Russian bankers ended 2019 as the most pessimistic executives in the Russian corporate world, a recent survey of Russia’s top firms, found.

With inflation and interest rates coming down, Russia’s businesses in little need of corporate loans, and new regulations to tighten the consumer loan market coming into force — more than one in every three financial institutions told Deloitte they were not looking forward to what the future has in store.

Nevertheless, industry leaders might find it tricky to get too worked up about their current predicament, since the Russian banking sector has been on something of a hot streak in recent years, as the central bank closed down or bought out the worst performers, and a living standards squeeze pushed up demand for consumer loans, overdrafts and credit cards.

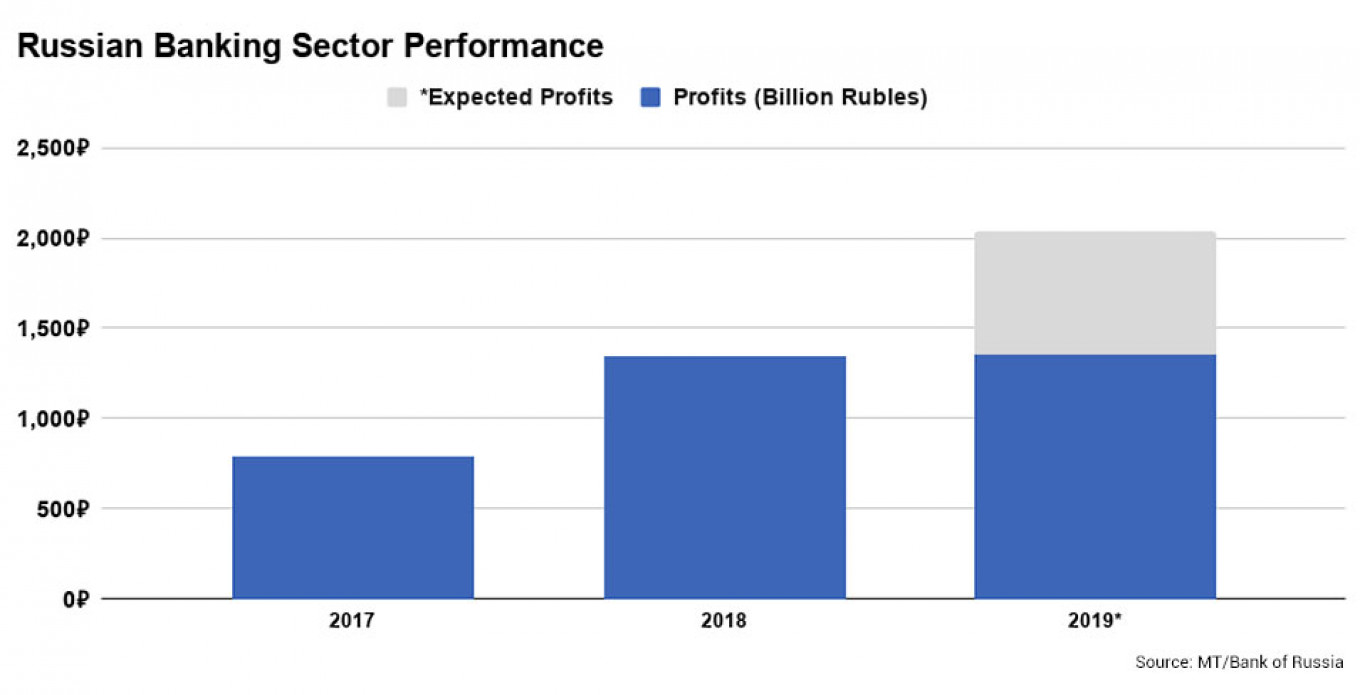

Banks booked 1.3 trillion rubles of earnings last year (more than $15 billion at the time), data from the Central Bank shows. That was 70% higher than in 2017. This year, earnings are set to grow by another 50%, on course to hit two trillion rubles ($31 billion).

“In Russia, banks can generate a lot of profits,” said Yaroslav Sovgyra, an associate managing director at ratings agency Moody’s. “If you have proper management, if you don’t do silly things, you can be really profitable.”

Low interest rates

For the few foreign retail banks still operating in Russia, such profitability can be an important source of relief from weaker performance in their home countries.

“The main difference between the Russian banking sector and the whole of the developed world is interest rates,” said Madina Khrustaleva, an analyst at T.S. Lombard.

