currency and reduce volatility on the market during this period."

The ruble has traded with extreme volatility in the 18 months since Russia invaded Ukraine as the West has targeted Moscow’s foreign currency reserves and crucial energy exports through sanctions designed to cripple Russia’s economy.

After falling beyond 100 against the dollar in the days after Russia invaded, strict capital controls, surging energy prices and a collapse in Russian imports pushed the currency to become the world’s best-performing currency for much of 2022.

But Europe's halting of Russian oil and gas purchases, along with measures such as the G7’s oil price cap, have put pressure on the ruble once more in recent months.

It fell precipitously at the start of August, breaking past 100 rubles against the dollar for the first time since the outbreak of war in Ukraine.

In response, Russia’s Central Bank hiked interest rates from 8.5% to 12%.

The move helped strengthen the ruble to under 94 against the dollar, but it has slowly weakened to around 98 against the U.S. currency.

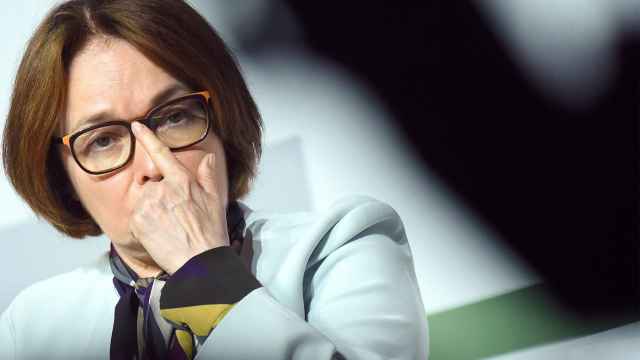

A dispute has broken out in recent weeks between the government and the Russian Central Bank, whose governor Elvira Nabiullina is against additional government intervention in the economy to avoid weakening it further.

Meanwhile, Finance Minister Anton Siluanov has advocated for stricter capital controls.

AFP contributed to this reporting.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.