Russian diamond major Alrosa saw its diamond sales plunge 95% year-on-year to $15.6 million in April.

“Alrosa virtually stopped selling rough and polished diamonds as governments across the globe were taking active steps to prevent the spread of the coronavirus, while Alrosa remained committed to its price over volume strategy,” BCS Global Markets said on May 13.

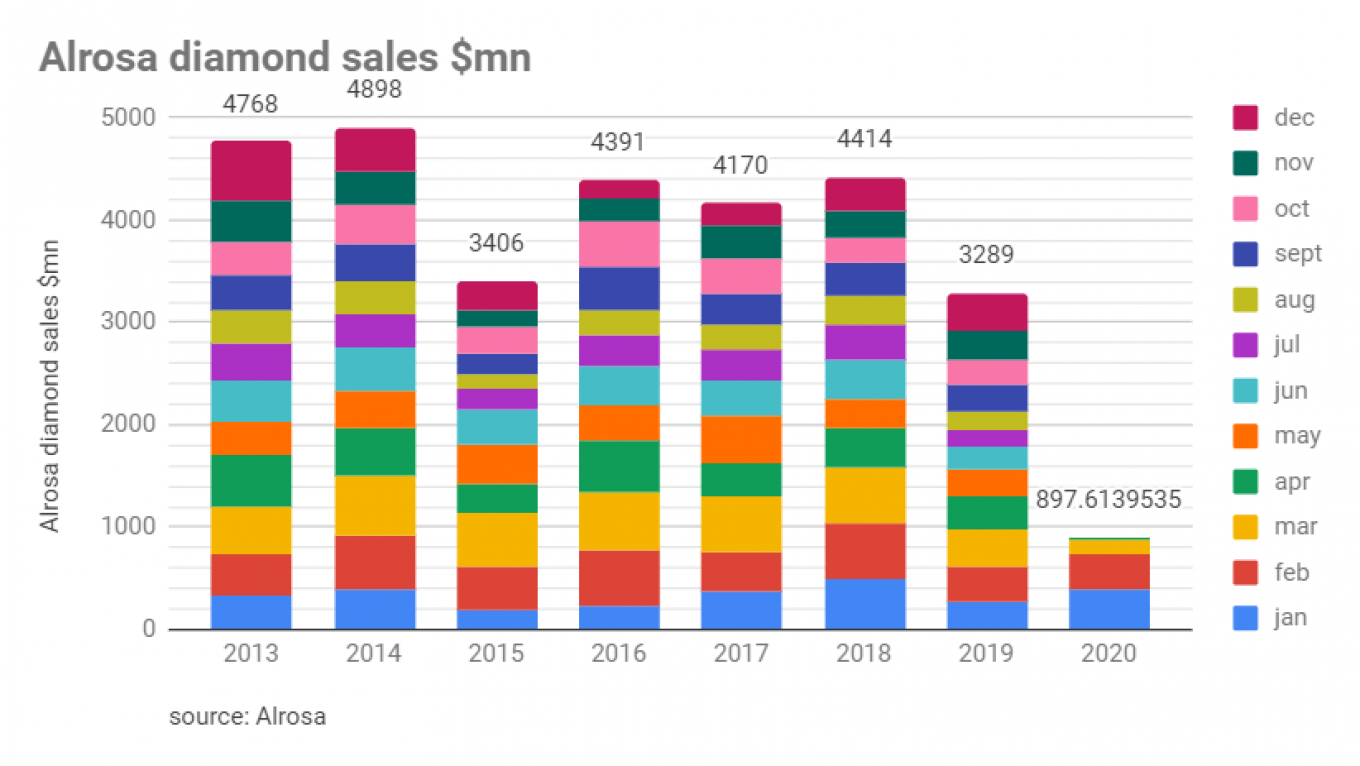

At the end of 2019 Alrosa’s sales rebounded after a difficult year, but that outlook was worsened by the coronavirus pandemic as the company posted a 60% drop in sales in March.

But despite the market difficulties that have already forced Alrosa to shut down two lower-margin stone mines, the diamond miner has tried to maintain solid investment appeal and recommended paying a dividend of 2.63 rubles ($0.035) per share for the second half of 2019. This brought the total payout for 2019 to 100% of free cash flow, double that of the minimum 50% payout of free cash flow.

When Alrosa’s sales suffered earlier in 2019, the company also counterbalanced it with an effort to improve its investment case and pledged to pay dividends for the second half of the year even if cash flow turned negative.

In April, CEO Sergei Ivanov, supported the image of the company by selling half of his stake in order to support the Republic of Yakutia, where most of the company's operations are located, to fight the pandemic.

Alrosa expects to see an upward trend in demand for diamonds as early as the beginning of the third quarter.

“Weak diamond sales results by Alrosa in April were expected, as the diamond trade was practically paralyzed during the month,” BCS Global Markets said, expecting diamond demand and the company’s sales to start recovering in the summer.

BCS GM analysts have maintained a Buy recommendation on the name, as have Renaissance Capital, which predicts Alrosa to be one of the V-shaped recovery stocks.

Russia’s Federal State Property Management Agency owns 33% of Alrosa, the Republic of Yakutia has a 25% plus one share. The regions of Yakutia where the company operates own a total of 8%, and the free float is around 34%.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.