Russia’s stock market has returned about 30% this year, making it one of the best performing in the world, but as a retail investor how do you go about buying Russian shares if you think the rally is going to continue?

Investing in Russian equity is a rollercoaster ride, but when the market performs, it flies. So far, this has been one of the up years, with Russian stocks outperforming not only the other emerging markets, but even the U.S. S&P500 index.

The benchmark MSCI Emerging Markets Index has gained 3.42% over 12 months, and the S&P500 5.27%. But Russia’s RTS Index gained 36.57% during the same period. On top of that, investors earned an additional 9.29% if you count the generous dividend payments companies dish out to shareholders.

Once limited to the big gun institutional investors, more recently buying exotic stocks like Russian shares have been made easy and cheap by the advent of exchange-traded funds (ETFs).

In the old days you had to set up a brokerage account and order your broker to buy the shares for you. These accounts were complicated to create and expensive to use, as you were charged for each transaction. The alternative is to invest into a fund, but most of these have a 2+20 deal where the fund manager takes a 2% commission management fee each year and keeps 20% of any profit the fund makes. One of the biggest appeals of an ETF is that it charges a flat fee — typically less than 1% of the money under management — making it a far cheaper way to invest in somewhere like Russia.

ETFs carry an “expense ratio.” If this ratio is 0.5% then the fund will cost you $5 in annual fees for every $1,000 you invest. The average ETF expense ratio is 0.74%, according to Morningstar Investment Research.

ETFs take a lot of the leg work out of buying shares as they come as a premade bundle of stocks — typically the biggest and most liquid bluechip names — designed to give the investor a nice balanced portfolio.

And ETFs are sold under various wrappers such as index trackers or growth names. ETFs are also themselves listed on exchanges, so they are easy to cash out of, as the fund itself can be sold at any time.

The no-frills rock bottom prices of ETFs mean that investors have traded in their expensive brokerage accounts for them, and the bulk of equity investments into Russia for are now made via ETFs, contributing to the death of the famous investment banking names of the 1990s like Troika Dialog, Renaissance Capital and Aton.

Despite the size of the Russian market there are actually only a dozen Russian ETFs that cover it. Only two ETFs — ITI Funds RTS Equity UCITS ETF (ticker: RUSE) listed in Moscow and London and NEXT FUNDS Russia RTS Linked E (ticker: 1324) listed in Tokyo — that track the leading dollar denominated Russia Trading System (RTS) index, the benchmark of Russian stocks for most international investors.

The two biggest and best-established Russian ETFs are American. There are six U.S. traded ETFs in all, but the VanEck Vectors Russia ETF (ticker: RSX) and iShares MSCI Russia ETF (ticker: ERUS) have by far the most assets under management (AUM) — $1.1 billion and $653 million AUM, respectively. All the others are small funds with between $14 million and $40 million AUM.

But irrespective of size, the performance of all the U.S. ETFs this year has been outstanding, with all of them returning between 20% and 30% year-to-date as of the end of August. (The Direxion Bull fund is a special case as it is structured to triple rises and is up 67.6%, whereas its sister “Bull” fund is down by almost 50%.) Even the latest entry into the game, the Franklin ETF (FTSE), is up by a handsome 29.4% over the period.

The performance of these funds over time also reflects the wild swings that the Russian stock market is prone to. The VanEck Vectors Russia ETF has been making gains all year – 7% in four weeks, 13% in 26 weeks, but it sold off in August along with most Russian stocks. Since the start of this year the fund has returned 24.3%, which is the bulk of the 25% it returned in the last 12 months. Over three years it has made over 40%, but over five years — including the crisis years of 2014-2016 — it lost 57.82%.

Investing in Russian stocks is not a long-term appreciation story as the economy grows. When investing into Russia, timing is everything.

By ETF standards, the U.S. funds are expensive The VanEck Market Vectors Russia ETF has a 0.63% expense ratio, but high liquidity and tight bid/ask spread balance this higher cost. The story is similar with the other funds, but the gains investors expect to make from a stock with such a high risk-to-reward profile mean few investors worry too much about the fees.

