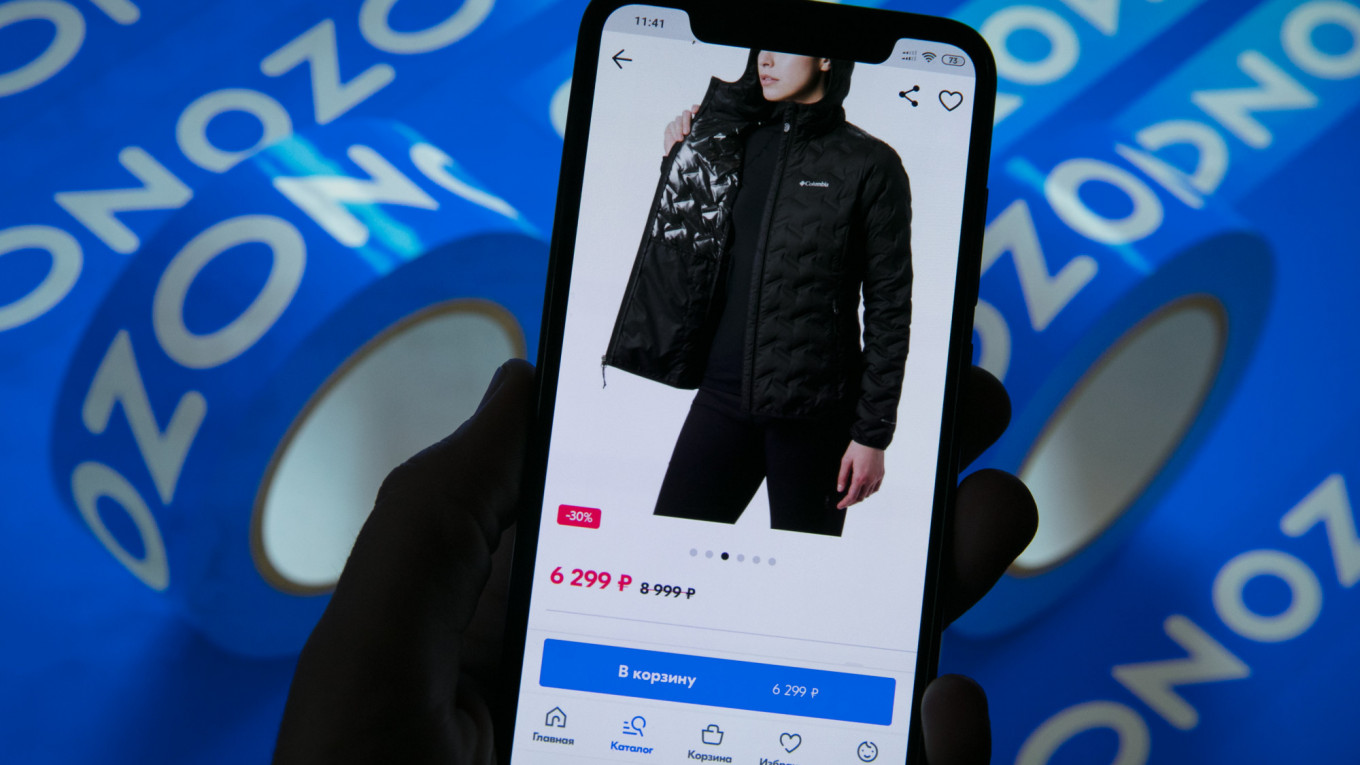

Ozon, Russia’s leading multi-category e-commerce company, aims to go public later this year or in early 2021, the company announced Friday, and has started the registration procedure for an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC).

The company did not provide any details on the potential placement but, according to sources quoted by The Wall Street Journal, it could be valued between $3-5 billion.

In 2019, Ozon’s gross merchandise value (GMV) amounted to 80.5 billion rubles ($1.25 billion based on average exchange rates for the year) — up 93% from 2018. Growth has been accelerating this year, with GMV surging 188% year-on-year in the second quarter.

“In addition to the vast room for structural growth in a market that has seen relatively low penetration and high fragmentation, Russian online retailers received an additional boost from the lockdown environment on the back of the Covid-19 outbreak this year,” said Oksana Mustiatsa and Mikhail Terentiev, market analysts at Sova Capital. They believe the effect could outlast the pandemic.

“We think that Ozon, being the second largest multi-category e-retailer in Russia, is well positioned to benefit from these trends due to its rapid marketplace development and the expansion of its logistics and fulfillment capabilities,” the analysts told East-West Digital News. Marketplace — sales by third parties using Ozon as a platform — accounted for 50% of GMV in June.

In total, according to market research agency Data Insight, online sales of physical goods in Russia could reach 2.5 trillion rubles this year ($32 billion), and potentially 7 trillion rubles ($89 billion) by 2024.

Another Russian digital major, Ivi, is also eyeing a Western IPO, according to numerous reports over the past two years. The company has not yet issued an official statement about the latest rumors, but two unnamed banking sources told Reuters last week that Ivi was considering going public in the near future.

Russia’s largest video streaming platform in terms of revenue, Ivi generated 6.1 billion rubles ($95 million) in revenues last year — up 55% from 2018. The average monthly audience grew by 14% and had exceeded 50 million unique users by late 2019. Total viewing time for the year amounted to a billion hours, including 400 million hours from paying subscribers, the company said.

Ivi could be valued at more than $700 million, according to analysts cited by various media outlets in early 2020.

The Russian online video market was valued at around $300 million in 2019. The main players are domestic platforms Ivi, Okko, Amediateka, as well as well-known foreign players like YouTube, iTunes and Google Play. When the market launched, many only video platforms relied primarily on advertising revenues. However, user-generated revenues now exceed advertising income.

Russian IPOs in the West

Despite the unfavorable geopolitical context, several Russian digital companies have raised substantial amounts on Western exchanges in the past years — or are considering doing so in the near future.

The latest cases include online job service HeadHunter, which went public on the U.S. Nasdaq exchange in June 2019, Yandex, which raised another $460 million in June 2020, and Mail.Ru, which is in the process of raising an extra $600 million on the London Stock Exchange.

Yandex.Taxi, Russia’s leading ride-hailing platform — a joint venture of Yandex and Uber — was actively preparing for an IPO last year. The listing, initially scheduled for 2020, was postponed due to market conditions surrounding the coronavirus pandemic.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.