Six months ago, things were looking pretty bad for Gazprom. Gas prices were in the doldrums. European utilities wanted to move toward fangled spot market contracts and away from oil-indexed links. U.S. shale gas was placing downward pressures on liquefied natural gas, while Europe entertained developing its own unconventional reserves. Prospective pipelines from Central Asia and the Middle East stole some tentative Russian ground when the European Union-inspired Nabucco project was upgraded to become a “project of European interest” to counter Moscow’s South Stream designs. Brussels even managed to pass the third energy package to keep unbundling in fashion and take the political sting out of the tails of third-party countries — namely Russia.

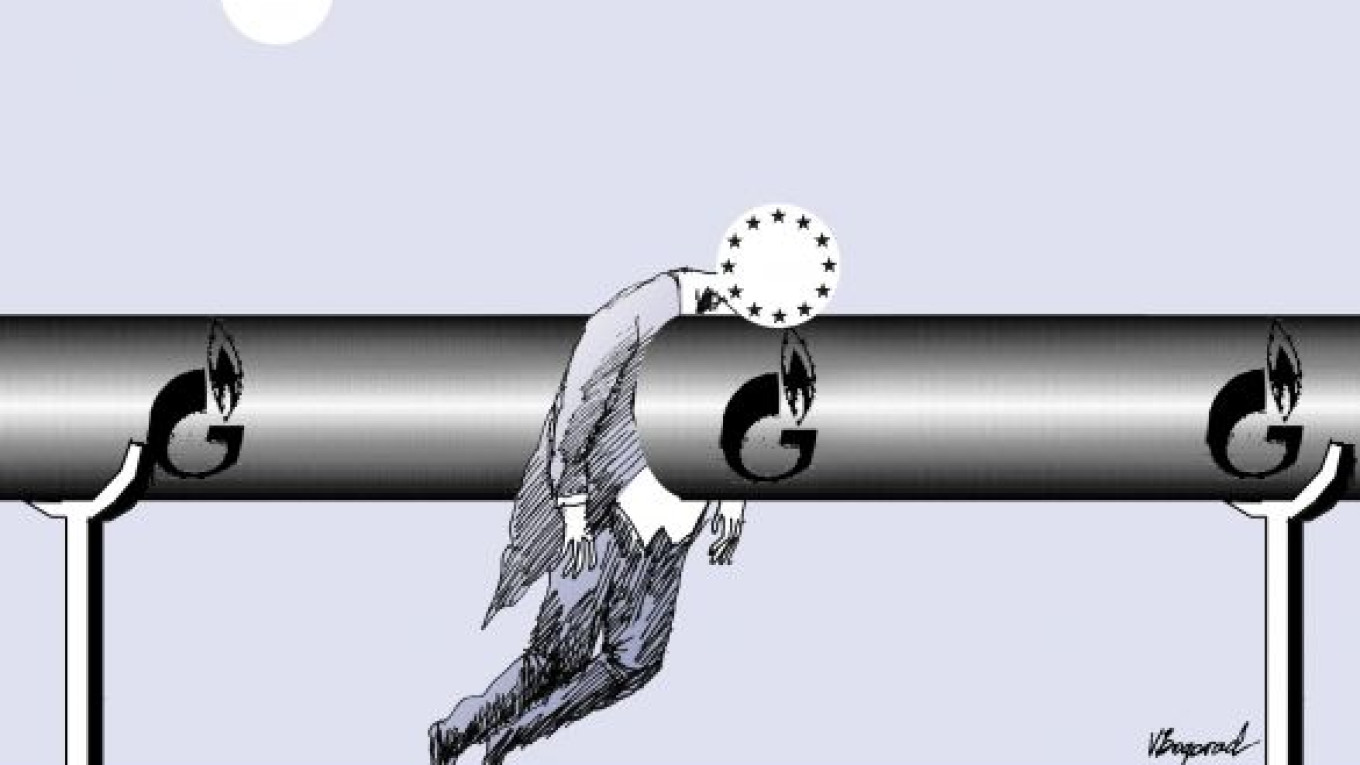

But things have swung back in Gazprom’s favor and drastically so. Part of the explanation is grounded in fundamentals. Tentative economic recovery in Europe will see Russian gas exports creep back toward 158 billion cubic meters this year, with demand expected to fully rebound by 2013 if not before. That’s hardly anyone’s fault, but the real gain for Gazprom has been from a trilogy of European policy blunders — namely, military malaise, fracking failures and nuclear nonsense.

Europe’s inability to credibly project military power across the Middle East and North Africa has not only seen 16 percent of gas supplies slip offline, but far more important, it has shown how weak Europe’s energy diversification hand is. Such military indecision will result in far greater dependence on Russian hydrocarbons, precisely because Europe’s security seal is too politically leaky for upstream producers to take seriously. Upstream players in Central Asia, the Maghreb and the Persian Gulf have long made clear that energy supplies are not just purely a market issue, they have to come with credible political and security guarantees if prospects are to be developed and pipelines welded. From Budapest to Berlin, Paris to Prague, Europe has no real choice but to go long on Moscow to secure its vital oil and gas supplies.

The fact that Paris has just turned its back on fracking and cracking shale gas on French soil is therefore all the more staggering. Other Western European states will follow where NIMBY-ism is high and market assumptions remarkably lazy that LNG will provide ample marginal supply to offset Russian dependency on the cheap. You’d think Europe would at least optimize its market position to keep shale prospectively on the table and Gazprom on its toes, but this is apparently not the case. That’s a game that will only be played in more vulnerable Central and Eastern European and South East European countries.

That just leaves nuclear nonsense, best portrayed by Germany’s decision to phase out all its nuclear power plants by 2022 on the back of the Fukushima disaster. The economic pain inflicted on German utilities has been sufficient to see RWE invite Gazprom to join downstream gas and power ventures to shore up balance sheets. RWE will lose about 30 percent of installed capacity from the nuclear closures and heavy losses on fuel rod taxes. Germany could need anything up to another 20 bcm per year of gas to fill prospective gaps, which is exactly what Gazprom is banking on to keep exports high and prices firm.

A degree of brinkmanship is obviously involved in the RWE-Gazprom deal, both from RWE to try to force a nuclear rethink in Berlin and from Gazprom to underpin European market share at Russian prices. Gazprom head Alexei Miller has wisely been talking to E.On and RWE about prospective tie-ups to enhance Gazprom’s negotiating position. Irrespective of how things contractually play out, should Berlin follow through on the closure of nuclear plants, we can expect to see oil-indexed pricing cemented between Germany and Moscow on security of supply grounds.

We can also expect to see Gazprom gain a far greater downstream German stake, with other European markets following suit, once vertical integration flood gates have been opened. By way of footnote, expect to see Nabucco die an early death given that RWE is the main European utility spearheading the project. That will be around the same time that Nord Stream comes online. This is all ominous news.

Is this game, set and match to Gazprom? Perhaps not quite, but Europe seems intent on grabbing a gas defeat from the jaws of victory. Gazprom is back in the lead, but how it decides to keep its position is still a big question — both between old European markets and new Asian ones. If nothing else, Europe can’t say it hasn’t been warned of the perils of structural dependence on Russian gas in the past. It’s the future that now looks so much worse.

Matthew Hulbert is senior research fellow at the Clingendael International Energy Program, in The Hague. The views expressed by the author are his own.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.