Low interest rates are generally bad for banks, since they squeeze their ability to charge a premium on their own loans — the so-called net interest margin. In the Eurozone, central bank rates are at their lowest ever level of minus 0.5%, while in the U.S. they have spent a decade below 2%. Whereas in Russia, interest rates have been at least 6% for the last five years.

“The net interest margins on the Russian market are much higher, and the returns are super in comparison. In Russia, many businesses have double-digit returns, but returns in the banking sector are remarkably high.” Krustaleva added.

High profits

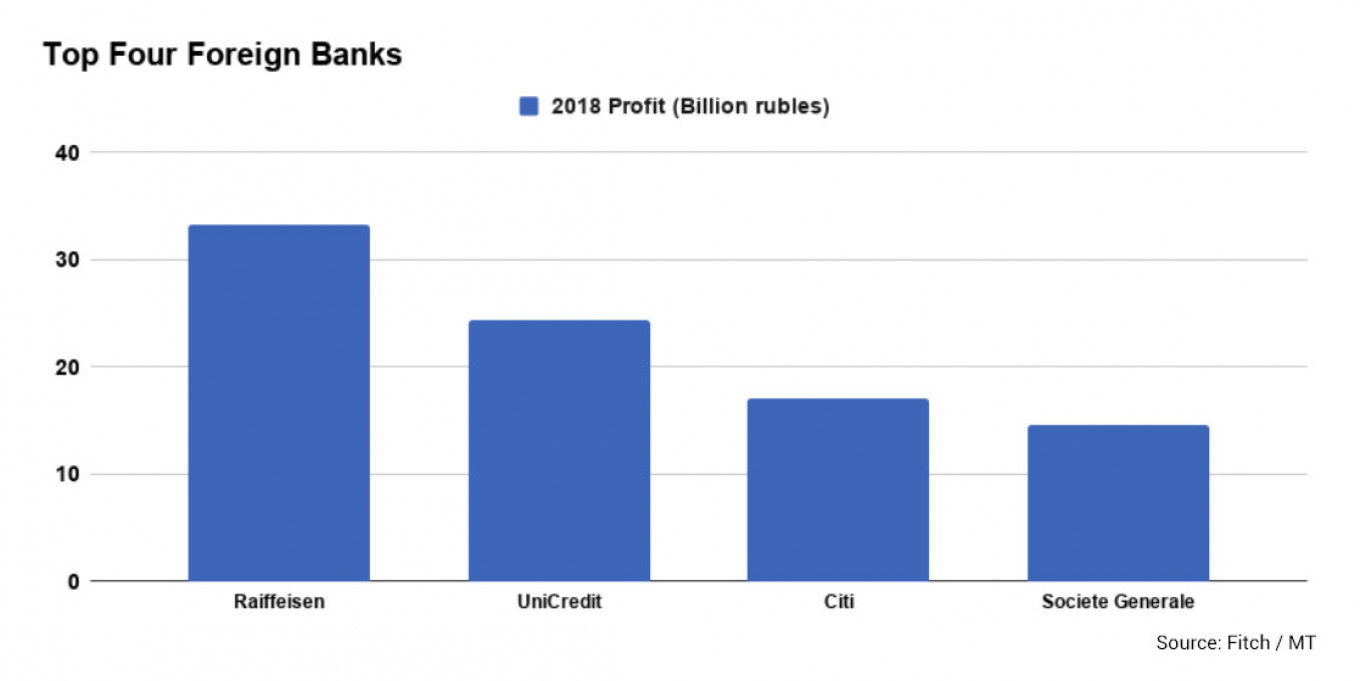

Raiffeisen Bank is a prime example. The Russian arm of the Austrian-headquartered lender accounts for only around 10% of the entire bank’s assets, but contributes 40% of net profits, Ekaterina Ovchinnikova, head of investor relations told the Moscow Times.

“We deliver the highest profitability, we have the best non-performing loan ratio and the best cost-to-income ratios. Compared with other groups, we are one of the best performing subsidiaries.”

Combined, the Russian subsidiaries of foreign banks have earned more than $3 billion in profits since the start of 2018, data from ratings agency Fitch shows. Raiffeisen’s return on equity — a measure of profitability in the banking sector — in Russia is almost 25%. U.S. lender Citibank’s Russian division returns 34%. That compares to an average of 6% for banks in Europe.