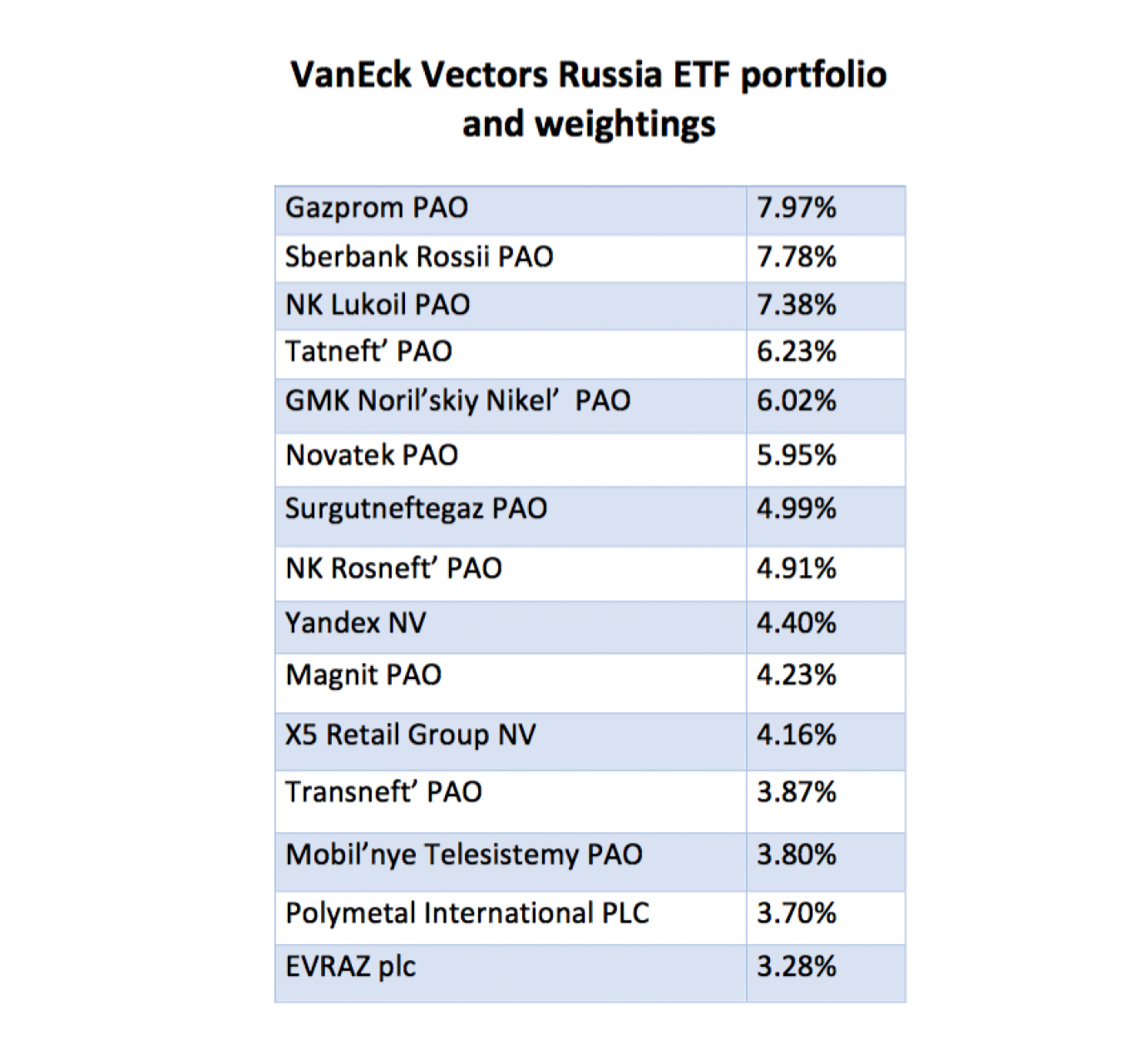

Look down the list of the U.S. funds and they have all very similar profiles and returns, as they all more or less invest in the same top 25 liquid big cap names. These are not index trackers, they simply buy into the leading Russian bluechips with a bias towards the names with the largest capitalizations. VanEck is typical and holds 26 stocks that make up a who’s who of Russian publicly traded companies.

