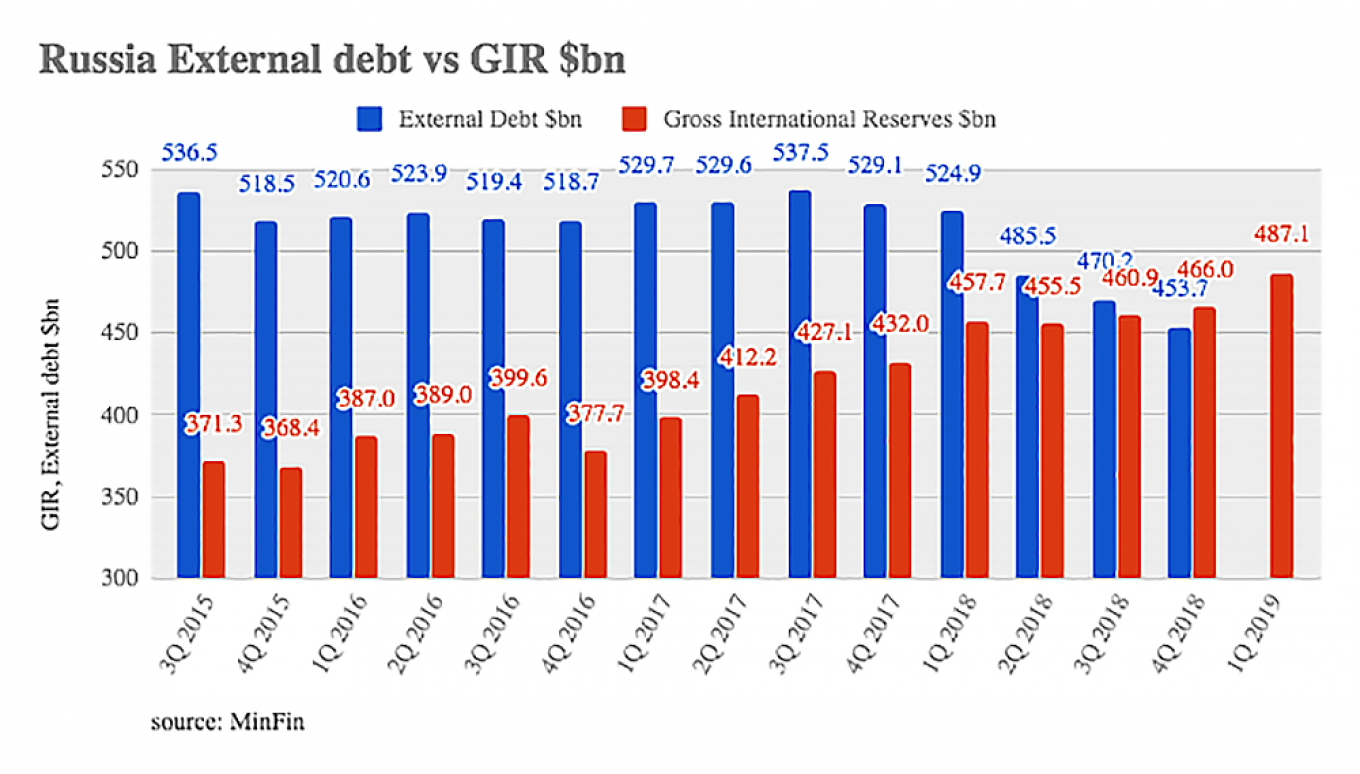

Russia’s gross international reserves (GIR), including gold, continue to creep upwards and reached $487.1 billion as of March 22 — enough to cover Russia’s external debt dollar for dollar in cash.

In February during his state of the nation speech President Vladimir Putin boasted that for the first time Russia has enough money in its reserves to cover all its external debt with cash.

At the end of the last quarter of 2018 Russia had an external debt of $453.7 billion and the debt has been falling steadily over the twelve months as the government makes use of the windfall from rising oil prices and falling expenditures to pay off more debt early.

Russia already had one of the lowest levels of debt of any major country in the world. While most western countries have debt to GDP ratios well over the Maastricht rules recommended maximum of 60% (and some like Italy are well over 100%), Russia’s debt to GDP ratio has been hovering around 15% for years. At the start of 2016 Russia’s external debt was $520 billion and it rose to a high of $537 billion in the third quarter of 2017, but it began to taper off quickly as 2018 got underway.

Falling debt

The falling debt is part of the Kremlin’s strategy to sanction-proof as more financial sanctions are expected to be imposed this year. The Defending American Security Against Kremlin Aggression Act (DASKAA) sanctions that could target Russia’s sovereign bonds are supposed to be read by the US Congress in April.

The Central Bank of Russia (CBR) has also taken preventative measures including slashing its holdings of US Treasury bills and Russia has been actively building up gold as a share of its GIR since 2007.

A “financial fortress” had been built that makes it very difficult to pressure the Kremlin, but it comes at a cost. With the emphasis on stability over prosperity investment has been below par and the economy underperforming. Despite Russia’s growing cash pile of reserves real incomes in Russia fell again slightly in 2018, down for the fifth year in a row.

Now the economy has been largely insulated from the dangers of more sanctions the Kremlin is turning to the growing discontent and has launched a massive social and infrastructure investment plan that is supposed to “transform” Russia and improve lives as outlined in the May Decrees and the RUB25.7 trillion ($390bn) investments planned for the 12 national projects. The jury remains out on whether this will be enough to see GDP growth accelerate to over 3% in 2021, which is the short-term goal.

This piece first appeared in bne IntelliNews.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.