A Russia-linked company has invested in a space venture worthy of a science fiction novel, betting that asteroids could be mined for gold and platinum.

The company, called I2BF Global Ventures, put its money on U.S.-based Planetary Resources, said Ilya Golubovich, managing partner of the venture fund. Michael Murray, a consultant for Planetary Resources, confirmed the report.

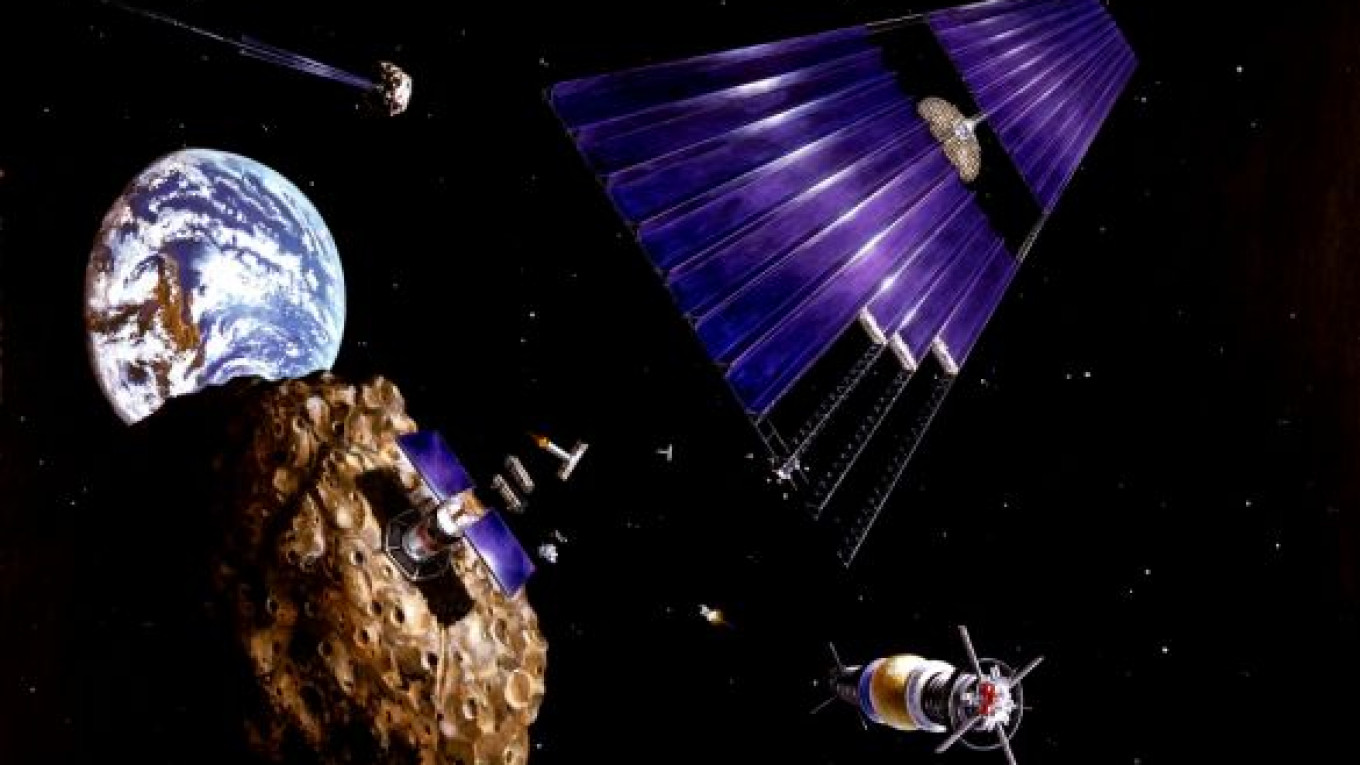

Planetary Resources might also use water-rich asteroids to supply orbital "filling stations" with fuel and water, making spaceflights less expensive, Golubovich said.

He did not disclose the amount of the investment but said it was less than "tens of millions of dollars." He added that the company would also participate in Planetary Resources' future investment rounds.

I2BF Global Ventures intends to invest more than $50 million — up to 25 percent of its funds ?€” in the space industry, Golubovich said.

Earlier, Eric Anderson, who organizes private customers' flights to the International Space Station, estimated the costs of launching six spacecraft to an asteroid at $25 million to $30 million, while spending on recent state-financed asteroid missions amounted to $400 million. Anderson is a founder of Planetary Resources.

In April, Planetary Resources announced plans to launch exploration satellites in two years and start mining platinum group metals, including gold, and collecting water on asteroids in 10 years.

One asteroid with a 500-meter diameter has as an equivalent the amount of platinum group metals produced over all of human history, Anderson said earlier. He also said the platinum resources of one 50-meter asteroid could be worth $50 billion.

Such investments are a sort of a gamble, said Alexander Galitsky, managing partner of Almaz Capital Partners, which is participating in the Foundation B612 space project. If something useful is found on asteroids, it could give a boost to new space discoveries, he added.

"Private spaceflights are, of course, first of all a huge monetary risk," venture investor Esther Dyson said. "But though it is huge, it is not boundless."

The project's costs are high but they are likely to decrease once Planetary Resources starts producing something that is in demand, he said.

New York-based I2BF Global Ventures focuses on venture capital investments in the U.S. and Russia.

Golubovich, a Russian-born investor who lives in London, is the son of Alexei Golubovich, the founder of Arbat Capital and a former top executive of the now defunct oil company Yukos.

Currently, Planetary Resources makes money by selling technology licenses, launching satellite networks for governments and private customers and selling and processing satellite data, Golubovich said.

Planetary Resources' founders include Peter Diamandis, who helped finance SpaceShipOne, the world's first private spaceflight, as well as Google chief executive Larry Page, former Microsoft executive and space tourist Charles Simonyi, former Goldman Sachs head John Whitehead and film director James Cameron.

A Message from The Moscow Times:

Dear readers,

We are facing unprecedented challenges. Russia's Prosecutor General's Office has designated The Moscow Times as an "undesirable" organization, criminalizing our work and putting our staff at risk of prosecution. This follows our earlier unjust labeling as a "foreign agent."

These actions are direct attempts to silence independent journalism in Russia. The authorities claim our work "discredits the decisions of the Russian leadership." We see things differently: we strive to provide accurate, unbiased reporting on Russia.

We, the journalists of The Moscow Times, refuse to be silenced. But to continue our work, we need your help.

Your support, no matter how small, makes a world of difference. If you can, please support us monthly starting from just $2. It's quick to set up, and every contribution makes a significant impact.

By supporting The Moscow Times, you're defending open, independent journalism in the face of repression. Thank you for standing with us.

Remind me later.