Russian ETFs in the rest of the world

The other ETFs are traded on a variety of exchanges where they target their local investors.

For example, France’s Lyxor PEA MSCI Russia IMI Select fund (PRIS) is traded on Euronext in Paris, and ComStage Dow Jones Russia GDR (CBMRUC30) is traded on half a dozen German exchanges. Both of these funds are relatively small and have about $20 million AUM. The Next Funds Russia RTS Linked fund (1324) is the biggest ETF outside the U.S. with $1.3 billion, but is only traded on the Tokyo exchange.

Almost all the EFTs invest into equities, but you can make an ETF out of anything and ITI Funds has also set up one of only two Russian bond ETFs — the ITI Funds Russia-Focused USD fund (RUSB) that is domiciled in Luxembourg but publically traded in Moscow, London and Kazakhstan.

The ITI Funds RUSB bond fund holds top Russia’s corporate and sovereign eurobonds and has returned a whopping, by bond fund standards, 15.4% return in the past 12 months.

Like equities, the returns from investments into Russian bonds are supercharged by the generous coupon payments, making them even more attractive for investors. The average coupon payment adds another 5.61% to returns in dollar terms.

“In the whole world there are only two bond ETFs focusing on Russia,” said Gleb Yakovlev, the CEO of ITI Funds.

“The ITI bond ETF gives an investor exposure to Russia’s sovereign eurobonds, but it doesn't include all the bonds. Those that are going to mature in less than one and a half years are excluded, as are bonds that have anything less than rating level. The bonds of Russian companies under sanctions have also been excluded.”

There are 16 bonds in the ITI Funds RUSB bond fund, all of which are senior debt, so if there is a default then the fund is first in the queue to reclaim its money. Another difference between the equity and bond funds is that the equity fund pays out dividends to its shareholders whereas the bond fund takes coupon payments and reinvests them.

“Equity is more dangerous than bonds so we have a principle to payout dividend payments to the investors, while bonds are safer, so we reinvest the coupon payments,” said Yakovlev.

London-based ETFs

For investors that want to buy an ETF in London there are also half a dozen choices: iShares MSCI Russia ETF (CSRU), ITI Funds RTS Equity UCITS ETF (RUSE), HSBC MSCI RUSSIA CAPPED UCITS (HRUD), FinEx Tradable Russian Corporative (FXRU) and Invesco RDX UCITS ETF (RDXS).

Out of all the funds on the market the ITI Funds and FinEx ETFs are the cheapest to use, with an effective cost ratio of only 0.5%, and the ITI Russia equity fund is the best performing in Europe having returned 29% year-to-date, well ahead of the average of 18% for the European group of funds.

The outstanding feature of the ITI Funds RUSE equity ETF is that it tracks the RTS index rather than simply buying a mix of the biggest names on the Russian stock market, as most ETFs do.

Launched in the spring of 2018, the ITI Funds RUSE equity fund is targeting institutional investors and has been set up to appeal to them. It is UCITS 5 qualified — the highest standard of transparency and reliability — and domiciled in Luxembourg to provide the best in international support and custodial services to investors.

Currently the ITI Funds RUSE equity fund has $6.8 million in AUM, while the bond fund is a little bigger with $8.2 million. Still small in size, the two funds are aggressively raising money and the managers hope that will grow rapidly once they get up to $50 million in size.

“There are already institutional investors in the fund but they are just dipping their toes in the water now. One of the problems in Russia is that the investors are still not very clear on what an EFT is. There is a process of education to go through,” says Yakovlev.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.