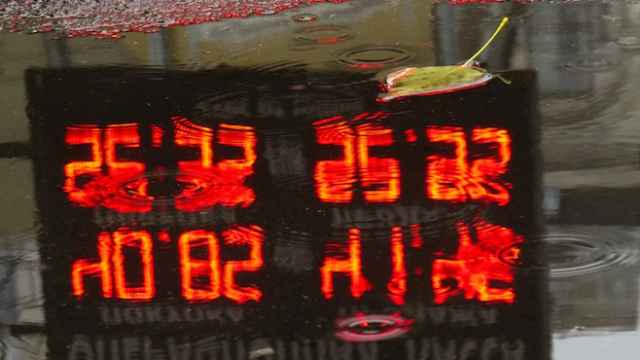

The Russian ruble swung wildly on Thursday, plunging to historic lows before rising 5 percent in just over an hour, as traders abandoned their positions before a key Central Bank meeting this Friday when policymakers are expected to hike interest rates in an effort to prop up the tumbling currency.

After passing the mark of 43 to the U.S. dollar for the first time ever late Wednesday, the ruble extended days of falls as it collapsed past the mark of 53 to the euro and 70 to the British pound on Thursday morning.

But the record lows were suddenly reversed shortly after 1 p.m. in Moscow when the ruble gained 142 kopeks against the euro-dollar basket in 80 minutes, a surge of more than 5 percent.

Traders told The Moscow Times that the sudden upswing was the product of bets on the ruble's weakness being reversed ahead of the Central Bank's monthly rate-setting meeting.

"The ruble strengthened on reduction of oversold ruble positions," Denis Korshilov, head of fixed income, currencies and commodities at Citibank in Moscow, said in written comments.

"The sharpness of the move is related to the big size of those currency positions, built-up over October with the help of Central Bank currency interventions and export proceeds."

The ruble could strengthen to 40 against the U.S. dollar if the Central Bank delivers the expected rate hike Friday, said Yaroslav Podsevatkin, head of trading at Moscow brokerage Aton.

Analysts said the big ruble swing could also have been linked to Central Bank intervention on the market or a Ukrainian news report claiming that Russian President Vladimir Putin had reached an agreement with his counterpart in Kiev over the disputed Crimea region, annexed by the Kremlin in March.

"Market moves today suggest that the Central Bank has tried to get ahead of the curve," macroeconomic research company Capital Economics said in a note to investors.

"The most obvious explanation [for the ruble's strength] is that policymakers have intervened heavily on the foreign exchange market."

The Central Bank has spent more than $60 billion of Russia's foreign currency reserves this year in an effort to slow the ruble's devaluation, but an intervention pushing the ruble to a gain of as much as 5 percent would be a significant departure from its stated policy.

The regulator uses a trading corridor to control ruble volatility — when the exchange rate leaves the specified range, foreign reserves are committed. With every $350 million sold, the corridor is shifted by 5 kopeks.

A majority of economists surveyed by Bloomberg predict that the Central Bank will increase rates by 0.5 percent Friday in a bid to dampen inflation and curb the ruble's falls. The Central Bank has already raised rates three times this year, a cumulative hike of 2.5 percent.

"In the current conditions the stabilization of the ruble requires a quite aggressive raise of the base interest rate," ING Bank's chief economist in Moscow, Dmitry Polevoi, wrote in a note Thursday.

Despite Thursday's feverish gains, the ruble has shed over 20 percent against the dollar since January on the back of a declining oil price, Russia risk aversion and Western sanctions on Moscow for its annexation of the Crimea and support for separatist rebels in eastern Ukraine.

But raising interest rates carries risks, not least the possibility of tipping the tanking Russian economy into recession.

A dramatic interest rate rise could provoke panic among the population and a rush to dump rubles, or market instability because of Western sanctions blocking Russian companies from U.S. and EU capital markets, analysts said.

"Russia is suffering from a credit shock from abroad, so it is dangerous to hike interest rates more than [0.5 percent]," said Oleg Kouzmin, chief economist for Renaissance Capital in Moscow.

Speculation that the Central Bank will use Friday's meeting to announce that it will reduce the intensity of its defense of the ruble has fueled the currency's relentless decline in recent days.

The Central Bank has said repeatedly that it will move to a free floating ruble by 2015 but has faced accusations that its policy of burning through foreign reserves in support of the ruble is creating a self-fulfilling currency crisis.

The ruble weakened after its large jump in Thursday evening trading, but remained significantly stronger than its close the day before, hovering about 46.5 rubles to the euro-dollar basket.

"Today serves as a warning shot to those who believe the ruble is a one-way trade," Tom Levinson, chief currency strategist at Sberbank CIB, said in a note Thursday.

Contact the author at h.amos@imedia.ru

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.