Russia's consumer credit market could stall next year, ending several years of break-neck growth as the economy slows and banks reduce lending, the head of one of the country's largest consumer lenders said.

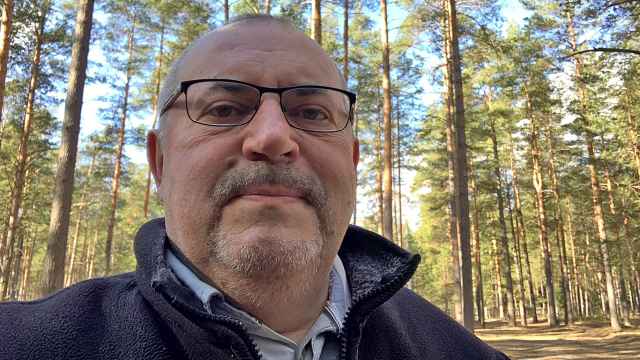

Ivan Svitek, chairman of Home Credit and Finance Bank, said his bank had become more selective in its lending, after a downturn in the Russian economy — aggravated by Western sanctions over Ukraine — had increased the risk of non-payment.

Underlining the change in fortunes for consumer-focused banks, whose loan books grew at an annual rate of more than 30 percent from late 2011 to the start of 2014, Svitek said his bank would post a loss this year, due in part to rising loan-loss provisions as non-performing loans rise. Last year it reported a profit of around 11 billion rubles ($290 million).

"Next year the market could reach zero (growth) at some point due to a decline in the number of quality borrowers and careful policy by banks, which don't want to pile up risks when the economy is stagnating," Svitek said at the Reuters Russia Investment Summit.

Svitek said his bank, which ranks in Russia's top 30 banks by assets according to data from Interfax and is controlled by Czech investment firm PPF Group, noticed a deterioration in the quality of its credit portfolio early last year and had since sharply reduced the number of loans it issues.

"The demand for loans is huge, but we have become more selective in our choice of client, we look at his job prospects and income," Svitek said at the summit.

He said the bank expected its credit portfolio to grow 10 percent this year, in terms of the total value of loans.

A rising middle class in Russia had spurred consumer lending, allowing consumer-focused banks to reap healthy profit margins, higher even than state banks such as Sberbank and VTB which enjoy cheaper funding costs.

Russia's central bank moved to cool the boom in consumer lending last year, forcing banks to raise their provisions against bad loans and boost capital to prevent them from destabilizing the wider financial system.

This year, growth in unsecured consumer loans offered by Russian banks for consumer purchases has declined from an annual rate of 31 percent in January to 19 percent in August, according to Central Bank data.

Svitek said Home Credit and Finance Bank's financial results would "significantly improve" next year, adding that the bank was well capitalized and had no problems with liquidity.

"We are optimising costs, we have entered a cost-saving regime," he said.

"When your margins are high you can compensate for any mistake, but when your margins are low you can't allow yourself any mistakes. Therefore we must control expenses and think carefully about new projects."

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.