Billionaire George Soros once called his $1.8 billion purchase of 25 percent of Svyazinvest, Russia's largest telecommunications holding, "the worst investment of [his] life," having sold the stake for $625 million in 2004 to Lev Blavatnik's Access Industries.

The telecoms market has traveled a bumpy road to the next level of maturity since then. Considering that Blavatnik sold the stake after two years for $1.3 billion, and looking at the double-digit share appreciation of several of the Svyazinvest regional companies in 2010, the investment climate is getting more attractive.

"I think that the whole industry is undervalued," Alexander Izosimov, chief executive of VimpelCom Ltd., said in early February.

A number of key organizational and technological questions are due to be resolved in the course of this year, which should leave both industry players and investors with clarity as to which companies are well managed, when the next generation of services will be provided, and by whom.

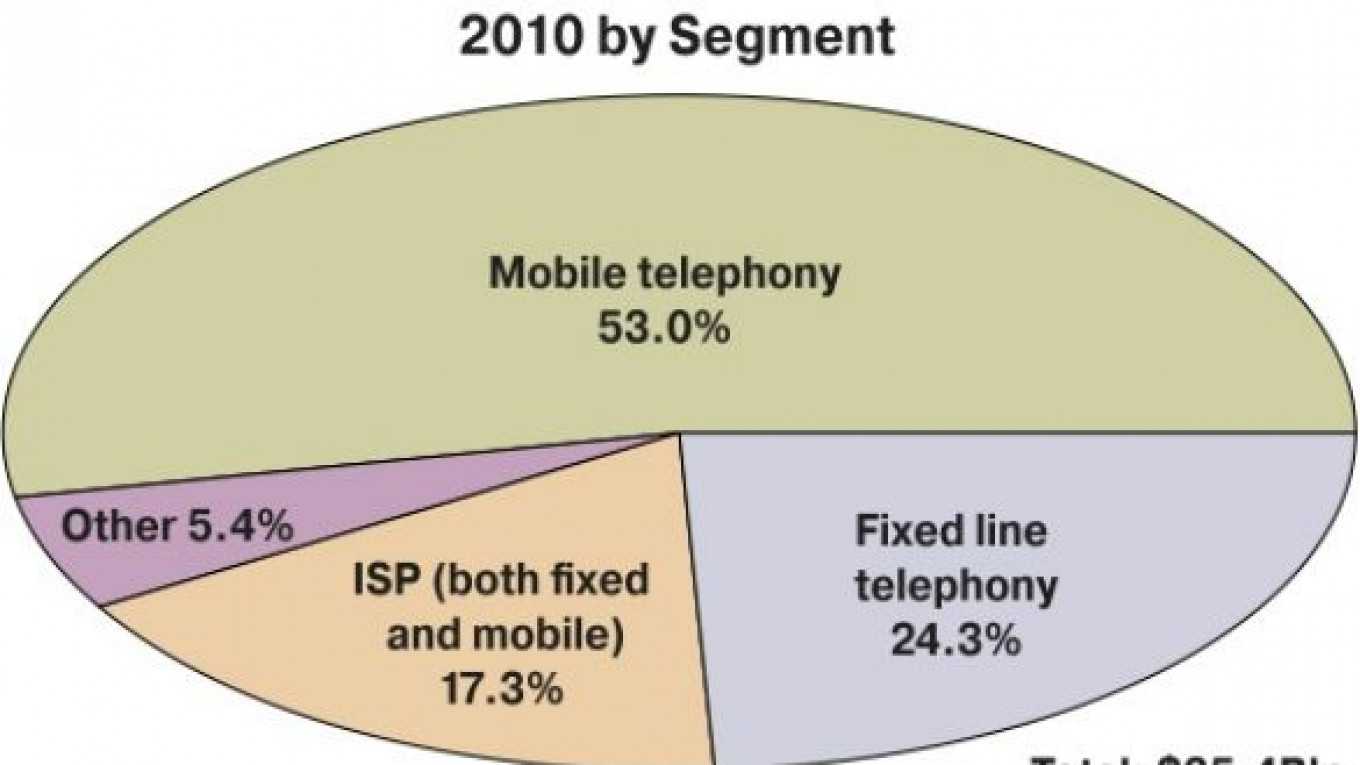

The telecoms services market was valued at a little over 1 trillion rubles ($35 billion) for 2010, and is estimated to grow 6.7 precent by the end of this year, according to PMR, a market research firm specializing on Central and Eastern Europe.