Low market share

Despite those numbers, the share of foreign banks with operations in Russia is low. In total, they account for around 6% of the banking sector by assets. Russian subsidiaries of just four banks — Italy’s UniCredit, French bank Societe Generale’s subsidiary Rosbank, Austria’s Raiffeisen Bank and U.S. Citibank — make-up over three-quarters of that.

A number of others have been bruised by failed entries and high-profile retreats. British bank Barclays wrote off almost $400 million in losses from Russia when the global financial crisis hit weeks after it bought a local bank in an attempted Eastern expansion. HSBC also shuttered its Russian retail operations in 2011 as part of a global downsizing, leaving behind only a small team to service its international corporate clients.

So, with profits so high for those that are here, why are there still so few foreign banks in the Russian market? Experts point to a mix of culture, competition and politics.

“All over the world, the top market positions are occupied by local banks,” said Maxim Nalyutin, director of financial services at Deloitte Russia. “It’s the same in Russia as in the U.K., Europe and the U.S. Psychologically, people need to trust banks, and culturally it’s much easier to trust a brand that has existed on the market for a long time, rather than a new player.”

In the 1990s, with a new country and new companies — Russian and foreign — popping up all over the place, “Russians favored foreign banks because of the brand,” Sovgyra of Moody's told the Moscow Times. “But now, I don’t know if we can say it’s a clear competitive advantage. People seem to be more indifferent.”

Nalyutin added: “In Russia, given that people remember many banking crises — at the end of the U.S.S.R., 1998 and 2008 — they are looking for more conservative strategies. They are more interested in a bank with a good reputation and with government support. That’s why in Russia, the most successful are big, state-owned banks.”

Tech advantage

The Russian banking market also combines aspects of both a monopoly and a highly-competitive environment, which shuts out new entrants, particularly foreign ones.

On one side, “state banks have significantly strengthened their positions, with more than 70% of the assets of the entire banking sector,” said Tania Aleshkina, chief editor of Russian financial news site Frank Media. On the other, competition between the banks remains fierce, promoting innovation and customer-friendly products.

Sberbank alone controls 56% of mortgages and 44% of all deposits. “It’s kind of an elephant, and when Sberbank does something like reducing mortgage rates, everybody has to correct their own policy,” said Khrustaleva.

Many Russians keep Sberbank accounts even if they also bank elsewhere to make use of services such as the ability to transfer money to other Sberbank accounts using just a mobile phone number.

That service — used widely for small payments like settling a dinner bill among friends or making a payment at a retailer without a card machine — strikes at the second major hurdle newbies have to overcome: technology.

“In terms of technology, the banking sector is one step ahead of the Western market,” Khrustaleva added.

“Russia is one of the leaders in the speed of development of digital channels in the banking sector,” Alexander Ovchinnikov, chief financial officer of Societe Generale subsidiary Rosbank told The Moscow Times.

The technological sophistication of the market was one reason Barclays and HSBC failed to crack Russia, says Deloitte’s Nalyutin. “The quality of services is much more interesting and developed in Russia. In that sense, the British banks didn’t have anything to bring or to offer … Russian clients didn’t understand what the proposition of these banks was. If a bank has similar products, there is no value in moving from a well-known local bank to a new foreign one.”

No new entrants

Despite the profitability of the foreign banks in Russia, these cultural barriers and the technological sophistication of the market, combined with the wider economic and political climate, leads consultants to say they are not holding their breath for the next bank to knock on their door asking for advice on how to enter Russia.

“If you were lucky enough to be a foreign bank in Russia 10 years ago, and haven’t left by now, you are in a good position,” said Max Hauser, managing director at the Boston Consulting Group in Moscow.

“But if you are right now considering entering Russia, your considerations will be very short. It would not be an easy business case for a standardized universal bank from the West to enter Russia, given the level of competition and the level of advantage that the local players have.”

Deloitte’s Nalyutin agreed. The foreign banks that are thriving in Moscow “came at a good time, when there was lots of space for development and when, culturally, Russia was more open to international companies and businesses.”

Now, however, as the culmination of new tighter loan regulations is set to knock the sector in 2020, and Russia remains firmly out of favor with international investors, Hauser says: “From both a political standpoint and a market perspective, I can’t see anybody spending money to enter Russia right now.”

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.