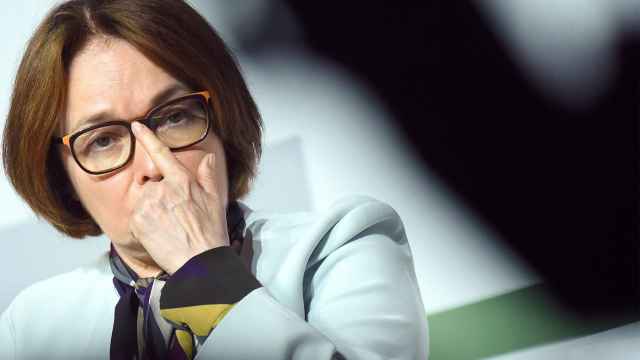

Five years ago, Central Bank Governor Elvira Nabiullina’s decision to let the ruble trade freely faced a gut-wrenching test. An oil-price collapse and international sanctions had put the currency into a nosedive that even a 650 basis-point rate hike couldn’t immediately halt.

Fast-forward half a decade and the picture in Russian markets couldn’t look more different.

The government’s decision to abandon currency interventions, a cautious interest-rate policy, and tighter budget rules, means it enters 2020 with more than half a trillion dollars of reserves and one of the world’s most lucrative carry-trade currencies.

And the ruble is set to top the pack again in 2020, offering a safe haven amid concerns over the trade war between the U.S. and China, according to a Bloomberg survey of 57 global investors, strategists and traders. Analysts at HSBC Holdings Plc see the currency gaining as much as 7% from current levels, calling it a “beacon of light” in emerging Europe, the Middle East and Africa.

A high interest-rate differential relative to U.S. borrowing costs and ruble strength have combined to yield the best carry-trade returns in emerging markets. In fact, investors profited from ruble assets more than twice as much as the second-best performer, the Egyptian pound, which was floated in 2016.

The Bank of Russia started cutting within weeks of its emergency hike at the end of 2014, which, for a while, led to negative real rates in the ruble. However, falling inflation has restored those adjusted returns, which are almost as good as when the benchmark rate was at 17%.

A budget rule that absorbs Russia’s windfall oil revenue has boosted international reserves as a percentage of the nation’s gross domestic product back to the highest level since 2010. The government enjoys a twin surplus on its budget and current accounts, with both measures at the highest levels in at least a decade.

Plunging oil prices and international sanctions over Ukraine pushed the ruble to a record low in January 2016. Since then the budget rule has made the ruble less vulnerable to the oil price.

The price of hedging against a potential default by Moscow using credit-default swaps has narrowed faster than a similar drop for the developing world.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.