Russia is preparing for price rises as a result of the fall in the value of ruble.

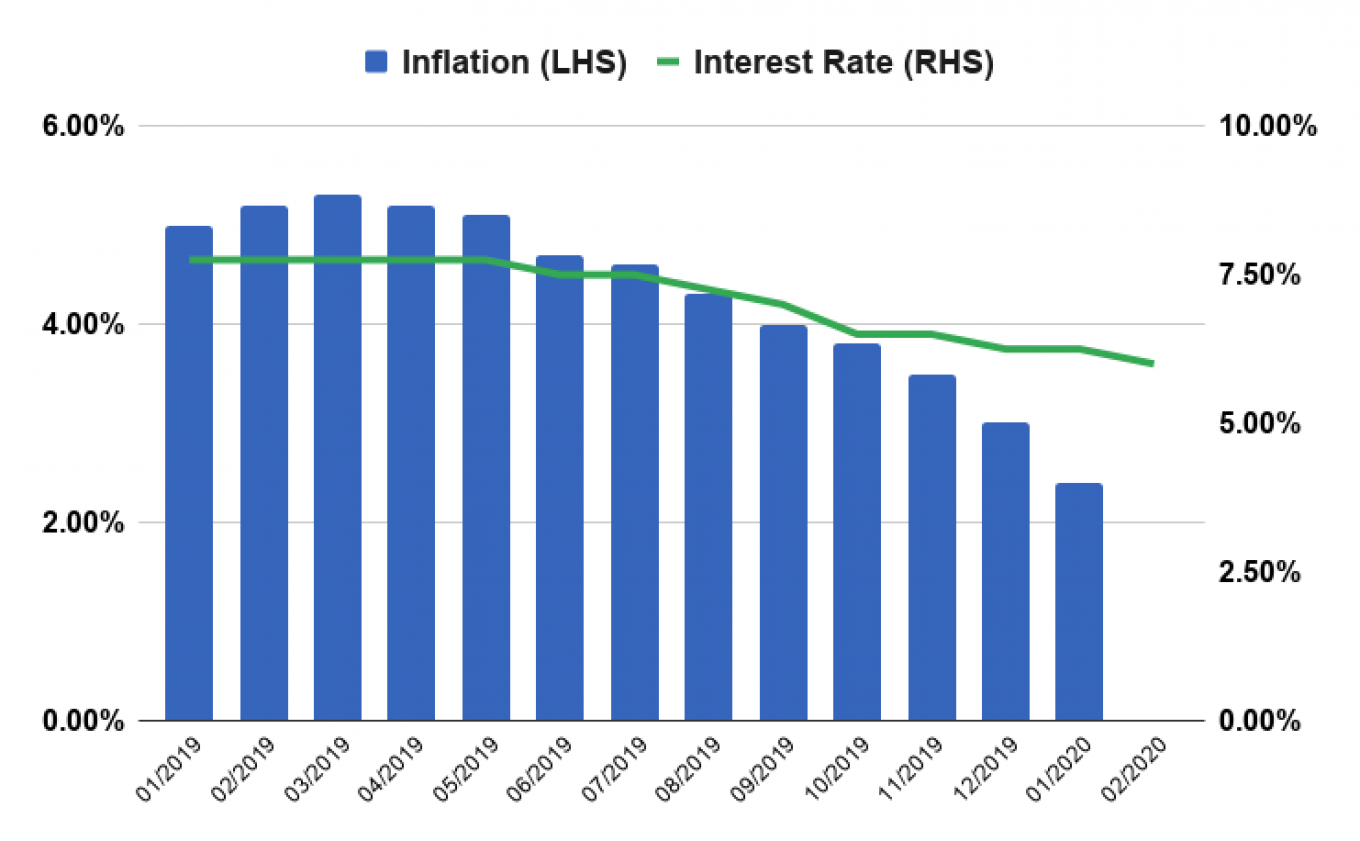

Inflation is expected to climb above the Central Bank’s 4% target by the end of the year, reversing a period of muted price rises and putting a stop to governor Elvira Nabiullina’s planned interest rate cuts.

“Taking into account the volatility in the foreign exchange market, the acceleration of inflation from the current low level may begin earlier than expected,” Russia’s Economy Ministry said Tuesday.

The rate of inflation has halved over the last 12 months, coming in at just 2.3% in February, and the Central Bank was expected to keep cutting interest rates in response.

Economists say that is now off the table, and the next interest rate move may well be a hike instead.

The key factor is the relationship between oil prices, the ruble and inflation. More than one-third of the Russian state budget comes from energy revenues, and the currency is highly susceptible to changes in the oil price — although less than it used to be, analysts say.

When oil falls below $42.40 — the benchmark rate at which Russia starts selling foreign exchange reserves in a bid to support the currency — the ruble tends to depreciate and inflation can pick up quickly, according to economists.

ING’s Dmitry Dolgin estimates that every 10% fall in the value of the ruble leads to a 0.3-0.5 percentage point increase in inflation. The ruble is currently down 15% against the dollar since the start of the year and remains volatile given uncertainty over how the oil price war between Saudi Arabia, Russia and the U.S. — the world’s three largest energy producers — will unfold.

Recent forecasts, updated in the wake of the breakdown of Russia’s oil alliance with OPEC, demonstrate the fine margins the Central Bank will have to interpret.

With oil prices at $40 a barrel, Renaissance Capital expects inflation to come in at 4% this year — on target. Whereas at $30 a barrel, that jumps to above 6%, and could prompt the Central Bank to start raising interest rate hikes to cool the rate of inflation.

Oil was trading between those levels Wednesday, at $36 a barrel, although volatility remains marked. Saudi Arabia upped the ante in the price war Wednesday by promising to pump out 13 million barrels a day — a significant increase in supply from its recent output of under 10 million.

Should the supply glut continue and oil prices hit $25 a barrel, Russia’s Central Bank said Tuesday it is bracing for inflation to approach 8% by the end of the year.

Oxford Economics’ Yevgenia Sleptsova says she expects a rate hike as early as next week in a play to contain capital outflows, while the consensus remains that Nabiullina will exercise caution and adopt a wait-and-see approach.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.