Mobile users are responsible for the lion's share of the revenue, with 219.3 million registered SIM cards by the end of 2010, and nationwide penetration figures passing the 150 percent threshold, according to Advanced Communications & Media, another industry research firm.

The industry saw a number of key mergers and acquisitions start last year, not only in the mobile sector, but also fixed, long-distance and cable.

The Giants Combine

Yevgeny Yurchenko, the self-ousted former head of Svyazinvest, could wind up as one of its partial owners, following the planned merger this spring between the holding that manages the seven regional fixed-line operators and Rostelecom, the long-distance and international carrier.

Yurchenko headed Svyazinvest prior to his abrupt resignation in September over disagreements on the future management of the merged company and of an ongoing acquisition.

He then tried and failed to take back his resignation, which had been accepted by the Communications and Press Ministry. He promptly filed a lawsuit, and Kommersant reported last week that he might win it.

Regardless of the fate of his management career, Yurchenko succeeded in scraping together shares of different parts of the holding and creating a fund that he said in late December could end up with 15 percent of the new Rostelecom, giving him two seats on the board.

Now Marshall Capital Partners owns 7.5 percent of Rostelecom's shares, making it the largest minority investor.

The new company will have about 200,000 employees and operate under the Rostelecom brand, said Oleg Rumyantsev, a spokesman for Rostelecom.

"Rostelecom will just get bigger," Rumyantsev said. "Its business will become more complex and bring a higher margin," he said.

That description begs the massive potential for the new company that will be able to expand its range of services and leverage the might of its newly acquired entities — including cable television and broadband Internet provider Akado, mobile operator Skylink, and the mobile providers and local fixed providers of the regional companies.

It remains to be seen whether Rostelecom will be able to attract the necessary management to bring it to the next step function and help change its corporate culture from one of a state monopolist to that of a world class multi-service telecoms provider.

This will become clear after the April 1 board meeting, when decisions about management are expected to be made.

Industry insiders say that Sergei Pridantsev — who was recently relieved of his role as the head of Comstar because of its merger with MTS — is the front-runner for leading the merged company.

Pridantsev would bring his energy and experience to a difficult role as head of Rostelecom — having to satisfy shareholders and the Russian government, as well as domestic, international, corporate and individual customers.

Rostelecom spokesman Rumyantsev said, however, that he knew of no plans to change management, as current president Alexander Provorotov's contract expires in July 2012.

4G

Regardless of its future management, Rostelecom is now in the business of mobile telephony, as evidenced by its role in the evolving plan to move the country to the next generation of technology, or 4G, which will allow high-speed data service over smartphones.

The government issued a decree last month saying 4G must be up and running by 2014, in time for the Sochi Olympics.

There is a lot of money at stake — though mobile broadband only brought an estimated $2.1 billion in revenues to operators last year, it is expected to grow by more than 40 percent this year, according to industry experts.

In 2011, operators' earnings from mobile broadband access will exceed that of fixed-line Internet providers, said Vitaly Solonin of J'Son & Partners Consulting.

Meanwhile, revamping networks to provide the new level of service will likely cost each provider several billion dollars.

Last year saw a tense squabble over the distribution of the necessary frequencies for the new service — which remain in the hands of the Defense Ministry.

Finally, at the end of December, the Communications and Press Ministry announced the formation of a consortium including VimpelCom, MTS, MegaFon — also known as "the big three" — and Rostelecom.

