Prime Minister Dmitry Medvedev on Thursday approved a new schedule for reducing state ownership of companies, which slows down some of the major privatizations.

Medvedev made the move in an attempt to give a new impetus to the government pullout from as many companies as possible — an exercise that stalled amid market turbulence and counteraction from inside the government.

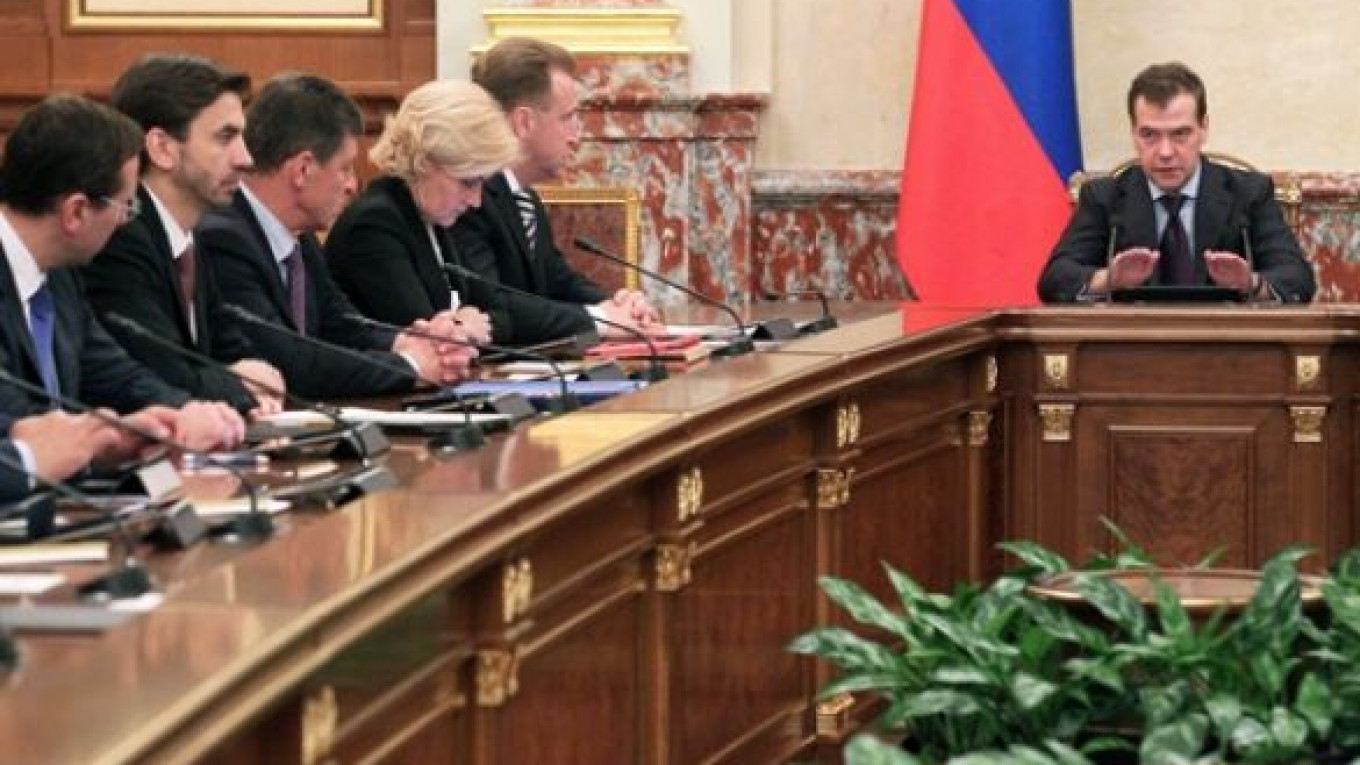

Medvedev made a point of ordering the broadcast of the Cabinet's discussion of the matter on closed-circuit television for reporters to get a better picture of the plans. Under previous Prime Minister Vladimir Putin, the Cabinet almost never went beyond showing footage of introductory speeches.

“We need to take into account the current situation and the possible risks,” Medvedev said in a prepared speech at a Cabinet session, reading from his iPad. “But in any event, it's necessary to move forward, adhering to the pace and deadlines that were stated.”

Every seat around the Cabinet meeting desk now has an iPad 2 installed for ministers to cut down on paper notes. Medvedev, a fan of the latest gadgets and online social networks, ended up looking into two iPads — one of them his personal device — rolling his lips at times as he sidetracked himself to tap and scroll.

The sell-off schedule, approved Thursday, envisions that stakes will change hands through 2013 in big-time companies like Europe's third-largest lender Sberbank, shipper Sovcomflot, diamond miner Alrosa, United Grain Company and high-tech investor Rusnano.

“We really look to some hard evidence that it's really going to happen,” said Peter Westin, chief strategist at brokerage Aton. “There's been a lot of changes, and some changes look like a backtracking.”

First Deputy Prime Minister Igor Shuvalov first announced extensive privatization plans in September 2009, when the government badly needed money to supplement revenues in the throes of the global economic crisis. Since then, the sole major deal has been the sale of some of the state's holdings in the country's second-largest bank VTB.

“We have a lot of plans coming out,” Westin said. “But there seems to be fewer signs of implementation over the last couple of years.”

The Sberbank stake in question measures, as before, 7.58 percent minus one share and costs $4 billion, according to the current valuation of the traded stock. It is by far the biggest stake slated for a sale by the end of 2013.

The government intends to offer 25 percent minus one share in Sovcomflot by the end of 2013, a stake that could bring in at least 25 billion rubles ($780 million), said Economic Development Minister Andrei Belousov. Under the original privatization plan, adopted in November 2010, the government was going to offer the market or an investor 50 percent minus one share of the shipper by that time.

The stake in United Grain Company is 49 percent, and in Rusnano 10 percent. It remained unclear what portion of Alrosa the government was prepared to sell this or next year.

The new schedule delayed further privatization of oil champion Rosneft to some time before 2016. Former Deputy Prime Minister Igor Sechin, now demoted to Rosneft chief, resisted the initial end-of-2013 deadline to sell 25 percent minus one share in the company.

President Putin's decree of last month stipulates that another state company, Rosneftegaz, could step in as an interim investor in the course of privatizing Rosneft and some of the other energy assets.

Thursday's decision allowed the government to wait more, also until 2016, before shedding more of its shares in VTB.

In addition, it said the government has until 2016 to sell all of agriculture-focused lender Rosselkhozbank, 99.9 percent of farm-equipment-leasing company Rosagrolizing and to complete the privatization of Sovcomflot and Alrosa.

Some of the other targets to lose state ownership by then are Sheremetyevo Airport, the Aeroflot airline, electricity generator Inter RAO and renewable energy producer RusHydro.

In the course of the privatizations over these years, the stakes could change hands through public offerings, sale to a strategic investor or, Shuvalov said Thursday, an issue of convertible bonds.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.