The consortium has two goals: technical proof of concept how 4G's Long Term Evolution standard, or LTE, will work in the country's vast geography, and the political-financial struggle to extract the golden tooth of necessary frequencies from the jaws of the Defense Ministry, at a price more reasonable than the 60 billion rubles ($2 billion) initially stated.The consortium will soon be given a chief dentist to perform this delicate procedure. The front-running candidate to head the project is Gulnara Khasyanova, whose past experience in making Skylink the leader in mobile data services would bode well for the success of the task.

The operators will fund the technical work and come to conclusions by July 1 this year.

They are also to make a proposal to the Communications and Press Ministry on what guarantees to offer potential investors who are expected to participate in tenders for the frequencies and fund the Defense Ministry's conversion to other communication systems, while at the same time rolling out their own networks.

The members of the consortium will have the highest chances to get LTE frequencies, analysts believe, and other operators are trying to get on board.

Swedish operator Tele2, which has invested $2.5 billion in Russia and has roughly the same number of mobile subscribers as the new Rostelecom, has already sent letters to both Rostelecom and Communications and Press Minister Igor Shchyogolev seeking to join the consortium on the grounds that the company's experience in building LTE networks with Telenor in Sweden could be useful in Russia.

It is not impossible that a foreign investor like Tele2 could be excluded from participating in a project dealing with Russia's military frequencies on the grounds of national security, though it's doubtful that any of the big three would shed a tear for having less competition.

"I would not say that you can determine the leaders and the outsiders [of the 4G frequency distribution race] just yet. This race is only beginning," said Dmitry Strashnov, chief executive of Tele2 Russia.

The company remains optimistic and is putting its money where its mouth is.

Tele2 is "prepared to take on an equal amount of the financial responsibility for the conversion as other participants of the consortium," Strashnov said, adding that "the funds are available."

Investor Relations

The Tele2 case will be yet another test of Russia's respect for foreign investors. Norway's Telenor is also upbeat, despite the fact that its main local investment, VimpelCom Ltd., has once again become a battleground.

"We do not regret coming to Russia at all," Ole Bjorn Sjulstad, head of Telenor Russia, said at a news conference in February. "This is important for us to share our view as a shareholder," he said of the company's decision to seek legal action in the resolution of its dispute with VimpelCom Ltd.

Telenor is opposing a proposed $6.5 billion merger with the telecommunications assets of Egyptian billionaire Naguib Sawiris, which started last year.

Telenor's main argument is that each investment should come at an affordable price and Sawiris' assets, "burdened by debt," remote and operating on saturated markets cost more than VimpelCom Ltd. should have to pay.

Telenor, which owns 36 percent of voting shares in VimpelCom Ltd., has turned to both the London Court of International Arbitration and the Commercial Court in London in hopes of resolving the dispute. While the arbitration proceedings may take months or even years, the first hearing of the commercial court is scheduled for Feb. 25.

Depending on the results, there could be additional clarity, and possibly a vote at the next VimpelCom Ltd. shareholder meeting, which is due to take place in mid-March. Analysts say that despite Telenor's efforts, the deal will most likely go through.

VimpelCom Ltd. seems confident in its chances to win and improve share value, which has dropped, along with its market share.

"As soon as investors see that the company and the market are going in the right direction, there will be a correction," Izosimov said at the Troika Dialog investor conference earlier this month.

Other market players are considering expansion with great caution.

"We are looking at the world globally — I would not single out Europe or Asia. We are looking into potential mergers or partnerships with both leading developed and developing markets. But at this point, this issue is at a research stage," Mikhail Shamolin, chief executive of MTS, said at the Troika Dialog investor conference.

Shamolin said MTS has not yet found an asset that would satisfy all shareholders, though MTS owner AFK Sistema's Vladimir Yevtushenkov said Feb. 1 that merger talks were underway with an undisclosed international operator.

Analyst forecast continuing local consolidation with no major international deals, except for VimpelCom, for the remainder of 2011. This could be a result of a less-than-positive stereotype of Russian business partners.

"No one waits for Russians in Europe," one analyst said. The presence of Russian investors on the board of any telecommunications company is almost stereotypically a turnoff for foreign investors, and this is unlikely to change with time, she said.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.